For trucking company owners, fleet managers, and logistics professionals, understanding commercial truck insurance costs is critical. With insurance mandates impacting operational budgets, knowing which states offer the most competitive rates can yield significant savings. Wyoming consistently ranks as the state with the lowest commercial truck insurance premiums, driven by its unique demographics and risk profile. This article delves into the key factors influencing insurance costs, compares rates across states, explores how state regulations affect pricing, and presents case studies illustrating the advantages of securing insurance in cost-effective locations. Each chapter will lead you further into understanding not only why Wyoming stands out but also how various elements come together to shape the commercial truck insurance landscape.

Wyoming’s Edge: How a Sparse Landscape Keeps Commercial Truck Insurance Affordable

When fleets weigh the cost of operation, insurance often sits at the intersection of risk and price. In the ongoing discussion about which state offers the cheapest commercial truck insurance, Wyoming repeatedly rises to the top as a standout, not merely as a statistical blip but as a fingerprint of how risk, policy, and economy shape real premiums. Across credible analyses, including a 2024 Insurify assessment and The Zebra’s 2024 roundup, Wyoming is consistently placed among the most affordable states for commercial auto coverage. The story behind those numbers is not a simple headcount of crashes or miles driven, but a nuanced tapestry of geography, regulation, and cost of living that translates into lower risk exposure for insurers and, therefore, lower rates for fleets. While premiums will still vary by carrier, vehicle type, and fleet size, the pattern holds: Wyoming offers an unusually favorable environment for trucking insurance compared with many other states.

To understand why, one must start with the landscape itself. Wyoming is defined by its expansive spaces and relatively sparse population. The resulting low population density means fewer urban intersections, shorter daily exposure to congested traffic, and fewer high-speed choke points that often become accident hotspots. It is not that Wyoming is devoid of risk; rather, the risk exposure is distributed differently than in denser states. For insurers, fewer claims signals a steadier, lower‑volatility book. That basic math translates into premiums that are often noticeably lower than the national average. When we pair this with other supporting factors—lower fuel prices, a pro-business regulatory climate, and generally lower crime and urban congestion—the insurance pricing environment reads like a coherent, reinforcing system rather than a single quirk of a single year.

Fuel costs, a perennial line item in the operating budget of any trucking operation, also play a subtle but tangible role in the insurance equation. Wyoming has benefited in recent years from relatively lower fuel prices compared with many competing states. While fuel is a separate cost from insurance, the broader picture of operating expenses matters to insurers who assess the overall risk profile of a fleet. Lower fuel costs contribute to steadier maintenance schedules, more reliable trip planning, and reduced likelihood of sudden, high-cost incidents associated with fuel-related distress or hurried routing. In practice, this means fleets running in Wyoming may present a more predictable pattern of mileage and maintenance, which contributes to a more predictable claims outcome and, again, to favorable pricing.

Beyond the pocketbook of day-to-day operations, the regulatory environment in Wyoming plays a complementary and meaningful role. The state’s business-friendly policies extend into the commercial vehicle sector, where administrative clarity and predictable permitting processes reduce downtime and cost. A state with straightforward licensing, permitting, and compliance workflows helps fleets operate with fewer unexpected penalties or compliance-related incidents. Even if coverage itself remains dictated by federal safety standards, the surrounding environment can influence risk perception and administrative load, which in turn can influence pricing. A smoother path to compliant operation lessens the chance that minor delays or bureaucratic frictions become costly problems that show up in premium calculations.

Another piece of the Wyoming risk profile is its crime landscape and urban dynamics. Wyoming is characterized by lower crime rates and fewer densely packed urban centers. Lower crime reduces the likelihood of theft, vandalism, or other preventable loss events that can raise premiums for fleets with valuable cargo or equipment. While cargo theft rates for trucking are a complex mix of geography, supply chains, and security practices, the general picture in Wyoming tends to align with lower risk perceptions from insurers. The absence of high-density traffic hubs also dampens the frequency of severe incidents that can trigger spikes in loss histories for carriers operating in more congested areas. Taken together, these factors help explain why Wyoming can maintain competitive pricing on commercial truck insurance without compromising coverage quality.

Of course, the story is not about pricing alone. The cost of premiums interacts with policy requirements, safety standards, and the broader regulatory framework that governs commercial trucking. The Federal Motor Carrier Safety Administration (FMCSA) and national safety and compliance data underscore that coverage is a necessity, not a luxury. While Wyoming may offer favorable premium conditions, fleets must still meet stringent federal standards to operate legally. Premiums respond to risk, and risk is still carefully measured through a combination of vehicle type, cargo, routes, safety record, and maintenance discipline. An understated but important theme is that affordability in Wyoming does not equate to lax oversight. The state’s DOT and related agencies emphasize compliance and efficiency, which in turn helps fleets avoid penalties that could otherwise drive up insurance costs.

From a fleet planning perspective, moving or expanding operations into Wyoming can deliver meaningful bottom-line advantages. The combination of lower average premiums, reduced operating costs, and efficient permitting creates a cost structure that is attractive for long-haul operators, regional players, or fleets seeking to optimize overhead. It is not a case of chasing the cheapest quote in a vacuum; it is about a holistic cost ecosystem where risk is lower, regulatory friction is minimized, and operational efficiency supports predictable pricing. That holistic picture is what makes Wyoming stand out in national comparisons and helps explain why insurers, in their models, tend to reflect a favorable rate environment for commercial trucking in the state.

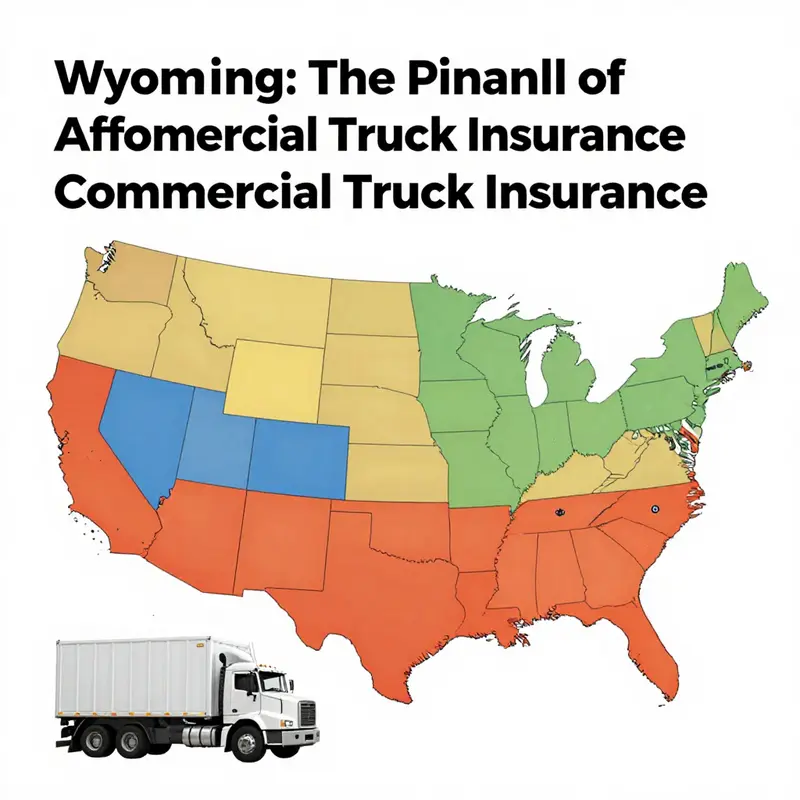

The importance of understanding regional realities is clear when we look at the broader landscape. The Zebra’s 2024 analysis places Wyoming alongside other affordable states such as Idaho, Vermont, and Maine, all of which share a common thread: less urbanization and a lower risk profile for trucking operations. These states demonstrate that affordability in commercial truck insurance often correlates with a combination of population density, traffic patterns, crime rates, and regulatory climates. It is a reminder that the cheapest insurance is rarely a product of a single factor; it is the sum of many interlocking elements that shape risk, claims history, and pricing structures. For decision makers evaluating site selection or expansion, Wyoming’s profile offers a compelling case study in how geographic and policy context can translate into tangible savings without sacrificing safety or compliance.

For readers seeking a practical lens on how these dynamics play out in real budgeting, consider the broader insurance context as part of fleet cost optimization. The insured experiences of carriers in Wyoming illustrate how disciplined risk management, steady maintenance practices, and route planning aligned with regional realities contribute to a favorable premium environment. It is a reminder that insurance is not just about coverage limits and deductibles; it is also about the everyday choices that fleets make—where they operate, how they maintain equipment, and how well they adhere to safety standards. In Wyoming, those choices seem to converge with a lower-cost insurance outcome while still delivering robust protection against risk.

For those who want to explore the practical implications of these trends in more depth, the broader fleet‑cost conversation—and the way insurance prices come together with other operating expenses—is explored in depth on the blog page that covers market dynamics, fleet economics, and strategic decision making. You can read more on the blog page here: blog.

As the discussion of state-by-state cost contrasts evolves, it is worth noting that while Wyoming may lead in affordability, insurance is never a one-size-fits-all proposition. Premiums differ by carrier, the size and scope of the fleet, cargo types, and the specific routes operated. A long-haul operator with a nationwide network might experience different pricing pressures than a regional fleet that keeps its operations primarily within the Mountain West. Nevertheless, the converging factors that yield Wyoming’s competitive pricing—low exposure to dense urban traffic, favorable operating costs, and a straightforward regulatory environment—offer a persuasive model for how cost efficiency can align with safety and compliance in commercial trucking.

In sum, Wyoming’s edge in cheap commercial truck insurance stems from a well-aligned mix of geography, economics, and governance. It is not simply an outlier in a single year; it is a sustained pattern reflected in independent analyses and corroborated by federal safety data. For fleets weighing expansion, relocation, or diversification of routes, Wyoming provides a compelling case study in how the broader business environment can shape insurance costs in meaningful and sustainable ways. When combined with rigorous safety practices and disciplined fleet management, Wyoming’s framework offers a practical path to reducing overhead without compromising the protection that trucking operations rely on to keep goods moving and businesses resilient.

External resource: https://www.fmcsa.dot.gov/

The State-by-State Price of Protection: How Regulatory, Legal, and Market Forces Shape Commercial Truck Insurance Costs

When fleets size up where to base operations or how to structure coverage, the question often comes down to aorta-sized number: where can we get the most protection for the least price? The answer is rarely a single state, and it is never a single factor. The research landscape for commercial truck insurance shows Wyoming consistently appearing at the low end of the cost spectrum, but the real story behind any state’s price tag lies in a tapestry of regulatory rules, legal environments, market competition, and the everyday risk profile that fleets bring to the road. In practice, what matters is not a neat headline number but a composite of policy requirements, risk exposure, and the way insurers price that risk. This is a story about how the state you operate in can tilt the economics of coverage, even before you quote a single premium. And it helps explain why, across analyses in 2024, Wyoming repeatedly lands near the top of the list for the lowest average commercial auto insurance premiums, while other states with tougher rules or denser traffic push average costs higher for the same fleet mix.

Several pivotal factors drive these differences. One clear driver is the minimum liability coverage that states require. There is no universal baseline; states set their own floor for what drivers and carriers must carry in coverage. In practice, higher minimums translate into higher baseline costs for insurers, which they reflect in premium calculations. This helps explain why states with stringent requirements, such as California or New York, tend to have higher starting points for premiums than many other places. For fleets, that means even before evaluating a single claim history or fleet age, the regulatory floor has already nudged the price upward in those regions. Wyoming, by contrast, has comparatively modest minimums by many industry benchmarks, contributing to a lower starting cost for insurers and, by extension, for many carriers in the state.

Beyond the bare minimums, the regulatory environment shapes risk in practical terms. States differ in hours-of-service rules, vehicle maintenance standards, and oversight intensity. The more a state requires frequent inspections, strict adherence to timetables, and robust maintenance programs, the more the operational risk profile can look to insurers as something with greater chance of incidents or costly downtime. When regulators tighten the leash on how trucks must be operated and kept, the likelihood—and cost—of claims subtly rises. Insurers price that additional risk into premiums, and operators must decide whether the added compliance expense yields a commensurate return in reduced exposure. Wyoming’s regulatory regime, paired with its sparse traffic and lower overall exposure, tends to produce a lighter, less volatile pricing environment for commercial trucking operations than in states with dense urban corridors and high claim experience.

A third thread in the price tapestry is traffic congestion and accident rates. The fundamental exposure an insurer must cover is the probability of a loss. Urban areas with heavy freight movement—think major corridors and metros with crowded interchanges—produce more opportunities for accidents, trailer damage, theft, and cargo problems. In states where fleets endlessly navigate congested metro areas, insurers adjust premiums upward to reflect higher exposure. Conversely, rural states or those with less densely populated transport networks typically show lower claim frequency, which can result in more favorable pricing for fleets that focus on long-haul routes with steady but predictable patterns. Wyoming’s geography—with long stretches of open road and relatively low traffic density—contributes to a lower real-world risk profile. It is not simply about fewer accidents; it is about the consistency of exposure and the predictable nature of a mostly highway-driven landscape that insurers view as less volatile than the combinations of urban density and high-speed traffic found in other states.

The legal environment also leaves a strong imprint on insurance costs. Tort law regimes differ widely, particularly around liability damages and non-economic claims. States that permit substantial damages in personal injury actions or lack strong caps can experience higher awards in lawsuits, and insurers price that potential exposure into premiums. Plaintiff-friendly environments, or court systems with high litigation frequency, tend to push up insurance costs as carriers try to hedge against larger-than-expected payouts. In contrast, states with more predictable liability frameworks or damage caps can offer more stable pricing for commercial trucking operations. These legal contours matter whether the fleet is one truck or a thousand. The variability across states in this dimension helps explain why a single fleet type might see a marked price difference simply by moving operations a few miles across state lines.

Another structural factor is the availability of insurance providers within a state. A competitive market with many carriers vying for trucking business can exert downward pressure on premiums, while markets with fewer players or regional monopolies can leave fleets with limited choices and less favorable terms. The extent of competition depends on regulatory barriers, the perceived risk profile of the state, and the overall health of the local insurance market. In practice, states with robust competition often deliver more flexible policy options and more competitive pricing structures, even when other risk factors remain constant. Wyoming’s ongoing blend of relatively low regulatory friction, a steady risk profile, and a modest pool of carriers interacts to create a pricing environment that analyses frequently rank among the most affordable in the nation. At the same time, the story is not a simple one-to-one match—fleet size, cargo type, driver training programs, telematics adoption, and loss history all steer the final premium in conjunction with state-level dynamics.

The synthesis of these factors is essential for fleet managers weighing multi-state operations or contemplating domicile shifts to optimize insurance costs. It is tempting to think the cheapest state is simply where the lowest posted average premium sits in a given year. Yet the lower price in a state like Wyoming is a function of a balance among regulatory minimums, risk exposure, legal environment, and market competition. For fleets that operate beyond a single border or move across state lines with varying truck routes and cargo mixes, the implications are practical and immediate: risk management and operational decisions implemented in one state can meaningfully alter the cost of coverage in another. The same fleet that benefits from lower minimums in Wyoming could face different dynamics if it moves into a jurisdiction with harsher regulatory requirements, greater urban density, or a legal framework that tends to yield higher claim costs. This reality underscores the importance of tailoring risk management programs to the state-specific landscape while also leveraging multi-state data to negotiate the most favorable terms for the entire operation.

In this light, the practical path for operators is not merely to chase the lowest raw premium but to align coverage with the actual risk profile they present and the regulatory realities of each domicile. That means investing in robust safety programs, driver training, and preventive maintenance that reduce the likelihood of incidents and demonstrate proactive risk management to insurers. It also means evaluating domicile decisions and route structures through a price-to-risk lens. A long-haul fleet that concentrates operations in a state with favorable risk characteristics may still realize meaningful savings by enhancing its safety metrics and loss control programs, while a more urban and high-traffic operation may benefit from strategic risk mitigations and a diversified insurer panel to keep pricing manageable. As analyses from 2024 show, the price signals are real, but the optimal policy mix depends on the interplay of state rules, market competition, and the fleet’s own risk discipline.

For fleets seeking a broader view beyond a single state, it can be helpful to consider market-trend syntheses that discuss the broader regulatory and economic contexts shaping pricing in trucking. This broader perspective, which examines uncertainties and cross-border dynamics in the Canadian and U.S. trucking markets, provides a complementary frame for interpreting state-level price signals and for planning how to position a fleet in a way that balances coverage quality with cost efficiency. To explore these market dynamics in more depth, please refer to Navigating economic uncertainties in the Canadian and U.S. trucking markets. (Internal link)

As you weigh state-by-state pricing, remember that external data and regulatory commentary matter as anchors. The National Association of Insurance Commissioners (NAIC) collects and analyzes regulatory data that can illuminate how price and availability evolve across jurisdictions, offering a macro view that complements the on-the-ground experience of premiums quoted by insurers. See NAIC for broader regulatory context and market trends that shape insurance pricing nationwide.

External resource: https://www.naic.org/

Wyoming on the Ledger: Why It Tops the List as the Cheapest Home for Commercial Truck Insurance

Across the United States, the cost of insuring a commercial truck is a function of risk, regulation, and the local price of doing business. No single national price exists; insurers price by state, and the gaps can be striking. In recent analyses, Wyoming repeatedly surfaces as the cheapest state for commercial truck insurance. A 2024 analysis by Insurify places Wyoming at the top for the lowest average premiums for commercial auto coverage, and The Zebra’s 2024 coverage study includes Wyoming among the most affordable states along with Idaho, Vermont, and Maine. The picture is not simply about a single number. It reflects a blend of population patterns, road use, claim history, and the legal weather in each state. While the exact average premium will vary by fleet size, vehicle type, cargo, and coverage levels, the trend is clear: Wyoming, by many measures, offers a comparatively favorable environment for price.

But to understand why a state sits at the bottom of the premium stack, one must look at the engine room of insurance pricing. The cost of insuring heavy trucks depends on how often claims are likely to occur and how costly those claims could be. The National Association of Insurance Commissioners provides a lens into the variation across states. California, a state with dense urban zones, high traffic volumes, and a litigious environment, can see average annual premiums for heavy trucking policies surpassing fifteen thousand dollars in some cases. In contrast, less densely populated states, and those whose legal climates calm the risk of protracted litigation, often report typical premiums in the eight to ten thousand dollar range for similar coverage. These figures are not universal. Differences appear by carrier, by the precise coverage mix, and by the size and scope of the operation. But the pattern is instructive: density of traffic, the intensity of urban mobility, and the texture of the tort system all shape the price tag on a policy.

Another strand in this tapestry comes from policy design and regulatory requirements that can push costs higher. Some states require higher minimum liability limits, and others impose no fault or near no fault frameworks that dampen the risk of catastrophic verdicts. In states with generous non economic damages, insurers price in the risk of larger payouts, and that filtering can lift premiums for fleets that operate under those regimes. Conversely, states with caps on non economic damages or with no fault systems tend to produce lower premiums, provided the safety and liability landscape remains stable. The federal layer also nudges pricing. The FMCSA notes that carriers operating in states with elevated risk profiles may need to secure additional coverage, including cargo and general liability insurance, which adds layers of cost to the policy stack. In short, state level cost is a mosaic of risk, law, and market structure, not a single metric.

Within this mosaic, Wyoming stands out for a suite of reasons tied to geography and demographics. The state’s low population density translates into fewer vehicles on the road at any given time. Less traffic means fewer opportunities for collisions and fewer claims filed against a policy. That translates into lower claims frequency, a central determinant of the premium insurers quote. The environment is also physically expansive, with long stretches of highway and challenging winter weather, yet the exposure profile is different from the urban sprawl of coastal megacities. In Wyoming, large-scale truck operations often contend with long-haul routes across open terrain, which imposes its own risk factors. However, the lack of dense city centers tends to mitigate multi-vehicle incidents, urban congestion, and the kinds of complex liability scenarios that drive insurance costs upward in metropolises. Add to that a lower cost of living and a lower overall price profile for goods and services, and you get a broader economic context in which insurers can price risk more conservatively.

The snapshot offered by Insurify and The Zebra is reinforced when one considers other affordable states that frequently make the same lists: Idaho, Vermont, and Maine. These states share a common thread of smaller urban footprints and fewer high-risk traffic patterns that typically drive claims costs down. They do not promise a universal solution for every trucking operation. A small fleet with regional routes may find Wyoming the simplest and most economical base for risk and operations. A regional operator with a spread across several states may face a different calculus, since multi-state operations push policies to cover a wider set of exposures, including cargo and cross-border considerations in some cases. Yet the underlying logic holds: fewer urban miles, less congested commuting corridors, and more predictable tort environments can yield lower insurance bills.

It is important, however, to keep cost in perspective. While price is crucial, it is not the sole determinant of where to base a trucking operation. The choice of base location interacts with fuel costs, labor supply, tax climates, access to key markets, regulatory compliance requirements, and the actual routes that fleets run. Insurance costs intersect with these factors in a meaningful way. A cheap premium in one state can be offset by higher cargo requirements, broader liability needs, or more expensive compliance burdens in another. Carriers operating in high-risk states often face layered coverage requirements: cargo insurance, general liability, and perhaps more robust risk management mandates that can add to the total cost of coverage even if the base rate is modest. That is why the broader study of premiums across states, as summarized by III and other aggregators, is essential for fleet planners who want to calibrate total cost of risk rather than focus on a single line item.

For fleet managers weighing where to anchor operations, the Wyoming edge emerges from a combination of risk signals and cost-of-doing-business factors. The state’s regulatory environment, observed claim frequencies, and the relative predictability of injury and damage claims contribute to a pricing climate that insurers find appealing. In parallel, the environmental and geographic realities of Wyoming influence risk in subtle, often overlooked ways. The open spaces reduce exposure to some urban accident scenarios, while high-speed rural roads can pose different kinds of hazards that are nonetheless manageable through standard risk controls. Taken together, these factors can push the average premium downward for heavy trucking operations when compared with states with comparable fleet sizes but more dense traveling conditions. It is this blend that repeatedly places Wyoming at or near the top of cheapest state rankings in multiple 2024 analyses.

For operators who read the landscape through a wider lens, it is instructive to compare cost signals with operational realities. The data suggest that California and New York sit at the higher end of the spectrum, driven by dense networks of highways, stricter liability norms, higher minimums, and an environment where litigation risks translate into larger expected losses. In contrast, the South and Midwest offer varying degrees of affordability depending on how heavily the operation depends on urban corridors versus rural routes. North Dakota and South Dakota, for example, are often cited as some of the more affordable environments in practice, not just in theory, because their risk profiles emphasize lower claim frequency and lower average claim severity, even if the number of miles driven is high. The juxtaposition raises a practical takeaway for fleet executives: cost containment in insurance comes from a broader risk management program that strengthens safety performance, tailors policy structures to the real exposure profile, and avoids the temptation to anchor decisions on a single pricing factor.

Within the broader narrative, the role of risk management should not be overlooked. Even in states where premiums run lower, fleets can drive costs down through strategic measures that change the risk calculus. That means investing in driver training, adopting telematics, maintaining vehicles to high safety standards, and implementing cargo protection measures that reduce damage claims. Insurers will respond to demonstrable risk reductions with friendlier pricing, sometimes in the form of lower deductibles or more favorable coverage terms. The interplay between input variables—driver behavior, equipment reliability, cargo security, and route planning—translates into measurable differences in premium across carriers. It is this dynamic that makes a deep, nuanced approach to location and risk essential for fleets seeking to optimize total cost of risk rather than simply chasing the lowest base rate.

For readers who want a data-driven, policy-level view to complement these insights, a look at comprehensive analyses such as those compiled by the Insurance Information Institute offers a deeper dive. The chapter above has drawn on the core themes from those sources to illustrate how state-level differences shape commercial truck insurance costs in practice. In discussing the practical implications, it is useful to consider that even within a single state, variation exists by geographic area, by the value of the cargo, by fleet size, and by the exact coverages included in a policy. The bottom line remains: Wyoming often leads the parade because of its low population density, relatively calm claim environment, and cost of living that keeps the price of doing business in check. Yet the economics of insurance do not exist in a vacuum. The total cost of risk is a function of exposure, policy design, and the operational footprint you select. Fleets that concentrate operations in fewer states with uniform risk profiles may squeeze the most value from lower base premiums, while multi-state operators might push the effective cost of risk higher but gain efficiency through consolidated coverage programs and safer operating practices. The evolving data from III and other industry observers confirms that price discipline is a moving target, influenced by policy structures, litigation climates, and evolving risk landscapes.

As you map a strategy around insurance costs, it is worth keeping an eye on the broader market signals that influence the prices you pay. For example, the trends in used truck sales can affect capital planning and risk exposure in ways that interact with insurance pricing. See how these trends are evolving in the latest discussion of used-truck-market dynamics with Current trends in used-truck-sales-growth. While this chapter focuses on the cost of insurance, the affordability of base fleets and the depreciation schedule of a truck can indirectly influence how aggressively a fleet invests in safety and risk controls.

Ultimately, the answer to the question of which state has the cheapest commercial truck insurance is nuanced. Wyoming often leads the parade because of its low population density, relatively calm claim environment, and cost of living that keeps the price of doing business in check. Yet the economics of insurance do not exist in a vacuum. The total cost of risk is a function of exposure, policy design, and the operational footprint you select. Fleets that concentrate operations in fewer states with uniform risk profiles may squeeze the most value from lower base premiums, while multi-state operators might push the effective cost of risk higher but gain efficiency through consolidated coverage programs and safer operating practices. The evolving data from III and other industry observers confirms that price discipline is a moving target, influenced by policy structures, litigation climates, and evolving risk landscapes.

External resource: https://www.iii.org/fact-statistic/insurance-and-trucking

The Regulatory Patchwork Behind Cheap Commercial Truck Insurance: How State Rules Mold Risk and Price

The economics of commercial truck insurance do not glide along a single, uniform line. Instead, they move to the cadence of state policy choices and the way those choices clamp down or loosen the risk signals that underwriters read. When a fleet operator sits down to balance premium costs against coverage needs, the first large determinant often sits quietly in the background: the regulatory environment. State mandates dictate not only what protection a policy must provide, but how insurers assess risk, price that risk, and ultimately decide how aggressively to compete for a given line of business. This regulatory backdrop helps explain why some states consistently report lower average premiums for commercial trucking, while others carry a heavier price tag, even when the underlying exposure seems similar. The connection between law, risk, and price is not abstract or theoretical; it translates into real, trackable differences in what a fleet pays for coverage year after year.

At the core of the regulatory mosaic are minimum liability requirements. Each state sets a floor for how much a truck must be insured for bodily injury and property damage in the event of an accident. That floor varies, and in some states, the minimums are notably higher, reflecting local policy choices about risk tolerance or the perceived consequences of highway crashes. More expansive requirements for cargo liability add another layer of cost, particularly for trucks hauling hazardous materials or high-value goods. Even when a fleet’s actual risk profile is modest, a higher mandated minimum can nudge premiums upward simply because underwriters price to the policy floor as a baseline. The net effect is a economic ceiling that builders of insurance products must respect, and a ceiling that operators must budget for when they operate in states with stricter cargo or car-load coverage rules.

Beyond liability, the landscape of uninsured/underinsured motorist coverage, personal injury protection, and other mandated coverages also affects price. Some states require robust UIM or PIP protections, while others leave a broader set of choices to the market. Those differences matter because they change the expected payout and the risk the insurer must cover. In states with broad mandate coverage, carriers price in higher potential claim costs, and those costs ripple through the premium a business ultimately pays. Conversely, states with leaner requirements can result in lower baseline premiums, especially if the remainder of the risk environment—such as highway density, average speeds, and crash severity—favors a lower probability of large or frequent claims.

A critical and often underappreciated consequence of state rules is how they complicate compliance for carriers that operate across multiple jurisdictions. A truck that runs regularly from state to state must meet the most stringent requirements among its routes. The engineering of a compliant program, therefore, becomes a balancing act: cover what’s required to stay legal, and avoid paying for coverage that isn’t necessary on the ground. This patchwork can push up the price tag, not because a single state demands more coverage for every mile, but because the operator faces a multiplicative effect of different rules across the route map. Insurers respond to this complexity by pricing for regulatory risk—anticipating penalties for noncompliance, the cost of extra endorsements, and the administrative burden of maintaining multiple state-specific policy structures. The practical outcome is that multi-state fleets often see higher premiums than those that operate in a single, less burdensome regulatory environment.

Enforcement and claims handling practices add another dimension. States differ in how aggressively regulators monitor compliance and how quickly claims are adjudicated when violations occur. A state with rigorous enforcement that yields predictable, prompt claim outcomes can translate into a lower perceived risk for insurers, reducing what they charge for coverage. On the other hand, more variable enforcement and longer claim lifecycles can tilt the risk calculus upward. Insurers adjust pricing to reflect these governance realities, which means that two fleets with roughly comparable exposure can pay different premiums simply because their operating state has a different risk management and regulatory posture. This is why comparing insurance costs across state lines is rarely a matter of apples to apples; it is more like apples to seasonal fruit baskets, where the season and the soil condition alter flavor and price alike.

The Wyoming example often surfaces in discussions of affordability, and for good reason. Analyses consistently identify Wyoming as among the states with the lowest average commercial auto insurance premiums. Several factors converge to explain this phenomenon. Population density is low, traffic congestion is modest, and overall claim frequency tends to be lower than in more urbanized states. A lower cost of living and a different urban footprint reduce driving exposure and the chance of high-severity, high-cost claims that insurers must price into premiums. In this sense, Wyoming’s regulatory posture is only one thread in a fabric of structural risk advantages. The result is a favorable environment for cheaper coverage, even before any particular policy feature or coverage tier is considered. The broader takeaway is that regulatory design interacts with macro-risk factors to shape pricing, and Wyoming exemplifies how a favorable risk landscape can materialize as lower costs for fleets.

To navigate this reality, fleet operators and independent drivers alike benefit from recognizing how regulations influence price beyond the obvious line items of coverage limits. A smart approach centers on aligning risk management with regulatory realities. Operators can reduce premium pressure by investing in driver training, rigorous maintenance, and telematics-enabled safety programs. Telematics, in particular, helps demonstrate to underwriters that a fleet is actively managing risk through proactive speed governance, harsh braking avoidance, and route optimization—factors that regulators may indirectly reward through lower premiums when combined with better loss experience. Yet even here, the impact of state rules must be acknowledged. A telematics program that delivers meaningful safety improvements may be more valuable in a state with higher minimums or stricter coverage expectations simply because the loss experience becomes more decisive in pricing. In states where enforcement is vigorous and claims handling is efficient, the insurance company’s confidence in loss projection improves, which can translate into more favorable terms for operators who prove consistent performance.

This interplay between regulation, risk, and price also helps explain why a single-state strategy can be financially prudent for some operations while a multi-state approach remains advantageous for others. For businesses with concentrated routes staying largely within one state, the regulatory floor may be lower, and the total cost of compliance more predictable. In contrast, multi-state operators must balance the aggregate burden of diverse rules with the value of uniform safety practices. The practical implication is not a one-size-fits-all answer but a careful calculation that weighs route structure, driver quality, maintenance discipline, and the degree of regulatory complexity—together with the price signals sent by insurers who price according to the jurisdictional risk mix.

For readers looking to connect the dots between market dynamics and policy design, a broader perspective can be gained by examining industry commentary and market analyses. A concise way to explore related discussions is to visit the broader trucking industry blog that surveys market dynamics and policy developments across North America. This resource provides context on how regulatory changes ripple through cost structures, without getting lost in product-level specifics. mcgrathtrucks blog.

The chapter above anchors the conversation in the reality that state regulation is not merely a bureaucratic backdrop but an active determinant of insurance economics. When fleets plan for the long haul, they must weigh the regulatory climate as a real cost driver—one that interacts with risk factors, enforcement styles, and the operational footprint. The cheapest state for commercial truck insurance is not simply the one with the lowest stated minimums; it is the one where the entire ecosystem—regulatory posture, enforcement efficiency, accident patterns, and maintenance culture—aligns to produce lower expected losses and, consequently, lower prices. Wyoming’s standing among the most affordable markets underscores the connection between a favorable risk environment and the price insurers quote for multi-vehicle, multi-state operations. Fleet managers who understand and anticipate these dynamics can negotiate smarter, design safer routes, and structure their coverage in ways that reflect real exposure rather than theoretical maximums. As the regulatory landscape continues to evolve, so too will the calculus insurers use to price risk, making ongoing education and adaptive risk management essential components of a cost-conscious trucking strategy. In practice, a mature pricing strategy emerges from a synthesis of regulatory awareness, disciplined safety programs, and a willingness to tailor coverage to route-specific realities rather than rely on generic, one-size-fits-all solutions. The result is a more predictable, sustainable cost trajectory that aligns with both regulatory obligations and business goals.

External resource for further reading on state mandates and pricing policies can be found here: https://www.americaninsuring.com/truck-insurance/state-regulations/.

Low-Cost Corridors and the Insurance Puzzle: Lessons from Texas, South Dakota, and Beyond

Across the sprawling landscape of American trucking, insurance costs do not arrive in a single national number. They arrive as a mosaic shaped by where fleets operate, how often a route passes through dense urban corridors, and the size and speed of the local insurance marketplace. In that sense, the story of cheapest commercial truck insurance is less about one state and more about a bundle of geographic and market conditions that tend to keep costs lower without sacrificing essential protection. The overarching question—which state has the cheapest commercial truck insurance—finds its most consistent answers in states with lighter traffic, lower population density, and competitive local markets. Yet even within that framework, the numbers shift as regulators loosen or tighten their grip, as road risk shifts with infrastructure investment, and as insurers adapt their underwriting to the evolving profile of a fleet’s operations. Against this backdrop, case studies of Texas and South Dakota illuminate how cost savings arise, what risks they entail, and how managers translate price signals into responsible risk management.\n\nIn Texas, a state famed for its vast logistics network and sprawling freight movements, the headline on affordability comes as a deliberate surprise. A 2024 report from the National Insurance Council places the average annual commercial truck insurance premium in Texas at roughly $18,500, a figure notably lower than the national average hovering around $24,000. This gap does not occur by accident. Texas benefits from a combination of factors that pressure premiums downward while preserving essential coverage. First, the state records a lower than might be expected traffic accident rate in certain corridors, and its road system, while dense in major markets, also features expansive less-traveled routes where exposure and claim frequency can be more predictable. Second, insurers note a comparatively competitive underwriting environment. A robust market with multiple local carriers and regional players tends to push rates toward actuarial parity, with providers offering a spectrum of policy constructs to fit different operation scales. Finally, Texas presents insurers and brokers with a flexible regulatory framework and a market that rewards tailored risk transfer—policies can be customized with deductibles, coverage limits, and endorsements that align with fleet size and the volatility of a given season or commodity. The practical upshot for a Texas-based trucking business, or any operation eyeing Texas as a primary corridor, is not merely lower sticker price but a broader menu of underwriting options. This translates into the ability to calibrate a policy to the specific risk profile of the operation—coverage for primary liability, physical damage, cargo, and non-trucking use—without paying for protection the fleet does not need. The result is a premium that looks favorable relative to peers in higher-risk states, even as the fleet sustains the same level of safety discipline and preventive maintenance.\n\nSouth Dakota presents a contrasting yet equally instructive case. The U.S. Insurance Statistics Yearbook (2024 data) highlights South Dakota as one of the states with very low average commercial truck insurance costs, reported at around $13,700 per year—a figure that underscores how low population density and lighter road use can translate into substantial savings. The state’s advantage rests on several interlocking dynamics. Its sparsely distributed population means fewer miles driven in heavy traffic, which in turn lowers exposure to high-severity crashes that typically drive up claims costs. The driving culture in many parts of the state, described as relatively conservative, reduces risky driving patterns and, by extension, the frequency and severity of claims. This combination makes it easier for insurers to price risk at a lower level, particularly when a market is hospitable to local and regional insurers who face less competitive pressure from mega-national underwriters. When more players enter a market, competition tends to compress prices further, and South Dakota’s regulatory environment has historically allowed for a broad spectrum of carriers to participate, which reinforces price competition. The practical implication is clear: for fleets operating primarily in or through markets with lower exposure and fewer high-traffic corridors, the premium signal from insurers can be markedly favorable. But the narrative comes with caveats. While the price tag may be appealing, the capacity and breadth of a carrier’s claims handling network, the speed of loss adjustment, and the availability of specialized cargo coverage in remote areas are critical considerations. A small, price-focused insurer may offer attractive annual rates but struggle to deliver timely service if a large claim arises or if a complex cargo loss needs specialized handling. Thus, the allure of lower premiums must be weighed against the reliability and reach of the insurer’s claims operations, and against the fleet’s need for rapid incident response, roadside support, and stable, long-term coverage commitments.\n\nWhat these cases reveal is a pattern that often emerges in discussions about the cheapest commercial truck insurance: geography and market structure strongly shape the base rate, yet the overall cost of risk can be mediated by how a company manages safety and claims readiness. In Texas, the combination of competitive underwriting and a broad, diverse carrier ecosystem supports more flexible policy design and targeted risk transfer. In South Dakota, the favorable equation rests on lower exposure, conservative driving norms, and a permissive regulatory climate that encourages multiple local insurers to compete on price and service. The broader takeaway for fleet managers is not simply to seek out the lowest price, but to translate price signals into a well-structured risk program that aligns insurance coverage with real operation risk. This means looking beyond the annual premium to the real cost of risk, including deductibles, coverage limits, cargo protection, and the insurer’s ability to respond when a claim hits the road.\n\nThe broader article’s inquiry into “which state has the cheapest commercial truck insurance” benefits from recognizing the value of a data-informed approach to state-by-state comparisons. While Wyoming routinely surfaces in analyses as one of the least expensive bases for commercial auto coverage, the Texas and South Dakota examples remind us that affordable pricing often coexists with a spectrum of underwriting options and service quality considerations that can materially affect total cost of risk over the life of a fleet. The question then becomes not only which state offers the cheapest numbers in a given year, but how a company’s operational footprint interacts with local market dynamics to shape total cost of risk. Fleet managers should map their routes, driver demographics, and cargo types against state-level market characteristics, including the density and speed of the insurer marketplace, the regulatory environment, and the capacity of carriers to provide robust claims support in the areas most traveled by the fleet.\n\nTo connect the practical takeaways with the broader market context, consider the idea of risk-informed pricing: the cost of insurance reflects not only the raw frequency of claims but also the speed and quality with which loss events are managed. In markets like Texas, the actuarial balance can accommodate a wider choice of policy configurations, enabling fleets to tailor coverage precisely to their operational realities while controlling premium outlays. In markets like South Dakota, the price signal is compelling, but fleet managers must assess whether the insurer’s claims network is commensurate with the fleet’s concentration in rural or semi-urban corridors where service coverage can be sparser. In all cases, a rigorous internal risk assessment—driven by driver training, telematics, safety programs, and maintenance discipline—helps ensure that the premium paid accurately reflects the fleet’s risk profile rather than a generic market average.\n\nThis chapter’s case-study orientation, drawn from the NIC and U.S. Insurance Statistics Yearbook results, also points to a practical path forward for the broader article: use regional cost signals as one input among many when budgeting for insurance across a diversified fleet. For some operators, the pattern of lower premiums in states with lower exposure can be a compelling financial lever, especially when accompanied by robust risk controls that reduce claim frequency and severity. For others, the same premium discount may not justify moving a fleet base if the implications for service coverage, claim handling speed, and cargo protection are not favorable. The nuanced message is clear. Price matters, but value—defined as the combination of price, coverage adequacy, and the insurer’s service reliability—matters even more.\n\nFor readers seeking deeper market context, one can consult broader market analyses that track cross-border and cross-state risk dynamics, including how macroeconomic shifts affect pricing and policy design. See the external benchmark below for a data-backed reference point. In practice, the chapters that follow will return to these ideas as they explore how fleet managers balance bottom-line insurance costs with long-term risk resilience across changing regulatory and economic landscapes. As the landscape evolves, the core discipline remains constant: align coverage with actual exposure, foster a culture of safety that reduces claims, and choose insurers who can deliver timely, credible risk management support as fleets traverse the cheapest and most expensive corridors alike. External reference: https://www.usinsurancereport.org/yearbook/2024. For readers seeking related practical insights within this site, consider the broader discussion on navigating uncertainty in the trucking markets navigating economic uncertainties in the Canadian and US trucking markets.

Final thoughts

Wyoming stands as a prime example of how geographic factors and state policies can influence commercial truck insurance prices. The combination of these elements creates an environment where trucking companies can operate with lower financial overheads, directly affecting profitability and operational efficiency. By understanding not only the current landscape of insurance rates but also the underlying factors and regulations, business owners can make informed decisions about their insurance needs. Ultimately, considering locales like Wyoming for commercial truck operations can result in significant cost benefits, establishing a solid foundation for sustained success in the trucking industry.