The landscape of commercial truck driving in the United States is essential for the logistics, construction, and transportation sectors, influencing overall supply chain efficiency. Understanding how much commercial truck drivers earn is crucial for trucking company owners, fleet managers, and procurement teams in construction and mining, as it directly impacts budgeting, hiring strategies, and operational efficiencies. This article breaks down the average earnings of commercial truck drivers, explores the various factors affecting their pay, compares earnings across different types of drivers, examines regional pay disparities, and projects future salary trends. Each chapter aims to equip decision-makers with the insights they need to navigate workforce management and compensation planning effectively.

The Real Paycheck Behind the Wheels: A Practical Portrait of How Much Commercial Truck Drivers Earn Across the U.S.

What a truck driver earns is not a single, simple number. It is a moving target shaped by miles driven, routes taken, the type of freight carried, and the employer’s pay model. Current data from a wide field of job postings and salary reports paint a usable snapshot: the average American commercial truck driver brings in about $1,735 each week. This figure comes from Indeed, which analyzed roughly 500,100 salaries posted over the last three years. It is a median weekly earnings figure across many roles and regions, not a one-size-fits-all salary. If you translate that weekly median into annual terms by the calendar, it suggests a ballpark of around $90,000 before taxes and deductions. Yet that number is best understood as a starting point, a way to anchor expectations in a market that prizes reliability, safety, and efficiency as much as it prizes the ability to cover long distances in a compressed timetable.

To grasp what drives the real pay, it helps to unwind the layers that sit between a headline number and a driver’s take-home pay. Experience matters, of course. A beginner with six months on the road will see a different pay trajectory than a seasoned veteran with several years of long-haul experience. The learning curve in trucking isn’t just about handling a rig; it is about mastering routes, timetables, customer expectations, and the regulatory environment. With time, a driver often earns more per mile or per hour, especially when coupled with a favorable pay structure that rewards reliability and safety records. The difference can be as simple as a few more cents per mile or as meaningful as a tiered bonus system that recognizes consistent on-time deliveries and low defect rates.

The kind of driving a driver does also matters. Local shifts that keep a driver near home typically offer predictability and shorter stretches, with earnings that come from a steady pattern rather than high-mileage bursts. Long-haul routes, by contrast, tend to generate higher gross pay through mileage-based compensation. The additional miles come with higher fatigue risk and time away from home, but they are often accompanied by incentives such as per diem payments, hazard pay for certain cargos, and sometimes enhanced overtime opportunities. The regional middle ground can deliver a balance: solid miles with more predictable scheduling than pure long-haul work, though the exact pay mix will still hinge on the employer’s policies and the freight mix they handle.

Freight type is another major determinant. Certain cargos carry higher risk or require special endorsements and equipment. Hazmat endorsements, oversized or overweight loads, and specialized freight can command premiums because the job requires extra training, adherence to tighter safety standards, or specialized handling. The premium is not universal, though; it depends on the carrier’s market niche, the routes that the fleet services, and the demand for those specialized services in a given region. The bottom line is that pay scales often reflect the complexity and risk of the load as much as the miles traveled. A driver moving hazardous materials will likely see a different pay envelope than one hauling dry goods across a few states, and a driver who runs oversized loads may encounter a different incentive structure altogether.

Employer type also colors earning potential. Large carriers with established pay scales, robust benefits packages, and sponsor programs for endorsements may offer more stable weekly pay and comprehensive benefits. Smaller fleets can provide competitive pay through flexible mileage bonuses or regional demands that push paid hours higher during peak seasons. Owner-operators, who lease their truck to fleets or operate under their own authority, face a different economics table entirely. They shoulder maintenance, insurance, taxes, and depreciation, yet they can capture higher gross earnings when freight rates, utilization, and equipment costs align. The choice between employed vs. contract driving is as much about risk tolerance and lifestyle as it is about numerical pay.

Location matters because the freight market is not uniform. Regions with higher demand for goods, tighter capacity, and stronger logistics hubs often enable carriers to offer more attractive compensation, especially for experienced drivers who regularly move between high-volume corridors. Conversely, markets with flatter demand cycles or thinner freight lanes can suppress weekly earnings even for skilled drivers. The pay picture thus blends regional demand with the specific fleet’s network, the carrier’s pricing power, and the driver’s schedule flexibility. In some ways, the road map to higher earnings mirrors a professional path in any specialized field: accumulate miles, sharpen the craft, seek opportunities in niches that pay more, and align with employers whose pay structures recognize the value you bring.

Beyond the base pay, many drivers supplement their weekly earnings with bonuses, overtime, and per diem arrangements. Overtime can be a meaningful lift when available, especially during peak demand periods or when a driver is required to meet tight delivery windows. Bonuses, which can be tied to on-time performance, fuel efficiency, or safety records, can push a driver’s weekly take-home beyond the median figures. Per diem arrangements, intended to offset meals and incidental expenses on long trips, can also add to overall compensation, improving the relative value of the job for drivers who spend extended time away from home. Health insurance and retirement plans, often offered by larger firms, further widen the appeal of trucking as a career for those who weigh long-term security alongside short-term earnings.

All of these factors contribute to the real-world experience of pay in trucking. The headline weekly average does not erase the variability that comes with schedule, route, and cargo mix. It also does not capture the sometimes hidden costs and challenges that shape a driver’s effective income. Taxes, insurance, truck maintenance, fuel, and downtime between loads can erode gross receipts and alter the net value of a given week. For someone entering the field, this means budgeting carefully, negotiating advance pay or better mileage rates, and seeking carriers that provide transparent pay structures and timely settlements. For veterans, it means choosing freight niches and routes that maximize earn-per-mile while balancing fatigue, safety, and personal well-being. The market’s current cadence—where demand, capacity, and regulatory pressures fluctuate with economic cycles—adds another layer of complexity. The same week that once yielded a comfortable premium can, in a downturn, compress into a leaner stretch with fewer miles or longer dwell times at shippers and receivers.

In charting a realistic expectation of pay, it helps to recognize the broader market dynamics that shape those weekly numbers. A growing economy tends to lift freight volumes, shorten idle times, and push carriers to compete for reliable drivers with improved pay and benefits. A slowing economy, rising fuel costs, or shifts in trade patterns can tighten the market, prompting carriers to pause wage growth, adjust incentive structures, or re-balance fleets toward more profitable lanes. The data landscape reflects these shifts: a sizable sample across many regions and job types shows where pay stands today, but not where it will stand tomorrow. For readers who want to situate these numbers within wider market conversations, a deeper look at the current and upcoming pressures within North American trucking helps illuminate why pay can feel inconsistent from week to week, even when the underlying rate card appears stable.

Ultimately, the question, “How much money do commercial truck drivers make?” invites a thoughtful answer that goes beyond a single figure. The weekly median around $1,735 is a useful anchor, but the full truth rests in the miles you drive, the load you carry, the contract you sign, and the market forces that reward or rebalance those choices. As markets ebb and flow, drivers and fleets learn to navigate with strategies that blend steady miles, specialized loads, and smart compensation plans. For a broader perspective on how market forces shape these patterns across North American trucking, you can explore a discussion of economic uncertainties in the Canadian and US trucking markets through this overview: Navigating Economic Uncertainties in the Canadian and US Trucking Markets.

For the most up-to-date and source-specific numbers, researchers and curious readers often turn to salary data aggregators that monitor postings and reported earnings. These sources reveal that the pay story is not fixed, and it changes with policy, demand, and the rhythms of freight. In practical terms, a driver weighing job offers should examine not only the headline weekly pay but also how the company calculates overtime, whether per diem is included, what benefits are offered, and how settlements are delivered. A carrier that pays higher per mile with a transparent overtime structure, backed by solid safety wins and predictable detention pay, can deliver a compelling value proposition even when the base rate looks modest on paper. In contrast, a lower headline rate paired with opaque timing on payments or limited benefits can undermine an otherwise strong miles-per-week outlook. This nuance matters because, in trucking, every dollar per mile or every detention hour translates into real life—coverage for a family, a plan for retirement, or a step toward a career that remains one of the most mobile and globally connected in the economy.

As readers move through the broader chapter, they may also notice that pay is not merely a function of the truck or the route. It is a reflection of the complex ecosystem that supports modern logistics: carriers negotiating rates with shippers, drivers negotiating with carriers, regulators shaping safety and hours-of-service rules, and technological improvements that aim to reduce downtime and improve fuel efficiency. Together, these forces create a landscape where earnings can improve with experience, choice of niche, and alignment with carriers that reward performance and reliability. The road to higher compensation is not a straight path; it is a balance between miles, cargo, time away, and the strategic decisions that drivers and fleets make in response to a market that never fully stabilizes. The next chapters will explore how specific niches—local, regional, and long-haul—alter this pay balance, and what a driver can do to position themselves for the best possible earning trajectory within the realities of today’s trucking world.

External resource: https://www.indeed.com/salaries/truck-driver-salary

Beyond the Meter and the Miles: How Experience, Routes, and Markets Shape Commercial Truck Driver Pay

Earnings for commercial truck drivers are not a single number but a landscape shaped by routes, responsibilities, and the economic weather that governs demand for freight. The average weekly income reflected in industry data is a snapshot of a broad, dynamic field. Yet reality within the cab varies widely. The bottom line is simple in theory: more miles, tougher routes, and longer time away from home generally push pay higher. The complexity lies in balancing these advantages against personal costs—time away from family, fatigue, safety considerations, and the tradeoffs of different work arrangements. Reading the numbers without considering the real-world mechanics behind them can mislead. When we unpack the factors driving earnings, it becomes clear that money follows a pattern tied to experience, the type of driving, geographic demand, the structure of compensation, and the labor market context around freight.\n\nExperience matters because reliability compounds value. An entry level driver faces a learning curve. New recruits learn route efficiency, regulatory compliance, fuel management, and the subtleties of working with different shippers and fleets. As proficiency grows, so does consistency—an asset employers prize. With more years behind the wheel, a driver can navigate complex logistics networks with fewer delays, handle time sensitive cargo, and minimize detention or wait times at facilities. Those factors translate into higher earning potential, especially when combined with a track record of on-time deliveries and safe driving. It is not merely a matter of clocking more hours; it is the ability to convert miles into dependable throughput. In the tug-of-war between risk and reward, experience tilts the balance toward stability and growth in earnings, even when overall demand takes a sideways turn.\n\nThe type of driving is the second pillar shaping pay. Local, regional, and long-haul assignments each carry distinct tradeoffs. Local drivers offer the appeal of predictable home time and routine shuttles within a metropolitan area or neighboring regions. That stability is valuable, but it often comes with lower per-mile rates and fewer opportunities to accumulate miles in a day. Regional driving, which keeps drivers on the road for several days at a time, tends to command higher compensation than local work. The longer journeys bring more miles and more time on the road, which, when paired with efficient routing and favorable dispatches, yields a higher weekly total. Long-haul drivers typically see the largest earning potential because their jobs center on sustained, high-mileage periods. They may spend extended stretches away from home, endure irregular sleep patterns, and navigate cross-country routes that demand greater planning—but the payoff often appears in higher pay per week or per mile, particularly when load volumes are strong and speed-to-pay cycles are short. The choice of driving type becomes a strategic decision, influenced not only by compensation but by life preferences and the ability to handle extended time away from family.\n\nGeographic region also matters, as demand and cost of living shape wage offers. Regions with dense freight markets, robust industrial sectors, and tight labor markets tend to push pay upward. Conversely, areas facing softer freight volumes or higher unemployment rates can see more modest compensation. Beyond regional demand, cost of living and the competitive landscape among carriers shape what employers offer to attract and retain drivers. Some regions benefit from supplemental incentives like per diem, housing allowances, or premium pay for night shifts or specialized routes. The geography of trucking is a map of opportunity: clusters where shippers, manufacturers, and distribution hubs converge tend to present more lucrative assignments, though they may demand greater familiarity with specific routes, weather patterns, or border crossings. For a driver weighing options, the regional calculus—home time expectations, seasonal demand, and the balance between miles and rest—becomes a central determinant of overall earnings.\n\nCompensation structure is the mechanism that translates miles into money. A core distinction exists between pay by the mile and pay by the hour. Per-mile pay rewards distance and efficiency, especially during peak seasons when freight volumes surge. But it also introduces variability: a driver’s income can swing with miles driven, detours, or days when freight moves slowly. Hourly pay, by contrast, offers a more predictable weekly total, which many drivers value for budgeting. Some fleets blend these models, pairing a base hourly wage with bonuses tied to safety, on-time delivery, or fuel efficiency. These hybrids aim to smooth income while preserving the incentive to maximize productive time on the road. In practice, drivers rotating between high-demand lanes and low-demand lanes may experience notable shifts in weekly earnings. Overtime protections and maximum driving hours regulations further shape how much time a driver can dedicate to pay-generating miles without compromising safety and well-being. The practical effect is that two drivers with similar skills and experience can earn very different sums simply because their compensation structures and dispatch realities diverge.\n\nUnionization and contractual terms add another layer of variance, especially in larger fleets and unionized sectors of the trucking industry. Where labor agreements exist, negotiated pay scales, benefit packages, and job protections can lift overall compensation and security for drivers. In specialized segments—such as hazardous materials, oversized loads, or time-sensitive freight—premiums often accompany the extra training, certification, or handling required. The premium for higher responsibility is not just about the cargo but about the assurances that a carrier wants to provide to customers regarding reliability and compliance. Drivers who can credibly demonstrate safety records, compliance with stringent handling protocols, and a history of minimal cargo damage build a reputation that translates into better engagements, higher rate options, and sometimes exclusive routes. The result is a marketplace where credentials and track records matter as much as the raw miles logged.\n\nPersonal factors—habits, preferences, and risk tolerance—also influence earnings. A driver willing to accept challenging routes, night shifts, and weekends often accrues more miles and earns more money over time. Those who prioritize a steadier home life may opt for more predictable schedules with lower variability in pay, accepting the tradeoff of overall earnings. The calculus includes outside-the-cab elements: the physical and mental toll of long-haul life, the impact on family dynamics, and the personal cost of irregular sleep patterns. Smart drivers pair flexibility with disciplined routing and fuel-saving practices to maximize income without compromising safety or health. The best earners tend to treat driving not only as a job but as a profession with continuous learning—staying current on regulatory changes, equipment technology, road conditions, and efficient loading practices. They also cultivate relationships with dispatchers and shippers who reward reliability with favorable lane assignments and priority loads.\n\nThe big takeaway is that the published average—such as the weekly figure seen in salary aggregators—reflects a blend of many job profiles rather than a single, uniform pay stub. Pay scales adapt to the market’s supply and demand, the mix of freight, and the strategic choices a driver makes about routes, schedules, and contracts. When assessing earnings, it helps to look beyond the headline number and consider where you might fit along the spectrum: entry-level paths that build experience, the long-haul tracks with higher earning potential but greater personal costs, or regional options that offer a balance. The interplay of these elements means the range of possible earnings is broad, and a driver’s success in raising pay depends on aligning personal preferences with market opportunities and choosing employers that reward the specific mix of miles, time, and safety that you bring to the road. For a clearer frame of reference, the U.S. Bureau of Labor Statistics provides precise, occupation-specific wage data that can help anchor expectations as the market shifts over time. In practical terms, this means a driver can navigate career choices more confidently when salary data is viewed in light of route type, regional demand, and the compensation structure offered by an employer. For readers curious about market dynamics amid volatility, you may find it helpful to consult resources on navigating economic uncertainties in the trucking markets, which offer context for shifting pay landscapes and the seasonal rhythms that drive freight volumes. Navigating economic uncertainties in the trucking markets can provide context. In closing, the picture of what commercial truck drivers make is not fixed, but rather a moving target shaped by skill, choice, and circumstance. The best strategy for a driver aiming to maximize earnings is to map out personal priorities—home time, tolerance for volatility, willingness to handle demanding cargo, and readiness to pursue higher-certification routes—against the economic realities of the specific lanes and employers they consider. A career in trucking offers the possibility of substantial income, but it requires careful alignment of routes, pay structures, and life goals. For anyone weighing entry or advancement, it helps to anchor expectations in a realistic assessment of how miles, load types, and contract terms interact with regional markets and industry norms. The dialogue between one’s ambitions and the market’s opportunities is ongoing, and the most successful drivers consistently recalibrate their choices as freight flows and regulations evolve. External data from respected statistical agencies remains a dependable compass for understanding the broader trajectory and ensuring that personal plans stay grounded in current labor market conditions. External reference: BLS wage data.

Pay Lanes on the Open Road: A Close Look at What Long-Haul, Regional, and Specialty Truck Drivers Earn

In the United States, the average weekly salary for a truck driver is $1,735, a figure drawn from 500,100 salaries reported to Indeed over the past 36 months. That aggregate number helps frame the market, but it does not tell the full story. Pay fluctuates with demand, miles logged, the type of freight, and the employer’s pay structure. The same job title can mask a wide range of earnings, because compensation is built from a combination of base pay, bonuses, per diem, overtime, and sometimes incentive packages tied to safety records or on-time delivery. The headline number is useful, but it tends to obscure the specific lanes that drive real income for most drivers. To understand how much money a driver can make, you have to map the lanes that structure earnings: long-haul, regional, and specialty work. Each lane carries its own blend of miles, time away from home, and required skill sets, all of which shape what a driver ultimately pockets. The following is a synthesis of current market trends, anchored by the same market data but interpreted through the realities of the road. While the overall average remains a useful reference point, the actual earnings you can expect depend more on the niche you choose, your experience, where you drive, and the policies of your employer.

Long-haul truck driving sits at the far end of the spectrum in terms of miles and time away from home. These drivers typically traverse multiple states on a regular basis, chasing freight where demand is highest and freight lanes are most reliable. In practical terms, the weekly pay for long-haul roles commonly falls in the $2,000 to $2,500 range. That range reflects the premium for miles with extended stretches away from home, and it is where experience can matter most. Veteran drivers often stack multiple sources of compensation—mileage-based pay, bonuses for hitting fuel efficiency or safety targets, and company-specific incentives—that can push weekly totals past the upper end of the range. The stronger base pay and the opportunity to earn mileage-based bonuses create a compelling math for professionals who love open road schedules and the autonomy that long-haul work can offer. Yet this lane is not for everyone. The very factors that justify higher pay—lengthier trips, complex routing, and the added risk of fatigue—also demand discipline, planning, and the stamina to manage extended time away from family and routine. When freight is light, or fuel costs spike, those numbers can tighten, reminding drivers that the earnings upside hinges on market demand and the ability to secure consistent miles.

Regional driving narrows the field in one key dimension: home time. Regional drivers cover defined corridors and return home more frequently—often at the end of a workweek or after a sequence of shorter legs. The typical weekly pay for regional roles tends to be in the $1,800 to $2,200 range. This lane blends the steadiness of regular schedules with the need to meet tight delivery windows and seasonal demand cycles. Because regional routes balance distance with predictable home time, they appeal to drivers who value consistency alongside earnings. Carriers may reward reliability and lane knowledge with enhanced pay in busy markets or during peak shipping periods, and regional drivers who maintain strong on-time performance and low detention times can unlock additional compensation through bonuses or per-m mile incentives. While the miles per week might be fewer than long-haul routes, the pay within regional positions often holds steady enough to support a reliable weekly take-home, particularly for those who prefer staying closer to home while still earning a competitive wage.

Specialty trucking stands apart in both skill requirements and compensation. Within this category, notable subtypes include Hazmat, refrigerated (reefer), and oversized or flatbed operations. Each specialization adds layers of training, regulatory compliance, and risk management, and those elements are reflected in the pay scale. Hazmat drivers tend to command the highest weekly earnings within the specialty groups, typically in the $2,200 to $2,800 range. The premium comes from the extra endorsements, rigorous safety protocols, and stricter handling requirements that come with transporting hazardous materials. The extra training and certification costs are offset by higher rates for freight that carries elevated risk, particularly when market demand for hazardous materials shipments grows. Reefer and flatbed/oversized loads offer strong earnings as well, generally in the ballpark of $2,000 to $2,600 per week, with variations driven by experience, regional demand, and the complexity of the loads. Reefer drivers must manage temperature-controlled environments and time-sensitive deliveries, while flatbed or oversized loads require careful loading, securing, and often more complex scheduling to accommodate unusual dimensions or permit requirements. In both cases, premium pay reflects the additional skill and precision demanded by these roles. The premium substantially compounds when you factor in bonuses for safety performance, detention allowances, and route-specific incentives, which can push weekly totals higher than the base ranges.

Beyond the category itself, a driver’s earnings are strongly influenced by location and market conditions. A driver based in a high-demand region or at a busy freight hub may see higher base rates or more opportunities to pick lucrative lanes, even within the same niche. Conversely, low-demand regions can compress earnings if miles are scarce or if competition among drivers drives down pay. The cost of living is a practical consideration too; some carriers tailor compensation to regional cost scales, while others maintain uniform pay structures that reward efficient drivers but do not fully compensate for high living costs in metropolitan hubs. The home-time preference also matters: some drivers accept longer trips to chase higher pay, while others prioritize time with family and still manage to secure good compensation through route selection and performance bonuses.

When considering overall earnings, drivers often encounter additional forms of compensation that can substantially alter take-home pay. Per diem arrangements, bonuses tied to performance, safety, or fuel efficiency, and overtime provisions can meaningfully augment weekly incomes. Per diem, in particular, can affect tax treatment and take-home pay in ways drivers should understand before signing on with a carrier. Overtime pay is another potential component, though it varies by employer and by whether the driver is legally or contractually eligible for overtime in a given role. Sign-on bonuses or retention bonuses can sweeten the early years, especially for drivers moving into high-demand niches or joining carriers expanding their regional or long-haul fleets. In short, the base pay ranges tell only part of the story; the full earnings picture frequently includes these supplemental elements, which together can push a driver’s weekly total well beyond the base expectations.

For drivers weighing the best path to higher earnings, the decision often rests on a mix of appetite for travel, tolerance for time away from home, and willingness to pursue additional credentials. Specializing in Hazmat, for instance, can be attractive when freight volumes and demand for hazardous materials rise. Pursuing endorsements and maintaining impeccable safety records can unlock premium pay, more available lanes, and better job security in volatile markets. Alternatively, someone who enjoys steady schedules and reliable home time might gravitate toward regional driving while still leveraging performance bonuses to lift earnings. Long-haul remains appealing to those who want maximum miles and are comfortable with extended trips and the associated personal costs. In each case, earnings are a function of miles, freight type, demand, and the employer’s pay policy—elements that shift with the economy and with regulatory or market changes.

The data landscape itself matters when you interpret these numbers. The $1,735 weekly average captures a broad swath of the job market, but it inevitably masks the dispersion around that mean. The distribution skews toward higher pay in niches with premium freight or where shortages of qualified drivers persist. It also reflects variations in geographic demand and the way different carriers structure incentives. A cautious takeaway is that you can’t assume a fixed ladder of pay progression by job title alone. Instead, it’s a relationship between lane choice, experience, location, and the subtle alignment of your skills with market needs. That is why many drivers who seek better earnings focus on acquiring targeted endorsements, seeking out carriers with robust mileage programs, and choosing lanes that balance miles with home time in a way that complements their lifestyle goals.

If you’re looking for ongoing context as pay trends evolve, a reliable step is to follow industry discourse and data sources that track miles, demand, and compensation over time. For further context and ongoing coverage of pay trends in trucking, you can explore the McGrath Trucks blog. As market conditions shift, the conversations about pay channels—long-haul versus regional, or traditional versus specialty segments—continue to evolve, with new endorsements and regulatory developments influencing what drivers can expect to earn in the coming years. And for a definitive reference point on salary levels, the Indeed data remains a benchmark to gauge how your lane compares to the market. See the official salary data here: https://www.indeed.com/salaries/truck-driver-salary

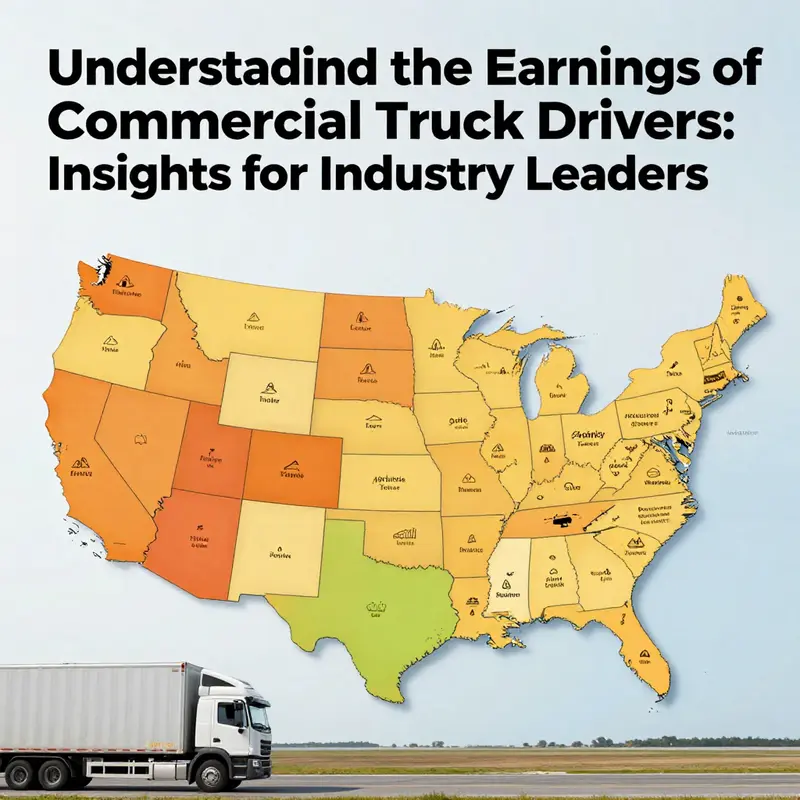

Pay by Place: How Regional Economies Shape Truckers’ Earning Power Across the United States

Regional differences in how much money commercial truck drivers make are not just a footnote in a career overview; they are a central thread that ties together market demand, cost of living, and the kinds of freight that dominate local corridors. Across the United States, pay sits on a spectrum where the same work can yield noticeably different outcomes depending on where a driver sits. A baseline snapshot helps orient the discussion: nationwide data show a robustly active market with weekly earnings that hover around a common reference point, yet that point shifts when you factor in region, route type, and the freight mix. The most visible takeaway is this: region matters as much as miles. The same trucker behind the wheel on a cross-country long-haul route may see a different paycheck than a regional driver who concentrates on a dense network of warehouses and distribution centers just a few hundred miles apart. This isn’t merely about gross numbers; it’s about how those numbers are shaped by the living costs, the freight demand cycles, and the labor markets that characterize each region.

A practical baseline comes from recent market data that aggregates a broad set of postings and reported salaries. On average, commercial truck drivers earn a substantial weekly sum, with figures that reflect the current market rate for the role. But this figure is not immune to the same forces that shape regional disparities: the job mix—long-haul versus regional or local routes—the kind of freight moved, and the extent to which employers sweeten pay with bonuses, per diem, or overtime. All of these add layers to a regional story about earnings. In regions with intense urban logistics networks, the pressure to fill shifts and keep freight moving can push base pay upward, while in more rural regions, wage levels may stabilize at a lower rung even as living expenses also fall. The overall narrative remains that earnings potential is a mosaic, with regional variation playing a decisive role.

To understand the regional gradient, it helps to anchor the analysis in state-level data, which shines a light on both the variation and the commonalities. The U.S. Bureau of Labor Statistics (BLS) provides a state-by-state view that highlights wide gaps in annual mean wages for truck drivers. As of May 2023, California stands out with a higher reported mean annual salary—about $74,650—reflecting the state’s high cost of living, dense urban centers, and substantial freight activity. Texas, another freight powerhouse, shows an annual mean around $68,490, illustrating that a large, diversified economy with significant manufacturing and logistics activity can sustain elevated pay, even without the luxury of living in the most expensive metros. By contrast, Mississippi and Alabama fall into a lower tier, with average annual wages in the mid-to-high $50,000s. These numbers are more than abstractions; they map onto everyday realities: for a driver, a career path through a high-demand corridor or a high-cost metro can become a different earning proposition when measured against local living costs and the availability of work that fits a driver’s preferred lifestyle.

This regional spread aligns with the broader economic fabric that underpins truck-driven freight. States with strong manufacturing bases, robust distribution networks, and large logistic clusters—such as Texas, Illinois, and Georgia—tend to offer more competitive pay, driven by high demand for trucking services and the need to attract drivers in tight labor markets. But the pay picture is nuanced. Regionally, the type of operation—whether a driver runs long-haul, regional, or local routes—often exerts as much influence on take-home pay as the nominal wage itself. Long-haul work can command higher insurance costs, fatigue management requirements, and the need to coordinate complex scheduling, yet it may come with incentive structures that reward miles and on-time delivery more directly. In regions where hazardous materials freight or specialized equipment is more common, the potential for higher earnings pairs with stricter qualifications and longer training pathways. The bottom line is that pay is a function of both the freight mix and the regulatory and operational environment that shape how much work is available and how it is compensated.

So, regional differences in earnings are not simply about a higher or lower base pay. They reflect how the local cost of living interacts with the market’s demand for drivers. In expensive coastal metros and their surrounding suburbs, base pay can be higher to offset housing costs, commuting pressures, and the premium put on time away from home. Yet this elevated wage can be offset by higher living expenses, which means the real purchasing power—the value of money after adjusting for what it costs to live—may or may not track the nominal wage rise. In contrast, rural or mid-sized regions may offer lower base wages but also lower living costs, potentially preserving a more favorable balance between earnings and expenses for certain drivers. The result is not a simple arithmetic outcome but a complex, sometimes counterintuitive landscape where two drivers with similar qualifications and experience can feel markedly different financially depending on their location and route type.

Beyond geography, the employment mix matters. Some regions are magnets for particular freight sectors—e-commerce distribution centers, agricultural commodities, or heavy manufacturing—that drive demand for drivers with specific skill sets. The presence of these sectors can lift base pay or create more opportunities for overtime and bonuses. The availability of regional lanes in a given state or metropolitan area can shape a driver’s schedule flexibility, which is itself a form of value. A driver who can align schedules with preferred home time or who can capture consistent, predictable runs may increase effective earnings even if the nominal rate remains stable. Conversely, regions with fragmented logistics networks or seasonal demand fluctuations may present more variable income streams, requiring drivers to adapt, diversify routes, or pursue additional endorsements to maintain steady earnings.

One of the subtler forces shaping regional pay is the ongoing supply and demand equilibrium in the labor market. When the market tightens—due to aging workforce, retirement waves, or a surge in freight volumes—wages tend to rise to attract talent. Conversely, a softening economy or a drop in freight volumes can cool pay growth and broaden the appeal of regional routing as a practical career path. This dynamic is amplified by structural forces such as driver shortages and the evolving regulatory environment, which can constrain supply just as demand surges. In places where logistics infrastructure is concentrated—think large distribution hubs and inland ports—the competition for qualified drivers can push compensation higher, particularly for specialized roles that demand extra training, endorsements, or long-haul experience. The interplay of these regional and structural factors means earnings are less a fixed number and more a moving target, with drivers who understand their regional marketplace often carving out superior outcomes by tailoring their routes, qualifications, and schedules to what the local freight economy most values.

To connect this regional mosaic to a broader strategic view, consider how macro trends ripple through the road freight landscape. A deeper look at how cross-border trade, fuel costs, and regulatory shifts influence regional opportunities can be enlightening, especially for drivers evaluating where to base their operations or what routes to pursue. For a broader view of how macro trends ripple through the road freight landscape, see navigating economic uncertainties in the Canadian and US trucking markets. This resource helps illuminate how regional economics, policy changes, and market cycles interact to shape earning opportunities across the continent, reinforcing the idea that regional pay is a composite of many moving parts rather than a single constant. The takeaway is practical: if you’re planning your next career move, you should weigh not just the posted wage but the full compensation ecosystem in your region—the base rate, bonuses, per diem, overtime, the typical route mix, and the cost of living you would shoulder.

The structure of regional pay also intersects with the labor market signals embedded in official statistics. The BLS data provide a formal baseline for state-by-state earnings, but the lived experience of drivers includes additional layers—shifts, home-time frequency, bonuses for safety records or fuel efficiency, and the often overlooked but meaningful impact of per diem arrangements. Taken together, these pieces form a nuanced portrait: regional differences matter, and smart planners balance the local economy, the freight mix, personal life considerations, and the career track they want to build. For policymakers and industry analysts, the regional spread is a litmus test of how well the trucking sector is aligning with broader economic conditions and labor market health. For drivers, it’s a guide to where pay structures and opportunity align best with personal goals, whether those goals center on minimizing commute time, maximizing long-haul experience, or optimizing earnings while maintaining preferred home time.

External data and further reading can illuminate how the numbers evolve over time. For a detailed, state-by-state perspective on truck driver wages, consult the official Bureau of Labor Statistics figures. External reference: https://www.bls.gov/oes/current/oes259010.htm

Pay on the Horizon: Projected Earnings for Commercial Truck Drivers Through 2030

Forecasting pay for commercial truck drivers is a study in contrasts. On one hand, the most recent market snapshot shows drivers averaging roughly $1,735 per week, based on a broad compilation of salary reports from Indeed over the last three years. That figure captures the current market pulse—an economy where demand for freight continues to rise, and wages respond to the pressures of a tight labor pool. On the other hand, long-range projections paint a broader picture. The U.S. Bureau of Labor Statistics and industry analysts expect a median annual salary around $70,000 by 2030. To a reader focused on the daily pay stub, that may look like a modest increase from today’s numbers. But the two data points sit in different horizons and under different assumptions. The realized earnings of any individual driver will still hinge on the mix of miles, freight type, location, and the shape of the job. The future, in short, is not a single number; it is a spectrum shaped by market forces as diverse as the freight lanes themselves.

What makes this horizon possible is the steady, if uneven, growth in freight volumes. The economy continues to move more goods with greater efficiency, and as the e-commerce engine hums, demand for drivers remains high. Yet the same forces that push up demand can also carry some volatility. Fuel costs rise and fall with global and regional dynamics, and operators adjust pay scales to attract and retain talent. In a labor market still characterized by shortages of qualified drivers, those adjustments may translate into higher base pay, improved benefits, and more enticing incentive structures. For drivers weighing a potential career move, the calculus is as much about where you operate and what you haul as it is about the headline weekly or annual figures. Interstate long-haul routes tend to offer higher mileage pay and more opportunities for time away from home to be compensated, while regional runs can deliver steadier schedules and different kinds of per diem or accessorial pay. The distinctions matter, because the path to a higher annual income is often paved with miles, duty cycles, and the types of freight that command premium rates.

A central thread running through the projection is the interplay between demand, costs, and talent supply. When demand grows faster than the supply of capable drivers, wages tend to rise as carriers compete for scarce labor. The ongoing shortage of qualified drivers has already produced wage enhancements in many markets, even before longer-term projections take hold. This is especially true for segments that require specialized skills or endorsements—hazardous materials, for example, or specialized refrigerated freight that requires strict handling and compliance. The premium for those niches often translates into higher hourly rates or per-mile pay and can meaningfully boost annual earnings for drivers who choose to develop those qualifications. Yet such specialization also narrows the pool of opportunities, which means not every driver will be positioned to reap the greatest rewards. The balance of broad-based demand with targeted, high-value niches helps explain why the 2030 projection of $70,000 as a median income is not simply a up-tick from today’s averages but a reflection of a market that rewards experience and discernment as much as raw mileage.

The structure of driver pay adds further texture to the horizon. In practice, earnings are built from a base rate per mile, time away from home, detention and waiting time, accessorial pay for a range of duties, and, for some, per diem arrangements designed to offset expenses on the road. Long-haul drivers typically earn more per mile due to higher mileage rates, as well as additional compensation for the extended periods away from home. Regional drivers may enjoy more predictable schedules, which can translate into steadier weekly earnings and a different blend of per diem and bonuses. Then there are the incentives that can push annual pay higher—sign-on bonuses when a carrier is eager to attract talent, performance bonuses tied to safety or on-time delivery metrics, and overtime pay when schedules demand extra hours during peak freight periods. All of these components create a mosaic of potential annual outcomes, and the dispersion around the median can be wide depending on the carrier, the contract structure, and the driver’s willingness to accept challenging routes or longer dwell times at shipper and receiver facilities.

Experience and specialization remain the loudest amplifiers of earning potential. Entry-level drivers entering the industry may earn a solid, serviceable income, but the real edge comes with miles and mastery. Drivers who accumulate years of experience in long-haul lanes often command premium rates, especially when they bring a track record of safe driving, on-time performance, and reliable handling of complex freight. Specialization compounds this effect: drivers certified for hazardous materials, refrigerated goods, oversized loads, or other demanding cargoes can access freight with higher per-mile pay or lucrative bonuses. The trade-off is the time and training required to reach those qualifications and the willingness to accept the travel schedules that come with them. The projection by 2030 reflects that reality—the ladder to higher earnings increasingly climbs through skill and scope as much as it does through seniority.

Another layer to consider is how the economic environment cycles through costs and opportunities. While rising fuel costs can push carriers to offer higher wages to secure drivers, sustained periods of low fuel prices and softer freight demand can stabilize or even compress pay in some markets. Tariffs, regulatory changes, and shifts in consumer demand can also ripple through the industry, altering the relative value of different freight lanes and the risk-reward calculus for drivers and carriers alike. In times of economic uncertainty, drivers who diversify their skill set—embracing additional endorsements, staying current on regulatory requirements, and pursuing opportunities that align with high-demand lanes—tend to fare better because their portfolios are more adaptable. The linked arc of demand, cost, and talent supply thus shapes not just the amount on a pay stub but the probability of reaching a given target annually.

In this evolving landscape, even the language used to describe compensation matters. The 2030 projection enshrines a central truth: earnings for commercial truck drivers are not purely a function of miles traveled but a combination of mileage, type of freight, time away, and the competitive market for skilled labor. A driver who concentrates on long-haul routes with hazardous materials or specialized refrigerated freight can, over time, accumulate a portfolio of gigs that pays at premium rates. Conversely, those who prefer regional assignments with predictable schedules may find a steadier but comparatively narrower path to the same retained value in a different way—through consistent per diem practices, regular bonuses tied to operational efficiency, and a favorable mix of detention and loading/unloading compensation. The divergence across these pathways helps explain why the same industry, observed through the same macro lens, can yield a spectrum of outcomes that includes both the average and the outliers.

For readers seeking a sense of the broader context beyond these numbers, a deeper dive into market dynamics and uncertainty is useful. A resource that expands on how the trucking markets are navigating shifting conditions in both Canada and the United States can provide practical perspective on the kinds of pressures and opportunities drivers face as pay trends evolve. Navigating economic uncertainties in the Canadian and U.S. trucking markets offers insights into how carriers, shippers, and drivers respond to changing demand, capacity, and policy signals—context that helps explain why a 2030 median salary is plausible, yet not guaranteed in every lane.

All of this underscores a fundamental point: the future pay landscape for commercial truck drivers is inherently dynamic. The 2030 projection reflects a careful synthesis of demand growth, cost pressures, and the incentives built into compensation schemes designed to recruit and retain talent. It is not a promise of uniform gains for every driver, but a framework in which those who invest in experience, diversify their skill set, and target high-value freight can expect to see meaningful improvement in earnings over the decade. The same framework should also temper expectations; the road to higher pay requires deliberate choices about routes, endorsements, and the willingness to shoulder longer periods away from home when the freight market demands it. As with any long-haul forecast, the reality will depend on a mix of macroeconomic conditions and the micro-decisions that drivers and carriers make every day.

External resources can provide additional validation and nuance. For a detailed, official perspective on how these wage projections are shaped, refer to the U.S. Bureau of Labor Statistics’ Occupational Outlook Handbook for Truck Drivers, which documents the long-run employment trends and pay structures across the industry. https://www.bls.gov/ooh/transportation/truck-drivers.htm#tab-1

Final thoughts

As the trucking industry continues to adapt to changing economic conditions and advancements in technology, understanding the evolving salary landscape for commercial truck drivers is essential for ensuring competitiveness and operational success. From average earnings influenced by a variety of factors to regional disparities and future projections, the insights gained through this exploration guide employers and industry leaders in making informed decisions. As compensation impacts the recruitment and retention of talent, strategic salary planning will be vital in navigating the future of the trucking workforce.