Registering a commercial truck in Arizona involves a series of essential steps tailored to ensure compliance with state regulations. For truck owners, fleet managers, and procurement teams within construction and logistics sectors, understanding the requirements, registration types, applicable fees, and procedures is critical for efficient operations. This guide provides a thorough overview of eligibility and required documents, how to determine the correct registration type for your vehicle, an understanding of fees and taxes involved, and clear steps to submit your application. By following this structured process, you can streamline registration efforts and mitigate potential administrative challenges.

Meet Arizona’s Rules: Eligibility and Essential Documents to Register Your Commercial Truck

Understanding who can register a commercial truck in Arizona and exactly what paperwork to bring saves time and prevents surprises. Arizona requires proof of ownership, evidence of insurance, and compliance with both state and federal safety rules. If you prepare the right documents, you can avoid repeat trips to an MVD office and keep your vehicle on the road.

Begin by confirming eligibility. The truck must be used for commercial purposes, such as hauling freight, making deliveries, or transporting passengers for hire. You must be the legal owner of the vehicle, or you must represent the business that holds title. Businesses registered in Arizona can register vehicles in the company name. Nonresidents who maintain a business presence in the state will need documentation proving that presence. If you plan to operate across state lines, remember federal rules will apply too. The truck must meet Federal Motor Carrier Safety Administration standards when used in interstate commerce.

Driver qualifications affect eligibility to operate, though they do not alone affect registration. If you will drive the truck, you typically need a valid Commercial Driver’s License. For interstate driving you must be at least 21. For intrastate work, some commercial driving is allowed at 18. Make sure the driver’s endorsements match the vehicle and cargo type. Having a CDL on file or ready to show avoids delays if an MVD clerk needs verification.

Next, gather the required documents. The core items are straightforward, but small details matter.

-

Proof of ownership. Present the vehicle title signed over to you or the company. If the truck was recently bought, a properly executed bill of sale helps establish ownership while the title is processed. If there is a lienholder, bring the lien information exactly as it appears on the title. Out-of-state titles are accepted but must be clear and complete.

-

Application for registration and title. Use the correct state form. Arizona commonly uses the Application for Title and Registration (Form 967). In some commercial cases, other forms such as AR-482 or AR-483 may be required. Check the form instructions so you file the right one. Complete every field and sign where required.

-

Proof of insurance. Arizona requires liability insurance for commercial vehicles. Provide an insurance card or declaration page that lists the vehicle, policy effective dates, and the insured name. The policy must meet Arizona minimums for commercial operations. If your company policy is used, bring documentation showing the truck is covered under that policy.

-

Odometer disclosure. For trucks less than 10 years old, an odometer statement is required. This typically appears on the title or on a separate federal odometer disclosure statement. Ensure the mileage is accurate and legible.

-

VIN verification. A Vehicle Identification Number verification may be required, especially for out-of-state vehicles or titling changes. An authorized Arizona agent, law enforcement officer, or licensed inspection station can perform the verification. If a VIN verification is needed, don’t assume a clerk will catch it at the counter. Get it done beforehand to avoid delays.

-

Identification for the registrant. Bring valid photo ID showing your Arizona residency, or corporate documentation if you are registering the truck to a business. For a company, carry proof of the business’s Arizona registration, such as a certificate of good standing, articles of organization, or a recent business license. If someone else will register the truck for you, provide a signed authorization or power of attorney.

-

Payment method. Have funds ready for registration fees, title fees, and applicable taxes. Fees are weight-based for commercial trucks. If you are unsure of the total, check fee charts online or call the MVD before you go.

Certain situations call for additional paperwork.

If the truck is leased, bring the lease agreement along with the lessor’s authorization to register. If the vehicle is financed, provide the finance contract and lienholder details. For fleet registrations, prepare a list of vehicles and VINs, and verify whether fleet plates or apportioned registration will apply. For interstate travel, check whether apportioned plates through the International Registration Plan are necessary.

Special cargo requires permits and paperwork. Vehicles that carry hazardous materials need the appropriate endorsements and permits. Oversize or overweight trucks require permits and supporting route information. These items usually do not affect title work but are critical to lawful operation.

Pay attention to common pitfalls that cause delays. Missing signatures on the title are frequent issues. If the seller did not sign the title correctly, the MVD will not accept the transfer. Incomplete or illegible bill of sale information can also stall registration. If the truck was previously titled in another state, make sure the odometer disclosure, lien release, and any release of interest documents are present and properly notarized if required.

Another common snag involves insurance. The MVD verifies that the vehicle is insured. If your policy does not yet show the vehicle, provide a temporary binder or written confirmation from your insurer that names the vehicle and effective date. Electronic proof is acceptable when submitting documents online, but printed proof is still wise for in-person visits.

VIN number inconsistencies occur when a vehicle has aftermarket parts or salvage history. If the VIN plate or VIN imprint looks altered, expect an inspection or additional documentation explaining repairs. Vehicles coming from auctions or salvage yards sometimes need a salvage title or rebuilt title paperwork. Verify the title brand and ensure all supporting documents for rebuilt or salvage titles are in order.

If you represent a business, prepare corporate documentation. The MVD will accept registrations under a company name, but you must prove authority to act for the company. Bring a recent business filing record, landlord or lease documentation if the business address is not the same as the owner’s, and a company resolution or power of attorney naming authorized individuals. For sole proprietors, a DBA or trade name filing may be necessary if operating under a business name.

Consider electronic options. Arizona’s MVD accepts certain filings online. Scanning or photographing documents in advance and using the online portal speeds processing. When registering in person, present original documents plus copies for staff to keep. For mailed filings, include self-addressed stamped envelopes for return of plates and titles.

If anything about the truck’s history is unclear, request a vehicle history report before you complete the transaction. That can reveal salvage brands, odometer rollback signs, or undisclosed liens. Clearing title issues before you file avoids repeat trips.

When all documents are correct, the MVD will process your application and issue plates and a registration decal. If you need immediate proof of registration, ask for a temporary permit. Temporary permits allow legal operation while your permanent plates and registration mail to you.

Small practical tips reduce friction. Organize documents in a labeled folder. Use a checklist so nothing is overlooked. Confirm office hours for the MVD location you plan to visit, and avoid midday lunch closures. If you have a large fleet, contact the MVD in advance to arrange an appointment or review fleet-specific forms.

Finally, stay informed. State forms and requirements change occasionally. For the most accurate and current instructions, review official guidance before you go. If you want perspectives from the industry on buying and managing trucks, a useful resource is the McGrath Trucks blog for broader market context and practical tips: McGrath Trucks blog.

For direct, authoritative information on forms, title rules, and specific state requirements, check the Arizona Department of Transportation’s Motor Vehicle Division website: https://www.azdot.gov.

Choosing the Right Registration Path: Understanding How Arizona Classifies and Registers Your Commercial Truck

When you own or operate a commercial truck in Arizona, the question of registration isn’t just about getting plates. It is about matching your vehicle to the right regulatory track so you pay the correct fees, stay compliant, and keep your operation running smoothly. The Arizona system, administered through the Arizona Department of Transportation and its Motor Vehicle Division, relies on clear distinctions between vehicle weight, use, and the way the vehicle will be deployed in daily operations. To the disciplined fleet owner, this means starting with a precise assessment of your truck’s weight and purpose before you ever walk into an office or click through an online portal. The hinge on which the entire process turns is the gross vehicle weight rating, or GVWR, a rating that encapsulates the maximum loaded weight the vehicle is built to safely carry. In Arizona, a GVWR of 10,001 pounds or more generally places a truck into the commercial category. This threshold is not a mere number on a spec sheet; it is a doorway that leads you toward a specific registration path, one that carries implications for taxes, insurance, and how the vehicle is described on the paperwork you submit to the state. The practical effect for a fleet operator is simple enough: if your truck is used for business purposes and weighs more than 10,000 pounds, you will most likely be registering it as a commercial vehicle. If, on the other hand, a vehicle is used privately, which is uncommon for most commercial trucks, a standard vehicle registration could apply. Yet the line is not always that clean, which is why the classification becomes a point of careful verification rather than a quick assumption. As you weigh your options, the purpose of the vehicle matters just as much as the weight. A truck used exclusively for freight transport, long-haul deliveries, or carrier service is typically categorized as a commercial vehicle. A vehicle repurposed for passenger services or a specialized operation, such as certain maintenance fleets or dedicated service routes, might require different classifications within the commercial framework. The MVD’s classification system is designed to reflect both how the vehicle is used and its capacity to carry weight, and it recognizes that fleet managers must navigate a range of scenarios without compromising compliance. In practice, this means that the same make and model can inhabit different registration categories depending on its job in your operation. Your job is to determine the true use and the GVWR from the official sources you rely on, then proceed with the corresponding registration process. The category you choose affects not only the paperwork you file but the costs you incur and the type of documentation you need to present to the MVD. A straightforward example helps ground the concept: a commercial straight truck with a GVWR just over the 10,000-pound mark, used to haul freight for a local business, would fall under the commercial registration. Its plates, decals, and insurance requirements will align with commercial vehicle standards, even if the truck spends a portion of its time in other kinds of work. The same vehicle, if it were dedicated to a private, nonbusiness function, would be a much rarer case in the world of commercial fleets, but it would trigger a different registration classification and a different set of regulatory expectations. Because weight and use interact in nuanced ways, Arizona’s registration process emphasizes verification rather than assumption. You can start by confirming the GVWR on the vehicle’s label, often found on the door jamb or in the owner’s manual, and cross-checking with the title and any available specification sheets from the manufacturer. If you recently acquired a truck, the title documentation will typically show the GVWR or a closely related specification that clarifies the weight class. If you’re operating under a vehicle that is already titled and registered elsewhere but will be used in Arizona for business, you should review how that registration would translate under MVD rules in Arizona. The MVD recognizes that certain fleets maintain centralized or interjurisdictional registration arrangements for efficiency, and it can accommodate these structures while ensuring compliance with local requirements. In fact, a notable example across the broader trucking landscape is the way some large operators manage registration through centralized systems. A well-known practice in the industry is the use of centralized registrations for fleets that operate across multiple states. While this description references a general industry pattern rather than a product or service, it highlights the importance of understanding how a company’s registration approach can influence timing, documentation, and the flow of work when a vehicle crosses state lines. The aim is to avoid last-minute complications that disrupt service and to ensure that all commercial vehicles are properly declared according to their use and weight, so they remain in good standing with state authorities. For those who are new to the Arizona process, the starting point is clear in intent: determine the GVWR and confirm whether the vehicle’s primary use is business-related. If both answers point toward a commercial category, you will pursue commercial registration. If you are unsure, the best path is to consult the official sources and seek clarification before you submit an application. This is not merely bureaucratic caution; it is practical risk management for a business that relies on predictable, compliant operation. The official guidance published by the Arizona MVD provides the framework for how to classify vehicles, the documents you need to assemble, and the steps to complete the registration. It is a resource you should reference as you assemble titles, odometer statements, proof of insurance, and the appropriate registration forms. The forms themselves are the practical interfaces with state records. For commercial vehicles, you will typically be asked to complete a form that collects basic information about the vehicle, its ownership, and its intended use, as well as the necessary declarations related to title transfer when you are bringing the vehicle into Arizona or updating an existing title. The level of detail required can increase if your fleet includes multiple vehicles or specialized equipment, but the underlying principle remains the same: accurately reflect how the vehicle will operate within the state and ensure the weight classification is consistent with the vehicle’s actual capabilities. The decision to pursue commercial registration also interacts with insurance requirements. Arizona law requires liability insurance for all commercial vehicles, and your proof of insurance must align with the category you select. In practice, this means coordinating your insurance documents with your registration filings so there is no lag between submitting your application and providing coverage that satisfies the state’s minimums. As you prepare to determine the correct registration type, keep in mind that the state’s online and in-person processes are designed to accommodate both straightforward cases and more complex fleet configurations. The online portal offers a fast track for many registrants, but there are scenarios—such as when you must submit title transfers, obtain special permits for overweight operations, or address unusual vehicle configurations—where in-person or mail options provide the clarity you need and the ability to present supporting documents with certainty. If you choose to pursue online registration, you should gather digital copies of the required documents in advance. A well-organized digital packet reduces processing time and minimizes the chance of delays caused by missing information. You can upload documents such as the title, odometer declaration (if applicable), proof of insurance, and any other supporting paperwork through the ADOT MVD online system. This approach often leads to quicker approvals and faster receipt of plates and decals, enabling you to get back on the road with fewer interruptions to service. Another practical consideration is how this classification affects the day-to-day operation of your business. If your vehicle is a true workhorse, used for repeated freight runs and long-haul assignments, the commercial designation aligns with your operational reality and simplifies maintenance planning, insurance purchasing, and tax considerations related to business use. On the other hand, if your equipment is used in a more limited way or on a sporadic basis, you may need to evaluate whether a different use category or a specific subclass within the commercial framework better reflects the reality of your utilization. The precise choice can influence the fees you pay, the nature of the permits you may require, and the representations you must make to the MVD. Fees, taxes, and permits are not merely line items on a receipt; they are signals about the scope of your operation and the regulatory obligations that accompany it. The registration fee, driven in part by gross vehicle weight, interacts with state sales tax considerations and county or local fees that may apply. If your operation requires special permits—for example, for overweight transport or hazardous materials handling—these will add layers of compliance more than cost in some instances, but they are essential for legal operation. The process of selecting the correct registration type, therefore, becomes a disciplined exercise in aligning weight, usage, and regulatory requirements so your fleet can function without friction. It is a decision that should be revisited whenever there is a meaningful change in weight, configuration, or use. For a vehicle that grows heavier due to modifications, additional equipment, or changes in service, the classification could shift and trigger a different registration pathway. In practice, the best approach is to anchor your decision to the GVWR and the vehicle’s primary business function, verify through the MVD resources, and proceed with the correct forms and documentation. As you prepare to file, remember that you are not alone in this process. There are official channels to consult, including the Arizona MVD Vehicle Registration page, which provides the most up-to-date guidance on vehicle classification and registration requirements. For readers seeking practical fleet context and additional insights, consider also exploring industry resources that discuss how fleets navigate regulatory frameworks across borders and states. One resource that can complement your understanding is a fleet-focused blog noted for its practical discussions on policy, operations, and market trends. You can visit mcgrathtrucks.com/blog/ for further context and perspectives on current trends and how operators adapt. This kind of background can help you anticipate how regulatory decisions may align with broader market conditions and your own strategic planning. In the long run, the key to a smooth registration experience lies in accuracy, preparation, and a willingness to engage with the process rather than rush through it. Start by confirming the GVWR, then map out the vehicle’s primary use in the Arizona environment. Gather the requisite documents, including the title, odometer statement if applicable, proof of insurance, and the correct registration form for commercial vehicles. Decide whether you will register online, in person, or by mail, keeping in mind that the online path can be faster if you upload clear digital copies of your documents. If you choose the in-person route, you will have the advantage of speaking directly with a representative who can help if any part of your classification is ambiguous or if your fleet presents a complex configuration. In either case, you are working toward a straightforward objective: a properly classified, fully compliant registration that matches your truck’s weight and its business use, enabling your operation to move with the reliability your customers and drivers depend on. The process rewards those who take the time to verify their GVWR, understand the use case, and assemble a complete packet before submitting. It also rewards the fleet that keeps documentation up to date, ensuring insurance coverage aligns with the chosen category and that any changes to weight or use are promptly reflected in the registration. While the pathway to registration may seem procedural, it is, in truth, a strategic portion of running a compliant, efficient trucking operation in Arizona. When you approach the decision with a clear grasp of GVWR and usage, you create a foundation that supports not only regulatory compliance but also smoother operational planning, more predictable budgeting, and less downtime caused by administrative delays. As you become familiar with the process, you will notice how the pieces fit together: weight determines category, purpose defines the exact classification within that category, and the paperwork you assemble becomes the record of your operation’s compliance. With that awareness, you can approach the registration journey with confidence, knowing you have anchored your decisions in the two most decisive factors: weight and use. The Arizona MVD framework is designed to be navigable for legitimate operators, and when you document accurately, you harness an efficient path to plates, decals, and the assurance that your commercial vehicle is properly aligned with state requirements. For those who want to supplement their understanding with official guidance, the Arizona MVD’s vehicle registration page is the authoritative resource to consult as you finalize your decision about registration type and prepare your submission. External resource: https://mvd.arizona.gov/vehicle-registration

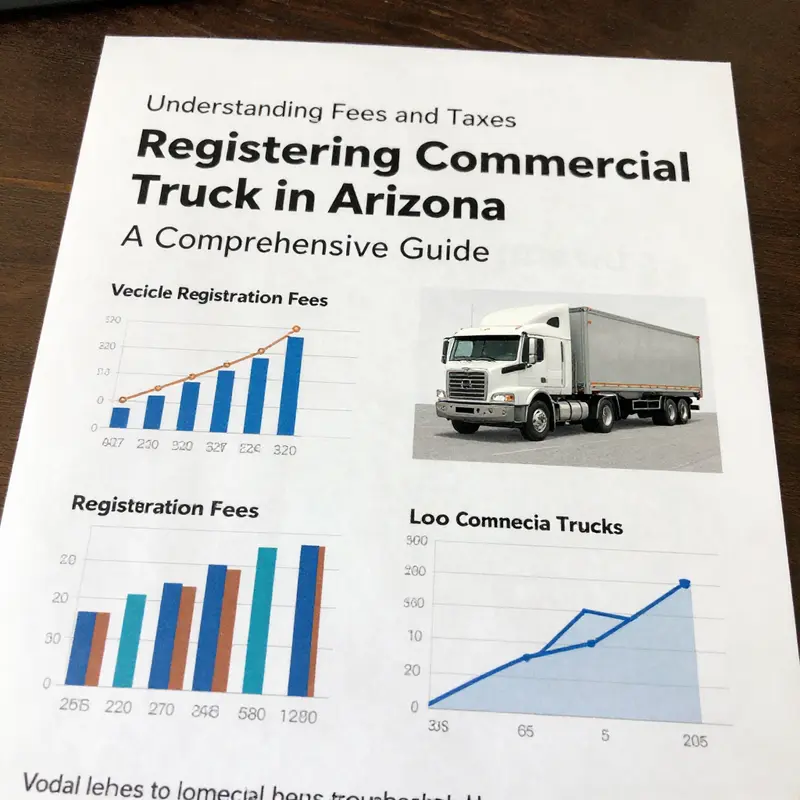

The True Cost of Compliance: Demystifying Fees and Taxes for Arizona Commercial Truck Registration

Registering a commercial truck in Arizona is more than a simple paperwork step; it is a balancing act between compliance, timing, and the cash you need to keep wheels turning. When you’re budgeting for a fleet or a single heavy-haul rig, you must look beyond the sticker price of the truck itself. The fees and taxes tied to registration can shape your operating costs for the year, and they vary with weight, use, and location. Understanding this landscape helps you plan, avoid surprises, and keep your business moving smoothly from the first moment you register to the moment you renew each year. The heart of the matter rests on a few core components: the registration fee itself, the title and license plate fees, state and local taxes, and any special permits that might apply to unusual operations. In Arizona, the weight of the vehicle is not just a technical detail; it is the primary determinant of what you will pay to keep it on the road. For commercial trucks, the gross vehicle weight rating (GVWR) is a pivotal number. Heavier trucks face higher registration fees because they place greater demand on roads, bridges, and infrastructure. The simplest way to frame it is this: the heavier the truck, the larger the annual registration bill. The range can start modestly, around several hundred dollars, and rise to well over a thousand dollars per year for the largest, hardest-working rigs. This spectrum is not arbitrary. It mirrors a deliberate system in which the state ties fees to vehicle characteristics while letting local counties layer in their own charges. You’ll also encounter a separate title fee when the vehicle’s ownership is transferred into your name or your business name. Title fees are a fixed cost but they are not inconsequential. They exist to reflect the legal action of changing ownership in the official record, and they’ll accompany the first registration or any subsequent title changes. When the paperwork is in order, your plates and decals complete the visible proof of registration. In Arizona, the license plate fee accompanies the registration, with a digital or physical plate issued and a registration decal or sticker placed on that plate to indicate current validation. The process itself is designed to track ownership, ensure insurance coverage, and verify that the vehicle remains compliant with state standards for operation on public roadways. Yet the details do not stop there. The state imposes a 5.6% sales tax on the purchase price of a vehicle bought within Arizona. If the vehicle is purchased out of state, you may be subject to a use tax instead; the treatment of that tax depends on where the purchase occurred and how the vehicle is used once it arrives in Arizona. Local counties can layer on additional charges, which means that the same model moving through two neighboring counties could carry different final costs in registration year after year. These local nuances matter, especially for trucking companies that operate across county lines or regularly register multiple vehicles in different jurisdictions. The outlay for fees and taxes is thus a mosaic rather than a single line item. To bring this to life, consider a typical commercial truck with a GVWR over 10,000 pounds. In such cases, the registration fees typically rise above the baseline, reflecting the greater impact on public infrastructure and the longer wear on highway systems. The state’s fee schedules are explicit, and while the general pattern is predictable, the exact amount may hinge on the precise GVWR bracket your truck sits in, plus whether you use the vehicle for business purposes or private travel—though the latter is rare for commercial trucks. The use classification matters not just for how the vehicle is taxed but also for the kind of registration you receive. If the truck is used for business purposes—freight, delivery, or other commercial services—you will generally register it as a commercial vehicle. That designation aligns with the way Arizona’s MVD accounts for the vehicle’s operational profile, including how it will be driven, where it will operate, and the permit regime it might require for specific cargos. If, by rare circumstance, a commercial truck were used privately, you would explore a standard registration pathway. In practice, commercial use is so common that the standard path most readers will encounter emphasizes commercial registration and the related fee structure. In addition to the core registration, title, and plate costs, you may encounter specialized fees based on how you use the truck and where it operates. Overweight and hazardous materials permits, for example, bring their own fee schedules. If your operation involves moving heavy loads or transporting hazardous commodities, you should factor in these permits as separate expenditures on top of the base registration. The heart of the financial planning exercise is to assemble a realistic estimate that covers all these variables. The base registration fee is determined by weight and use, but the exact amount is also shaped by the county where you register and any supplemental charges local jurisdictions add. The state’s tax regime adds another layer: 5.6% of the purchase price if you bought within Arizona, or a use tax if you brought the vehicle in from another state. Local sales taxes or use taxes may apply in addition to the state rate, which means you must check the local landscape as part of your budgeting. Given this complexity, the good news is that a careful, scenario-based calculation can provide a reliable forecast. For a typical Arizona registration calculation, you start with the GVWR bracket to determine the base fee, then apply the appropriate tax and any county-level charges. Your total can be influenced by whether the vehicle was bought new or used, where it was purchased, and how the registration is categorized. If you operate in multiple counties or plan to register more than one unit, maintaining a clear ledger of yearly fees becomes essential. The MVD’s fee schedules are designed to be transparent, and the best practice is to consult the official resources to derive the exact numbers for your truck. Still, a practical understanding helps you plan quarterly budgets and avoid surprises when renewal time arrives. One subtle but important point that often catches carriers off guard is the timing and method of registration. The process is moving toward flexibility, with options that include online registration through the Arizona MVD portal, in-person visits to a local MVD office, or even mail-in submissions in certain cases. The online option is particularly convenient for many operators because it allows you to upload digital copies of required documents and track the status of your registration in real time. The speed and convenience of online processing can be a real savings in a busy trucking operation, reducing the downtime between purchase and road readiness. The online experience is designed to streamline the submission of essential documents—title, odometer statement if applicable, proof of insurance, and the appropriate commercial registration form. The forms themselves—Form AR-482 or Form AR-483 for commercial vehicles—are the official conduits for capturing the business details, ownership information, and the vehicle’s vital statistics that regulators need to issue plates and decals. These forms are part of the legal framework that makes registration enforceable; they serve as a reliable, auditable trail that ties the truck’s identity to its owner and to the insurance that supports it on the road. The practical upshot is that you should assemble a complete packet before you begin the registration journey. Your packet should include the signed title transferring ownership to your name or your business, the odometer statement if the vehicle is less than 10 years old, proof of Arizona liability insurance for commercial use, the AR-482 or AR-483 form, and any proof of identity or business registration that your county might require. If you are operating the truck yourself and hold a CDL, you might need to present that license for identity or regulatory purposes, even though the CDL is not strictly required to register the vehicle. In terms of file preparation, the more you can digitalize, the better your odds of a smooth process. Upload digital copies of all documents when you use the online portal, and keep printed copies on hand if you choose to visit in person. When you approach the registration desk, whether online or in person, you are essentially presenting a complete legal package to confirm ownership, insurance status, and the intended use of the vehicle. With a full package, you can proceed to payment, choosing the exact mix of base fees, taxes, and any special permits that apply to your operation. The experience is designed to be predictable, but you should expect variability from year to year as local charges, weight classifications, and permit costs shift. A useful mindset is to treat registration as an annual cost of doing business rather than a one-time expense. Your fleet’s lifecycle will include periodic renewals, adjustments for weight changes, and permit needs as your operations evolve. For operators who manage fleets across multiple sites, this ongoing process benefits from a consolidated approach to data and budgeting. In practical terms, you can build a simple model: start with a baseline registration cost tied to GVWR, add the state and any local taxes, factor in the title and plate fees, then layer in potential permit costs if you anticipate overweight or hazardous materials shipments. As you estimate future years, consider how growth in payload, route diversity, or operating regions could influence fees. A heavier machine used more intensively in densely taxed urban counties could yield higher annual costs than a lighter truck cruising primarily in rural zones. The numbers you assemble then become a tool for negotiation and planning, not a faceless line item. They help you determine whether the economics of a given truck align with your price targets and expected revenue. If you want a deeper dive into the broader conversation about trucking costs, you can explore the wider literature and commentary in the industry, such as the content available on the McGrath Trucks Blog, which offers perspectives that complement regulatory detail with practical business considerations. For more context, see the McGrath Trucks Blog. In parallel, you should stay current with the official guidance. The Arizona Department of Transportation’s Motor Vehicle Division maintains the fee schedules and procedural instructions that govern registration. For the most up-to-date numbers and the exact steps, consult their site as part of your planning. The breadth of options—from online submission to in-person visits—means you can tailor the process to fit the rhythms of your business, without sacrificing compliance. The key is to approach registration with a clear, numbers-driven plan: identify the GVWR category, confirm use, determine applicable taxes, account for county-specific charges, and include any special permits in your forecast. Finally, remember that the details matter: even small differences in GVWR brackets or local tax rates can tilt the annual cost by hundreds of dollars per vehicle. This is why accurate data gathering before you register is essential—and why you should verify the latest schedules directly from the source. The Arizona MVD sets and updates these figures, and while the outline remains stable, the precise amounts can change with legislation or fiscal decisions. To support your planning, keep a running file that documents each vehicle’s weight, purchase location, financing status, and intended use. When renewal time comes, you will appreciate the clarity of a well-kept record. In the broader context of running a compliant trucking operation in Arizona, there is value in stepping back and viewing fees and taxes not as mere obligations but as a framework that keeps the system fair and predictable for everyone who shares the road. Keeping your costs transparent helps you price services accurately, schedule maintenance before spikes in insurance or permit costs, and avoid the last-minute scrambles that can disrupt service. It is this disciplined approach that turns registration from a bureaucratic hurdle into a predictable component of your operating plan. External resource: For official, up-to-date fee schedules and instructions, consult the Arizona Department of Transportation Motor Vehicle Division at https://www.azdot.gov/mvd. If you want to explore additional trucking topics and practical advice tied to the realities of today’s market, you can also consult the McGrath Trucks Blog for broader industry insights and context. See the McGrath Trucks Blog for related discussions: McGrath Trucks Blog.

From Submission to Plates: Navigating Arizona’s Commercial Truck Registration with Confidence

Registering a commercial truck in Arizona is more than a formality; it’s a careful alignment of ownership, safety, and state requirements designed to keep the road shared, safe, and compliant. The process walks a careful line between bureaucratic rigor and practical efficiency, and the aim is to get your vehicle properly titled and plated so it can operate in commerce, whether you’re delivering freight, supplying fleets, or moving equipment for a business that runs every day. In Arizona, the backbone of this system is the partnership between the Arizona Department of Transportation and the Motor Vehicle Division, which coordinate title transfers, registrations, inspections, and the issuance of plates and decals. Keeping this partnership in mind helps you navigate the steps without missteps or delays. The journey begins long before you walk into an office or click a button online. It starts with clarity about ownership, business structure, vehicle specifications, and the intended use of the truck on Arizona’s roads. Once you approach the process with that clarity, the steps unfold in a way that, while procedural, can be mastered with careful preparation and the right documents. This chapter walks you through those steps as a continuous narrative, from the moment you assemble your paperwork to the moment you affix your registration decal and receive your plates. Along the way, practical tips arise about what to bring, how to verify your vehicle meets state standards, and how to optimize the timing so you do not face unnecessary hold-ups.

The first essential dimension is eligibility. To register a commercial truck in Arizona, you must either be an Arizona resident or operate through a business entity that is registered in Arizona. The vehicle must be titled in your name or in your company’s name, a fundamental requirement that ties ownership to the registration. This link between ownership and registration matters because it ensures that liability and accountability travel with the vehicle. Before you go any further, gather the core documents that establish this link: the title or proof of ownership to your name or your business, along with a signed title transfer if the vehicle is being brought into your name or your company’s name for the first time. If the truck is newer, you’ll need an odometer statement for vehicles under ten years old, certifying the mileage at the time of transfer. Proof of insurance is mandatory in Arizona for commercial vehicles, reflecting the state’s emphasis on financial responsibility for operating heavy wheels on public roads. Insurance is not optional in this context; it is a prerequisite that makes the entire registration process possible and keeps legitimate commerce protected. You will also need the appropriate application form—either Form AR-482 or Form AR-483 when the commercial designation applies. The forms themselves are straightforward, but the information you provide must be consistent with the title and the insurance policy. If you are a driver who will operate the vehicle yourself, a Commercial Driver’s License (CDL) can be relevant for operation, though it is not a prerequisite for the registration itself. The distinction matters because sometimes a company will hold a CDL-drivers’ credential on staff, while the registration is a matter of title, insurance, and compliance rather than the individual operator license. This is a reminder that the registration process intersects with several regulatory streams, including safety and employment standards.

Beyond documents, you must determine the correct registration type. Arizona differentiates between registrations by use. If the truck is used for business purposes—such as freight hauling, deliveries, or any activity that supports a company’s commercial operations—you should pursue a commercial registration. The non-business or personal-use scenario for a commercial truck is unusual in practice, but it is possible in some rare circumstances where a vehicle is used outside the ordinary course of business. This decision about use affects the registration category and the associated fees, as well as the permitted operating parameters and even the potential need for specialized permits. The distinction matters because it shapes the entire cost structure and the regulatory requirements that apply to your vehicle. The next layer to consider is the cost side: the fees and taxes you will owe. In Arizona, registration fees are influenced by vehicle weight, the registration type (commercial versus private), and the county in which you register. Heavier vehicles carry higher base registration fees because they place different demands on road infrastructure and wear. The weight-based approach aligns with how Arizona calculates road usage and vehicle impact. In addition to the base registration fee, you should anticipate the state sales tax on the vehicle’s purchase price, which stands at five and a half to six percent depending on the year and jurisdiction, unless an exemption applies. County and local taxes or surcharges may apply as well, reflecting local funding for highways and transportation programs. Depending on your operations, you may also encounter special permits for overweight loads or hazardous materials, which add to the overall cost and the administrative steps. The financial side of registration is not simply a one-time payment; it can cascade into renewal cycles, license plate renewal fees, and periodic inspections that all carry their own costs. This is why, when you plan, you should budget not only the initial registration but also periodic renewals and any permits your operation may demand.

A practical path to submission follows a straightforward rhythm. You can choose to submit online through the Arizona MVD portal, visit an MVD office in person, or send the package by mail. The online option is increasingly preferred by fleets and solo operators alike, because it enables you to upload digital copies of your documents and track the status of your submission. If you select the in-person route, you should prepare for a potential inspection of the vehicle. An inspection step is not universal for every registration, but it is commonly required when the vehicle is new to Arizona or when it has not been inspected recently. The inspection underscores safety and compliance and may include a safety check and, where applicable, an emissions review. It’s worth noting that some fleets coordinate their inspections as part of their regulatory compliance calendars to avoid delays at the counter. When you go to the MVD office, bring all documents in your bundle, ensure the vehicle is available for any required physical checks, and be ready to pay the applicable fees. If you opt to mail your submission, understand that processing times tend to be longer. The MVD warns that mail-in processing can extend up to ten business days or more, depending on workload and the accuracy of the paperwork received. Digital copies can streamline this timeline, reducing back-and-forth and the chance of missing paperwork that triggers a return or re-submission.

While the mechanics of submission form the backbone of the process, there are several operational nuances that make a difference in progress and in the final outcome. For instance, the application itself is not just a blank form; it is a structured declaration of ownership and use that aligns with the vehicle’s title, the insurance policy, and the weight classification. Your odometer statement, where required, confirms the vehicle’s mileage at the time of transfer, which helps prevent disputes about wear and value. The proof of insurance must reflect Arizona liability coverage applicable to a heavy-duty vehicle and must meet minimum thresholds set by the state. The combination of these elements—title, odometer, insurance, application form, and potentially a CDL—converges into a single registration decision. If any one piece is missing or inconsistent, the process slows or stops. This reality underscores the value of a checklist approach. Start by confirming title ownership and the business entity status, then collect the insurance declarations page, the odometer statement if needed, and the correctly filled AR-482 or AR-483 form. Having these ready reduces the number of trips to the MVD, saves time, and minimizes friction at the counter or in the online portal.

Many readers will wonder about timing and what happens after you submit. Once the MVD or ADOT completes the review and approves your registration, you will receive several outputs. The first is the commercial registration certificate, which formally records your vehicle in the state’s registry as a vehicle authorized for commercial use. Second, you will obtain license plates, which may arrive by mail after the registration is approved. A registration decal—an important visual cue that confirms current registration—will be issued to be affixed to your plates. In some cases, if you need to demonstrate proof of registration immediately, a temporary permit may be issued at the time of your in-person submission. A practical note for operators who travel through multiple states is that, in Arizona, the registration system is designed to be compatible with broader regulatory expectations that emphasize safekeeping and accountability on the highway. The stability of the system means that once you have your plates and decals, you can operate with confidence, provided you stay current with renewals and any required additional permits.

As you prepare to embark on this process, a few best practices emerge from the field. First, keep your ownership documents and business registration papers organized and up to date, because changes in ownership or corporate structure invariably affect registrations and titles. Second, ensure the vehicle’s weight and GVWR are correctly identified, because misclassification can trigger administrative delays and misaligned fee assessments. Third, establish a routine for insurance renewals that align with registration renewal timelines; this coordination prevents lapses that could complicate re-registration or operational permission. Fourth, for fleets with multiple trucks, consider creating a centralized compliance calendar that tracks inspection dates, renewal windows, and permit requirements. This approach helps fleets avoid gaps in compliance that could lead to penalties or the inability to legally operate. Fifth, adopt a digital-first mindset where possible. Uploading scans of documents and using the online portal can accelerate processing, reduce the need for re-submission, and give you real-time visibility into the status of your registration.

As you digest these steps, you may want to broaden the knowledge landscape beyond the Arizona process itself. Industry resources and practitioner insights can provide helpful context about how registration fits into wider regulatory and operational strategies. For a broader discussion of trucking compliance, fleets sometimes reference blog resources that chart the regulatory terrain, safety considerations, and practical implications for day-to-day operations. See https://mcgrathtrucks.com/blog/ for a current perspective on how fleet managers think about compliance, equipment readiness, and regulatory changes that ripple through registration decisions. This broader lens can be useful when you’re aligning registration timing with other fleet activities, such as vehicle acquisitions, maintenance schedules, and emission-related requirements. While the blog reference is a general orientation, the core Arizona steps remain the practical compass you follow on your local road to compliance.

Finally, always verify the most up-to-date requirements with the official sources. While the narrative above captures the process and typical expectations, state regulations can change. The Arizona MVD maintains the definitive guidance on forms, fees, inspection requirements, and processing timelines, and it is wise to consult their official portal for the latest updates. For authoritative guidance, consult the official Arizona MVD site: https://mvd.az.gov

In composing this chapter, the aim has been to translate the procedural into a steady, navigable journey. A commercial truck registration in Arizona is not merely a bureaucratic hurdle; it is a safety-focused, accountability-driven framework that ties together ownership, insurance, vehicle standards, and road-use rights. When you approach it with a prepared mindset—documented ownership, correct vehicle classification, sufficient liability coverage, and a clear plan for inspections and permits—the path from submission to plates becomes a sequence of confirmations rather than a maze. The result is not only compliance but a smoother operation for your business, reducing risk and enabling you to focus on the core work that drives revenue. Whether you submit online or in person, the alignment of your documents with state standards will guide you to a successful registration that supports your trucking operations across Arizona and any jurisdictions where your business seeks to operate. This alignment—ownership, compliance, and timely renewal—is what turns a regulatory requirement into a reliable platform for growth, safety, and predictable operations on the open road.

Final thoughts

Understanding the process of registering your commercial truck in Arizona is crucial for compliance and operational efficiency. Each chapter of this guide has outlined the necessary steps, documents, and considerations to ensure a seamless registration experience. Whether you’re a trucking company owner, fleet manager, or engaged in procurement within the construction or logistics industries, adhering to these guidelines will help maintain legal and operational standards. By following this roadmap, your organization can navigate the complexities of Arizona’s registration requirements with confidence.