In the ever-evolving landscape of the used truck market, the persistent economic uncertainty has ignited both concern and cautious optimism among industry stakeholders. As freight demand has seen its fluctuations, one thing has remained clear: used truck prices have demonstrated remarkable stability. The demand for used trucks reflects broader trucking industry trends influenced by economic conditions. Even amidst challenges such as rising costs and market volatility, late-model, low-mileage trucks have maintained their value, fetching premiums that speak volumes about buyer confidence.

In recent months, numbers indicate an upswing in used truck sales, with analysts reporting better-than-anticipated results despite potential headwinds. This article delves into the factors underpinning the resilience of used truck prices, explores the impact of replacement demand on purchasing trends, and highlights key insights from market experts. With a cautious yet hopeful outlook, we analyze how these dynamics, including truck economics, may shape the future of the used truck market.

Revised: Factors Affecting Used Truck Prices

The prices of used trucks depend on several key factors that influence their value:

-

Mileage

Trucks with high mileage generally sell for less. For instance, trucks with over 100,000 to 150,000 miles cost significantly less than those with low mileage. -

Age of the Truck

Older trucks are worth less. Typically, each passing year reduces their value by about 10 to 20%. -

Condition and Maintenance History

Well-maintained trucks retain more value. Clean service records and the absence of major damage usually result in higher prices. -

Brand and Model Reputation

Popular brands like Ford, Chevy, Ram, and Toyota tend to hold their value better. Reliable models like the F-150, Silverado, and Tundra sell for higher prices. -

Configuration and Features

Trucks with 4×4 capability, diesel engines, towing packages, and newer technology (like backup cameras and infotainment systems) command higher prices. Basic work trucks are typically cheaper. -

Market Demand and Season

Demand peaks in spring and summer, causing prices to rise. Diesel and 4×4 trucks are generally more expensive in rural areas or during colder months. -

Fuel Type

Diesel trucks often sell for $3,000 to $8,000 more than comparable gas models, thanks to their better fuel economy and torque. -

Location

Prices vary by location; rural areas tend to have higher prices, while urban centers may see lower costs. Trucks from rust-belt regions with frame rust often sell for much less. -

Current Fuel Prices

When gas or diesel prices increase, fuel-efficient trucks gain value. -

Economy and Interest Rates

In a strong economy with lower interest rates, prices for used trucks tend to rise as financing becomes more accessible.

Industry Expert Quotes

To further emphasize the themes of market stability and replacement demand in the used truck sector, industry expert insights provide valuable context:

Chris Visser, Director of Specialty Vehicles at J.D. Power, highlighted the market dynamics stating, “The absence of significant trade packages in 2025 will maintain steady inventory and pricing in the used truck market.” He elaborated on the stability being influenced by normalized capacity, urging stakeholders to focus on small private fleets and owner-operators amid ongoing freight challenges. For more details, you can refer to his insights on stability amid economic challenges in this article.

Adding further to Visser’s commentary, he noted, “Owners are extending rig lifecycles longer than usual to capitalize on current freight while delaying new trades, contributing to market stability.” His observations reflect the strong demand for late-model used rigs, particularly low-mileage trucks, affirming that “retail sales per dealership reached 3.2 trucks in May 2025, the strongest since June 2023.” This is documented in his detailed reporting from a recent Commercial Carrier Journal article.

Conversely, Lucas Deal, a reporter for Trucks, Parts and Service, asserted that “Despite economic uncertainty from tariffs and subdued freight volumes, used truck prices have shown remarkable stability in 2025.” He emphasized the ongoing improvement in the spot market, indicating that increases in freight demand are helping to maintain higher prices and suggesting resilience in replacement demand for used trucks. For specifics on this perspective, refer to Deal’s analysis in the article on used truck price stability.

These insights from industry experts underscore a cautiously optimistic outlook for the used truck market, where steady demand and strategic planning are key to navigating the uncertainties ahead.

Industry Expert Quotes

To further emphasize the themes of market stability and replacement demand in the used truck sector, industry expert insights provide valuable context:

Chris Visser, Director of Specialty Vehicles at J.D. Power, highlighted the market dynamics stating, “The absence of significant trade packages in 2025 will maintain steady inventory and pricing in the used truck market.” He elaborated on the stability being influenced by normalized capacity, urging stakeholders to focus on small private fleets and owner-operators amid ongoing freight challenges. For more details, you can refer to his insights on stability amid economic challenges in this article.

Adding further to Visser’s commentary, he noted, “Owners are extending rig lifecycles longer than usual to capitalize on current freight while delaying new trades, contributing to market stability.” His observations reflect the strong demand for late-model used rigs, particularly low-mileage trucks, affirming that “retail sales per dealership reached 3.2 trucks in May 2025, the strongest since June 2023.” This is documented in his detailed reporting from a recent Commercial Carrier Journal article.

Conversely, Lucas Deal, a reporter for Trucks, Parts and Service, asserted that “Despite economic uncertainty from tariffs and subdued freight volumes, used truck prices have shown remarkable stability in 2025.” He emphasized the ongoing improvement in the spot market, indicating that increases in freight demand are helping to maintain higher prices and suggesting resilience in replacement demand for used trucks. For specifics on this perspective, refer to Deal’s analysis in the article on used truck price stability.

These insights from industry experts underscore a cautiously optimistic outlook for the used truck market, where steady demand and strategic planning are key to navigating the uncertainties ahead.

As these expert opinions intricately connect with the current landscape, key facts about the used truck market emerge, painting a clearer picture of its resilience. The following data points will delineate how these insights translate into real market dynamics.

- Used truck prices remained stable despite fluctuations in freight demand and economic uncertainty.

- August 2025 saw a slight price increase for two-year-old trucks, indicating a portion of stability in pricing.

- DAT’s report highlighted a 10% increase in load post volumes last week, reflecting enhanced freight activity.

- Truckstop.com observed a 22% boost in load post volumes following Labor Day, suggesting a positive shift in market engagement.

- National average flatbed rates positioned 11 cents/mile higher compared to the same week in 2024, hinting at rising freight costs.

- Replacement demand is a key factor driving purchases, particularly in late-model, low-mileage vehicles.

- Experts note that current market conditions prevent oversupply of used trucks.

- Overall, the used truck market shows cautious optimism, with strong retail and auction activity amidst broader economic pressures.

Market Trends and Insights

Recent analyses of the used truck market illustrate a landscape characterized by resilience and cautious optimism. In March 2025, used truck retail sales experienced a remarkable 28% month-over-month increase, indicating robust buyer interest, especially under current economic uncertainties. This surge in retail sales was further supported by a 44% rise in auction activity, underscoring a competitive and dynamic bidding environment for used trucks.

Even as average prices have shown some declines, the sustained demand for used trucks reflects a market keenly aware of the value being offered, particularly in light of potential supply disruptions from new truck production. For instance, used truck retail sales outperformed typical seasonal expectations in various reports, with key insights emphasizing that this momentum is expected to continue through the year.

Moreover, economic factors such as fluctuating interest rates and evolving trade policies will play critical roles in shaping buyer behaviors moving forward. Stakeholders must adapt by closely monitoring these trends and aligning their inventory strategies with market signals to remain competitive.

The benefits of forming strategic partnerships with auction platforms are also evident, as they can provide access to a wider selection of trucks and facilitate faster responses to changing buyer needs. With retail and auction activities both demonstrating strength, the outlook for the used truck market remains cautiously optimistic, fostering an environment where informed decision-making can lead to strategic advantages.

| Truck Category | Average Price | Price Change | Mileage |

|---|---|---|---|

| Class 8 Truck | $55,222 | -1% | 410,000 miles |

| 4- to 6-year-old Sleeper | Varies | -5.5% | Average ~436,000 miles |

| Late-model Sleeper (2023) | $80,000 | +1.6% (YoY) | ~Average approx. |

| 3- to 5-year-old Trucks | +2.4% (MoM) | ||

| Low-mileage Trucks (<300,000) | Upward pressure | N/A | N/A |

In conclusion, the used truck market has showcased remarkable resilience amidst a backdrop of economic uncertainty, underscored by stable pricing trends and strong demand for late-model, low-mileage vehicles. Despite fluctuations in freight demand and broader market challenges, tiers of the trucking industry have witnessed encouraging sales figures, particularly during recent months.

The interplay of replacement demand and caution in supply management has effectively supported price stability, with experts agreeing that these dynamics are likely to continue influencing market behavior. As we look towards the future, a balanced outlook remains imperative; while economic pressures may prompt volatility, a sustained focus on operational efficiency and strategic inventory management will be key for stakeholders to navigate potential shifts.

Ultimately, the outlook for the used truck market remains cautiously optimistic, fostering an environment where informed decision-making can enable strength and adaptability in uncertain times.

User Adoption Trends in the Used Truck Market

Recent trends indicate a significant rise in user adoption rates within the used truck market, particularly among owner-operators. Analytical reports show the following notable points:

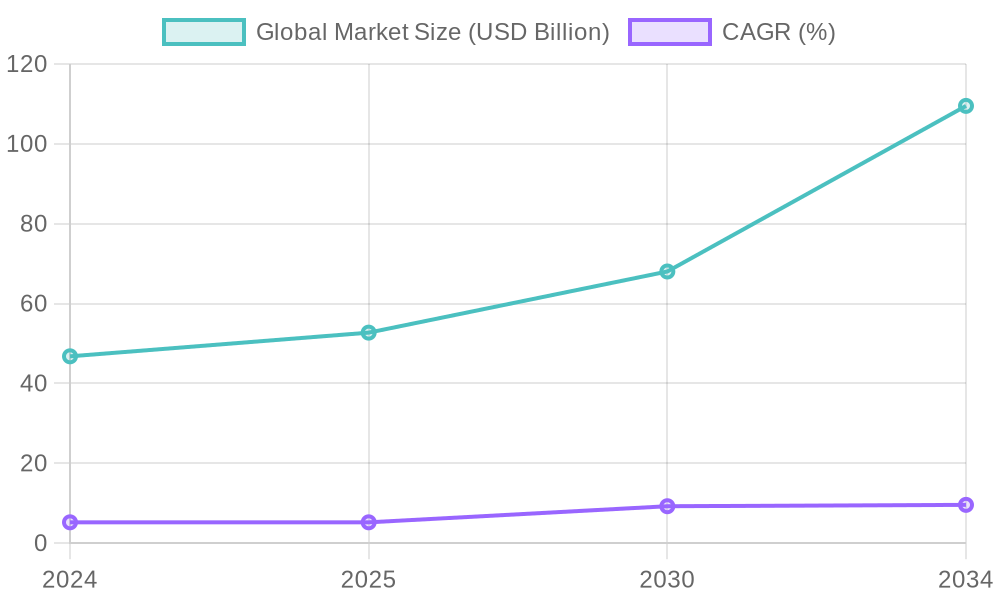

- Market Growth: The global used truck market reached approximately USD 46.3 billion in 2024, with estimates projecting a steady growth rate at a CAGR of about 3.16%, expected to reach USD 61.2 billion by 2033 (Source: IMARC Group).

- Owner-Operator Adoption: Owner-operators represent a notable segment of the market, comprising around 11% of truck drivers in the United States as of 2024, translating to approximately 922,000 independent operators (Source: Geotab). The increased adoption is primarily due to a growing preference for cost-effective solutions amid economic uncertainties, such as rising fuel costs and fluctuating interest rates.

- Economic Influences: The anticipated cuts in interest rates for 2025 could foster favorable purchasing conditions for small and medium-sized businesses (SMBs) and owner-operators, encouraging them to invest in used trucks rather than new ones (Source: Fortune Business Insights). Furthermore, value-driven owner-operators tend to favor 4- to 7-year-old trucks, which have seen price increases due to heightened competition for reliable used assets (Source: Mordor Intelligence).

- Current Trends: Digital platforms are making financing and purchases more accessible for owner-operators, enhancing their capability to acquire used trucks in a fluctuating market. Reports indicate that an increase in e-commerce and the need for operational efficiency in logistics are further driving the demand for used trucks (Source: Towards Automotive).

In conclusion, the combination of economic pressures and the strategic preferences of owner-operators is promoting a marked increase in the adoption of used trucks, demonstrating resilience in a fluctuating market environment. Owners are positioned to capitalize on the ongoing trends that favor the acquisition of used over new trucks, as these vehicles often present a more budget-friendly alternative.

Visual Representation

An abstract representation of the used truck market showing various economic factors influencing purchasing decisions among owner-operators, such as rising costs, interest rates, and supply chain disruptions.

Market Growth Visualization

A line chart depicting the growth of the used truck market, focusing on the economic influences and adoption rates among owner-operators over time.

User Adoption Trends in the Used Truck Market

User adoption trends indicate a robust growth trajectory for the used truck market, with significant shifts in buyer behavior influenced by economic conditions and evolving marketplace dynamics. Recent studies projected that the global used truck market will grow from approximately USD 46.3 billion in 2024 to USD 61.2 billion by 2033, achieving a compounded annual growth rate (CAGR) of 3.16%. This growth is driven largely by the economic advantage of acquiring used trucks over new ones, especially amid rising costs associated with new vehicle purchases and ongoing inflation pressures.

Economic Influences on User Behavior

The used truck market is currently witnessing a pivot towards cost-effective solutions as small and medium-sized businesses (SMBs) increasingly prefer buying pre-owned trucks rather than investing in new models. Economic uncertainties, such as fluctuating fuel prices and the anticipated cuts in interest rates for 2025, are fostering favorable purchasing conditions for users, particularly impacting owner-operators and smaller fleet operators. The combination of these economic factors is enhancing the incentive for businesses to acquire used vehicles that still meet operational needs without the new truck price tag.

Rise of Online Platforms and Digital Marketplaces

The emergence of online platforms has further facilitated this trend, enabling buyers to access a wider array of vehicle options that can suit various budget ranges. Digital auctions are burgeoning, with platforms such as Ritchie Bros. and others reporting significant increases in auction transactions. In March 2025, auction sales for Class 8 trucks surged 44% month-over-month, highlighting a strong preference for reliable mid-age assets among buyers. This shift to online bidding allows for transparent pricing and immediate access to auction inventories, with buyer trends indicating higher premiums for lower-mileage trucks indicating a quality over quantity approach to acquisitions.

In addition, peer-to-peer online sales platforms are gaining traction, allowing users to connect directly with sellers, further streamlining the purchasing process and expanding buyer pools. The prevalence of certified pre-owned programs is also supporting buyer confidence, mitigating apprehensions about purchasing used equipment.

Overall, the combination of economic factors and the strategic advantages provided by digital platforms showcases a critical transformation in the used truck market, making it a viable and attractive option for many operators.

The Role of Online Platforms and Auction Circuits in the Used Truck Market

In recent years, online platforms and auction circuits have transformed the landscape of the used truck market, introducing efficiency and transparency that significantly influence trade dynamics and pricing stability. Companies like Truckstop.com and ACT Research play instrumental roles in this evolution.

Online Platforms Facilitating Trades

Truckstop.com operates as one of the largest online freight marketplaces, boasting over 1 million loads posted daily. This platform not only connects freight carriers with shippers but also features a dedicated Truck Sales marketplace, facilitating the buying and selling of used trucks. These online tools allow users to gain real-time insights into market trends, enabling quicker and more informed trading decisions. According to Truckstop.com, its Rate Insights feature provides valuable data on rate trends, which aids users in negotiating fair prices; users reportedly experience a 12% increase in profitability on average when utilizing these insights effectively (Truckstop.com).

Moreover, recent data from ACT Research indicates that auction volumes have surged significantly, with a reported 18% year-over-year increase in auction units sold. This uptick underscores the vital role that both online platforms and physical auction houses, such as Ritchie Bros. and Manheim, play in maintaining market liquidity and accessibility (ACT Research). Online auctions provide a broader reach, allowing sellers to tap into extensive buyer networks without geographic limitations, thus reducing the time to close sales from an average of 45 days at physical auctions to as little as 18 days online (Commercial Carrier Journal).

Impact on Pricing Stability

The integration of digital platforms significantly enhances price stability within the used truck market. The spot market rates monitored through platforms like Truckstop.com serve as leading indicators of pricing trends, influencing the valuation of used trucks. When freight rates rise, there is an observable surge in demand for additional trucks, which, in turn, drives up prices for used Class 8 trucks (ACT Research). Conversely, when freight demand softens, the influx of trucks onto auction platforms helps mitigate excessive price fluctuations by increasing supply. In 2025, for instance, improved integration of real-time data from platforms like Truckstop with traditional auction results has shortened pricing correction cycles significantly from 9-12 months to 4-6 months, allowing for more adaptive market responses (Transport Topics).

Experts have noted that the combination of auction data and real-time freight rate information fosters a pricing environment where used Class 8 truck prices fluctuate only ±4% month-to-month, compared to historical swings of up to ±15% in prior years (ACT Research). Such stability not only assists buyers and sellers in making informed decisions but also supports broader market confidence, essential in an industry often vulnerable to economic shocks.

Conclusion

Ultimately, online platforms and auction circuits are reshaping the used truck market by facilitating quicker trades and bolstering pricing stability. Companies like Truckstop.com and ACT Research are at the forefront of this transformation, providing valuable tools and insights that mitigate volatility in an ever-changing economic landscape. As this digital shift continues to grow, it will be crucial for stakeholders within the industry to leverage these advancements to optimize their trading strategies and maintain competitive advantages.

Used Truck Market Stability Amid Economic Uncertainty

Introduction

In the ever-evolving landscape of the used truck market, the persistent economic uncertainty has ignited both concern and cautious optimism among industry stakeholders. As freight demand has seen its fluctuations, one thing has remained clear: used truck prices have demonstrated remarkable stability. Even amidst challenges such as rising costs and market volatility, late-model, low-mileage trucks have maintained their value, fetching premiums that speak volumes about buyer confidence. In recent months, numbers indicate an upswing in used truck sales, with analysts reporting better-than-anticipated results despite potential headwinds. This article delves into the factors underpinning the resilience of used truck prices, explores the impact of replacement demand on purchasing trends, and highlights key insights from market experts. With a cautious yet hopeful outlook, we analyze how these dynamics may shape the future of the used truck market.

Factors Affecting Used Truck Prices

Mileage

Trucks with high mileage generally sell for less. For instance, trucks with over 100,000 to 150,000 miles cost significantly less than those with low mileage.

Age of the Truck

Older trucks are worth less. Typically, each passing year reduces their value by about 10 to 20%.

Condition and Maintenance History

Well-maintained trucks retain more value. Clean service records and the absence of major damage usually result in higher prices.

Brand and Model Reputation

Popular brands like Ford, Chevy, Ram, and Toyota tend to hold their value better. Reliable models like the F-150, Silverado, and Tundra sell for higher prices.

Configuration and Features

Trucks with 4×4 capability, diesel engines, towing packages, and newer technology (like backup cameras and infotainment systems) command higher prices. Basic work trucks are typically cheaper.

Market Demand and Season

Demand peaks in spring and summer, causing prices to rise. Diesel and 4×4 trucks are generally more expensive in rural areas or during colder months.

Fuel Type

Diesel trucks often sell for $3,000 to $8,000 more than comparable gas models, thanks to their better fuel economy and torque.

Location

Prices vary by location; rural areas tend to have higher prices, while urban centers may see lower costs. Trucks from rust-belt regions with frame rust often sell for much less.

Current Fuel Prices

When gas or diesel prices increase, fuel-efficient trucks gain value.

Economy and Interest Rates

In a strong economy with lower interest rates, prices for used trucks tend to rise as financing becomes more accessible.

Industry Expert Quotes

To further emphasize the themes of market stability and replacement demand in the used truck sector, industry expert insights provide valuable context:

Chris Visser, Director of Specialty Vehicles at J.D. Power, highlighted the market dynamics stating, “The absence of significant trade packages in 2025 will maintain steady inventory and pricing in the used truck market.” He elaborated on the stability being influenced by normalized capacity, urging stakeholders to focus on small private fleets and owner-operators amid ongoing freight challenges. For more details, you can refer to his insights on stability amid economic challenges in this article.

Adding further to Visser’s commentary, he noted, “Owners are extending rig lifecycles longer than usual to capitalize on current freight while delaying new trades, contributing to market stability.” His observations reflect the strong demand for late-model used rigs, particularly low-mileage trucks, affirming that “retail sales per dealership reached 3.2 trucks in May 2025, the strongest since June 2023.” This is documented in his detailed reporting from a recent Commercial Carrier Journal article.

Conversely, Lucas Deal, a reporter for Trucks, Parts and Service, asserted that “Despite economic uncertainty from tariffs and subdued freight volumes, used truck prices have shown remarkable stability in 2025.” He emphasized the ongoing improvement in the spot market, indicating that increases in freight demand are helping to maintain higher prices and suggesting resilience in replacement demand for used trucks. For specifics on this perspective, refer to Deal’s analysis in the article on used truck price stability.

These insights from industry experts underscore a cautiously optimistic outlook for the used truck market, where steady demand and strategic planning are key to navigating the uncertainties ahead.

Key Facts about the Used Truck Market

- Used truck prices remained stable despite fluctuations in freight demand and economic uncertainty.

- August 2025 saw a slight price increase for two-year-old trucks, indicating a portion of stability in pricing.

- DAT’s report highlighted a 10% increase in load post volumes last week, reflecting enhanced freight activity.

- Truckstop.com observed a 22% boost in load post volumes following Labor Day, suggesting a positive shift in market engagement.

- National average flatbed rates positioned 11 cents/mile higher compared to the same week in 2024, hinting at rising freight costs.

- Replacement demand is a key factor driving purchases, particularly in late-model, low-mileage vehicles.

- Experts note that current market conditions prevent oversupply of used trucks.

- Overall, the used truck market shows cautious optimism, with strong retail and auction activity amidst broader economic pressures.

Market Trends and Insights

Recent analyses of the used truck market illustrate a landscape characterized by resilience and cautious optimism. In March 2025, used truck retail sales experienced a remarkable 28% month-over-month increase, indicating robust buyer interest, especially under current economic uncertainties. This surge in retail sales was further supported by a 44% rise in auction activity, underscoring a competitive and dynamic bidding environment for used trucks.

Even as average prices have shown some declines, the sustained demand for used trucks reflects a market keenly aware of the value being offered, particularly in light of potential supply disruptions from new truck production. For instance, used truck retail sales outperformed typical seasonal expectations in various reports, with key insights emphasizing that this momentum is expected to continue through the year.

Moreover, economic factors such as fluctuating interest rates and evolving trade policies will play critical roles in shaping buyer behaviors moving forward. Stakeholders must adapt by closely monitoring these trends and aligning their inventory strategies with market signals to remain competitive.

The benefits of forming strategic partnerships with auction platforms are also evident, as they can provide access to a wider selection of trucks and facilitate faster responses to changing buyer needs. With retail and auction activities both demonstrating strength, the outlook for the used truck market remains cautiously optimistic, fostering an environment where informed decision-making can lead to strategic advantages.

Conclusion

In conclusion, the used truck market has showcased remarkable resilience amidst a backdrop of economic uncertainty, underscored by stable pricing trends and strong demand for late-model, low-mileage vehicles. Despite fluctuations in freight demand and broader market challenges, tiers of the trucking industry have witnessed encouraging sales figures, particularly during recent months. The interplay of replacement demand and caution in supply management has effectively supported price stability, with experts agreeing that these dynamics are likely to continue influencing market behavior. As we look towards the future, a balanced outlook remains imperative; while economic pressures may prompt volatility, a sustained focus on operational efficiency and strategic inventory management will be key for stakeholders to navigate potential shifts. Ultimately, the outlook for the used truck market remains cautiously optimistic, fostering an environment where informed decision-making can enable strength and adaptability in uncertain times.

User Adoption Trends in the Used Truck Market

Market Growth

The global used truck market reached approximately USD 46.3 billion in 2024, with estimates projecting a steady growth rate at a CAGR of about 3.16%, expected to reach USD 61.2 billion by 2033 (Source: IMARC Group).

Owner-Operator Adoption

Owner-operators represent a notable segment of the market, comprising around 11% of truck drivers in the United States as of 2024, translating to approximately 922,000 independent operators (Source: Geotab). The increased adoption is primarily due to a growing preference for cost-effective solutions amid economic uncertainties, such as rising fuel costs and fluctuating interest rates.

Economic Influences

The anticipated cuts in interest rates for 2025 could foster favorable purchasing conditions for small and medium-sized businesses (SMBs) and owner-operators, encouraging them to invest in used trucks rather than new ones (Source: Fortune Business Insights). Furthermore, value-driven owner-operators tend to favor 4- to 7-year-old trucks, which have seen price increases due to heightened competition for reliable used assets (Source: Mordor Intelligence).

Current Trends

Digital platforms are making financing and purchases more accessible for owner-operators, enhancing their capability to acquire used trucks in a fluctuating market. Reports indicate that an increase in e-commerce and the need for operational efficiency in logistics are further driving the demand for used trucks (Source: Towards Automotive).

In conclusion, the combination of economic pressures and the strategic preferences of owner-operators is promoting a marked increase in the adoption of used trucks, demonstrating resilience in a fluctuating market environment. Owners are positioned to capitalize on the ongoing trends that favor the acquisition of used over new trucks, as these vehicles often present a more budget-friendly alternative.

The Role of Online Platforms and Auction Circuits in the Used Truck Market

In recent years, online platforms and auction circuits have transformed the landscape of the used truck market, introducing efficiency and transparency that significantly influence trade dynamics and pricing stability. Companies like Truckstop.com and ACT Research play instrumental roles in this evolution.

Online Platforms Facilitating Trades

Truckstop.com operates as one of the largest online freight marketplaces, boasting over 1 million loads posted daily. This platform not only connects freight carriers with shippers but also features a dedicated Truck Sales marketplace, facilitating the buying and selling of used trucks. These online tools allow users to gain real-time insights into market trends, enabling quicker and more informed trading decisions. According to Truckstop.com, its Rate Insights feature provides valuable data on rate trends, which aids users in negotiating fair prices; users reportedly experience a 12% increase in profitability on average when utilizing these insights effectively (Truckstop.com).

Moreover, recent data from ACT Research indicates that auction volumes have surged significantly, with a reported 18% year-over-year increase in auction units sold. This uptick underscores the vital role that both online platforms and physical auction houses, such as Ritchie Bros. and Manheim, play in maintaining market liquidity and accessibility (ACT Research).

Impact on Pricing Stability

The integration of digital platforms significantly enhances price stability within the used truck market. The spot market rates monitored through platforms like Truckstop.com serve as leading indicators of pricing trends, influencing the valuation of used trucks. When freight rates rise, there is an observable surge in demand for additional trucks, which, in turn, drives up prices for used Class 8 trucks (ACT Research). Conversely, when freight demand softens, the influx of trucks onto auction platforms helps mitigate excessive price fluctuations by increasing supply. In 2025, for instance, improved integration of real-time data from platforms like Truckstop with traditional auction results has shortened pricing correction cycles significantly from 9-12 months to 4-6 months, allowing for more adaptive market responses (Transport Topics).

Experts have noted that the combination of auction data and real-time freight rate information fosters a pricing environment where used Class 8 truck prices fluctuate only ±4% month-to-month, compared to historical swings of up to ±15% in prior years (ACT Research). Such stability not only assists buyers and sellers in making informed decisions but also supports broader market confidence, essential in an industry often vulnerable to economic shocks.

Conclusion

Ultimately, online platforms and auction circuits are reshaping the used truck market by facilitating quicker trades and bolstering pricing stability. Companies like Truckstop.com and ACT Research are at the forefront of this transformation, providing valuable tools and insights that mitigate volatility in an ever-changing economic landscape. As this digital shift continues to grow, it will be crucial for stakeholders within the industry to leverage these advancements to optimize their trading strategies and maintain competitive advantages.