Navigating the landscape of commercial truck insurance for a Ford F-150 is pivotal for trucking company owners, fleet managers, construction enterprise procurement teams, and logistics firms. The insurance cost varies significantly based on the unique profile of the vehicle and its use. This article will detail the critical factors influencing costs, provide insights into the average price range for a Ford F-150, and differentiate between commercial and personal insurance policies. Ultimately, we will offer recommendations for obtaining the most effective coverage tailored to your operational needs.

The Premium Puzzle: Decoding What Drives Commercial Insurance Costs for a High-Performance Full-Size Pickup

The price of commercial vehicle insurance for a popular full-size pickup used in business isn’t a single number you can memorize. It’s a dynamic equation built from risk, usage, and geography, stitched together by the policies you choose and the way your drivers operate. When fleets rely on a single versatile truck for everything from equipment transport to on-site service, insurers zoom in on a lattice of factors that extend far beyond a vehicle’s base sticker price. The result is a spectrum: a sportier, high-performance variant or a vehicle used intensively for hauling, or traveling through challenging routes, will typically push premiums higher. In practice, the annual cost for commercial coverage can range from roughly twelve hundred dollars to three thousand five hundred dollars for many standard operations, with high-risk profiles or specialized usage surpassing five thousand dollars per year. Those numbers aren’t universal caps; they are starting points, reflecting typical exposure and the economic climate of the market. The way a truck is used—whether for light construction, landscaping, local delivery, or field service—transforms how insurers view risk, and that perception shifts the bottom line in meaningful ways.

Vehicle type and performance sit at the core of this calculation. A high-performance engine, heavy-duty chassis, and a capable suspension system elevate the likelihood of higher speeds or aggressive driving in competitive job sites. In insurer terms, agility and power correlate with risk of loss, particularly when the vehicle shares roads with other heavy traffic, urban congestion, or adverse weather. A truck that can accelerate rapidly or navigate rough off-road work sites adds to the potential for rollovers or collisions, even if the driver is highly trained. The larger footprint of a full-size pickup compared with smaller work vans also means that damage in a crash carries a higher potential cost, which translates into higher premiums. In some cases, the same logic applies to trucks that are perceived as being more challenging to service after a claim. Parts availability and repair complexity can influence estimates of total loss or downtime, nudging rates upward in the long run. If the truck is an import or uses components that are not part of a standard national repair network, the premium can rise further as insured parties and repair facilities face longer lead times and higher costs for parts.

Driver profile matters just as much as the machine. An experienced operator with a clean driving record typically commands a more favorable rate. Conversely, a newer driver with limited time behind the wheel—especially in a vehicle that is larger, faster, or uses power-assisted features in high-stress settings—can trigger higher premiums. The nature of commercial use compounds this effect. A vehicle deployed for frequent hauling, long daily routes, or multi-site service work increases exposure to incidents, which in insurance terms means more days on the road and more miles under load. Your underwriting profile benefits from a demonstrated safety culture: documented training, adherence to company vehicle policies, and a history of proactive maintenance can all push premiums down. When a driver has a history of accidents or violations, even small infractions can ripple into higher costs because they signal future risk. For companies, presenting a solid driver‑training program and accident-prevention data can be a practical way to negotiate better terms.

Business nature and usage are not abstract categories; they translate directly into premium dimensions. The type of job you perform with the truck matters because insurers calibrate risk differently for a construction outfit versus a landscaping service or a local courier. Mileage matters too: higher annual miles mean more time on the road and greater chance of a loss. Routes matter as well: urban corridors with heavy traffic, unpredictable pedestrians, and tight curb lines can increase the probability and severity of incidents. The cadence of use—how many hours per day and how many days per week the truck operates—appears in the policy as exposure, shaping the base rate and the rate at which premiums accumulate over the policy year. The value and nature of the cargo carry weight, too. Carrying high‑value goods raises the potential payout for theft or damage, nudging premiums higher. Conversely, lower cargo risk—such as generic tools and equipment—can help keep costs in check.

Coverage levels and deductibles are the levers most business owners adjust to align protection with risk tolerance and cash flow. Liability limits are a straightforward way to modulate premium cost; increasing from a typical one or two million dollars in bodily injury and property damage to higher levels can raise the bill noticeably. Comprehensive and collision coverages, which repair or replace the vehicle for non-collision events like fire, vandalism, weather damage, or collision, add to the cost, especially if the vehicle operates in environments with elevated exposure to such risks. Deductibles offer a more direct trade-off: choosing a higher deductible reduces the monthly premium, but it increases out-of-pocket costs when a claim is filed. The balance between deductible level and premium is a practical calculus tied to the business’s risk appetite and financial resilience. A fleet that can absorb a higher deductible may enjoy a meaningful premium reduction, while a smaller operation prioritizing predictable expenses might favor a lower out-of-pocket threshold regardless of a somewhat higher ongoing cost.

Geography plays a subtle yet powerful role in shaping premiums. The local risk landscape—traffic density, crime rates, weather patterns, and even state or municipal laws—leans on the insurer’s risk models to determine the baseline rate. A fleet operating in regions with harsh winters, heavy snowfall, or frequent hail, for example, faces higher exposure to weather-related claims and thus higher premiums. Local regulations can affect not just policy terms but also the cost structure surrounding coverage, including the availability of certain coverages and the frequency of claim filings. Even taxes and fees associated with vehicle ownership can influence the total cost of ownership, and some of these can narrow or widen the premium when insurers consider the full economic picture of maintaining a commercial fleet in a given location. In this sense, a truck’s lifecycle cost and insurance cost are not isolated; they interact with the broader regulatory and climatic context in which a business operates.

Within this framework, a practical starting point is to consider a baseline range for commercial insurance on a standard full-size pickup used for light business tasks. For many operators, the annual premium hovers in the general range of about $1,200 to $3,500 when the vehicle is employed primarily for local service or delivery with modest cargo value and conservative liability limits. Higher-end policies, particularly those tied to high-visibility fleets, specialized on-site work, or assets with elevated exposure, can push the annual cost beyond five thousand dollars. It’s important to stress that these figures are indicative rather than prescriptive. They reflect broad market patterns and common risk profiles rather than a universal tariff. Each claim history, driver roster, vehicle configuration, and route set can tilt the scale in a different direction. Therefore, a tailored quote from multiple insurers remains the most reliable way to capture today’s nuances in premium pricing.

The path from broad patterns to a precise price often runs through a careful audit of how the vehicle is used and who is behind the wheel. A business that keeps meticulous driver records, maintains a robust preventive maintenance program, and enforces strict vehicle use policies not only improves safety but can also unlock more favorable terms. Insurers want proof that risk is being actively managed. Simple steps, such as documenting regular maintenance, scheduling and documenting safety trainings, and instituting clear incident reporting, may reduce premiums over time as the underwriting body grows confident in the company’s risk control. For fleets that operate in highly regulated sectors or that transport goods requiring high security, insurers may request additional protections, such as telematics data, to monitor driving behavior and vehicle performance. The adoption of telematics—tracking speed, acceleration, braking, and mileage—often results in more precise risk assessment and can yield favorable pricing for teams that demonstrate consistent, safe operation.

The practical takeaway for any business owner weighing commercial insurance for a high-performance full-size pickup is to view the process as a collaborative dialogue with insurers rather than a one-off price quote. Start with a clear description of the vehicle, its typical usage, and the cargo profile. Document the driver roster, experience levels, and any safety programs in place. Outline the expected annual mileage and typical routes. Decide on liability limits and coverage tiers that align with the business’s risk tolerance and cash flow. Consider how deductibles will work in practice and how much protection you truly need for both the vehicle and the goods it carries. As the negotiation unfolds, assemble quotes from insurers who specialize in commercial vehicle coverage, and compare not just the price but the scope of coverage, the inclusions, and the claim-handling reputation of the insurer.

For operators curious about how market dynamics may influence future pricing, a look at the broader used-truck market can be informative. Trends in used-truck availability, maintenance costs, and overall vehicle depreciation can affect replacement costs and, by extension, insurance risk profiles. A growing market for used, well-maintained pickups in commercial fleets can lead to more favorable premiums for some operators, as stability in the asset pool reduces overall risk. Conversely, if the market tightens and replacement parts become scarcer or more expensive, the insurer’s anticipated exposure grows, and rates may tick upward. This is why ongoing maintenance records, timely renewal reviews, and proactive risk management remain essential components of keeping insurance costs predictable year after year. The essential insight is that premiums are not a fixed price they are a moving target shaped by the vehicle, the people who operate it, and the business context in which it functions. A disciplined, proactive approach to risk management often proves to be the strongest driver of favorable outcomes over time.

Within the broader discussion, it can be helpful to connect with sources that illuminate how the market is evolving. For readers seeking a wider industry perspective, the piece on current trends in used-truck sales growth provides useful context about asset availability and depreciation, which in turn influences insurance considerations. See linked discussion here for a concise framing of these market dynamics: current trends in used-truck sales growth.

In sum, the cost picture for commercial insurance on a high-performance full-size pickup emerges from an integrated view: the vehicle’s capability and complexity, the driver’s track record and experience, the specifics of how the truck is deployed in business, the level of protection chosen, the deductibles you’re comfortable with, and the geographic and regulatory environment in which it operates. The insurance equation rewards clarity and proactive risk management. When a business can demonstrate discipline in maintenance, driver training, and policy adherence, it stands a fairer chance of securing coverage that protects both the bottom line and the day-to-day operations. For those embarking on the quoting process, it’s worth starting with a careful write-up of your typical usage, then layering in the details—the cargo value, the expected mileage, and the safety programs—before requesting bids from specialists in commercial vehicle coverage. The result is not just a price tag but a transparent, defendable protection plan that aligns with the realities of the job and the capabilities of the fleet.

External resources that offer broader industry context can help frame expectations for the pricing landscape. For a broader industry overview on risk assessment and market dynamics within commercial vehicle insurance, see the Insurance Information Institute’s resource on insurance basics and market factors: https://www.iii.org. These materials can complement the chapter’s focused discussion by situating premium decisions within the larger framework of how insurers evaluate risk, pricing, and claim experience across fleets and commercial operations.

When a Workhorse Becomes a Policy: Bending the Cost Curve of Commercial Insurance for the F-150

The Ford F-150 has long stood as a practical bridge between personal mobility and workhorse reliability. When a pickup shifts from weekend warrior to jobsite facilitator, the cost of insuring it climbs in subtle but meaningful ways. The question of how much commercial truck insurance costs for an F-150 does not invite a single, simple answer. Instead, it maps to a landscape shaped by the driver’s experience, the vehicle’s use, the driver’s location, the level of protection chosen, and the particular insurer’s appetite for risk. In broad terms, the standard range for commercial coverage on an F-150 in the United States typically sits somewhere between roughly $1,200 and $3,500 per year. For policies that incorporate broader protections or account for riskier operating profiles, premiums can push beyond $5,000 annually. Those numbers, while useful as a starting point, are best treated as a map rather than a fixed destination. They can move with the weather of market rates, the weight of a cargo load, or a driver’s past record.

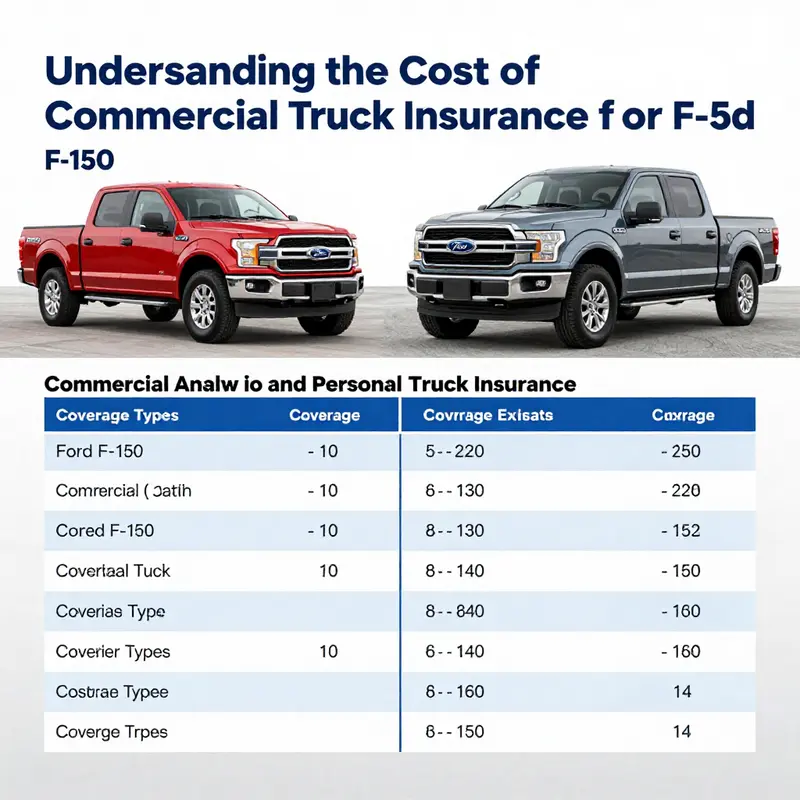

The distinction between personal and commercial insurance matters a great deal here. If the F-150 is used to deliver goods, ferry equipment, or support any revenue-generating activity, insurers will usually categorize it as a commercial vehicle. That classification generally translates into higher premiums because the exposure is larger and the stakes are higher. A personal-use truck that occasionally hauls a few tools in the bed will sit on a different risk horizon than a worker who drives all day, every day, through congested streets or remote job sites. The same vehicle can switch from a personal policy to a commercial one with a few lines added to the application, and that shift often carries a price tag that reflects the added exposure.

Several core variables consistently shape the final price. The driver’s experience and driving history are up there at the top. A cleaner record typically translates into lower premiums, while a history of accidents or violations can push costs higher. Location matters because traffic density, theft risk, and local legal requirements vary widely. Some regions pose higher liability risks or require more expensive medical coverage, which filters through to the premium. The intended use—delivery, service calls, or site work—sets the baseline risk profile. A truck that routinely visits construction sites or carries valuable tools can incur higher coverage needs, particularly if the cargo value is substantial. The amount and type of coverage you select will steer the price. A higher liability limit, collision coverage, comprehensive protection, and features like no-deductible plans or specialized add-ons naturally raise premiums.

Usage patterns also matter for a vehicle like the F-150. A one-owner, light-use fleet vehicle in a low-crime region will typically cost less to insure than a fleet-analyzed operation with multiple drivers, long daily miles, and regular exposure to high-traffic corridors. If the vehicle serves in a role where it routinely carries high-value cargo or operates in environments with elevated risk—rough terrain, remote worksites, or routes near salvage yards—the insurer will likely respond with a broader coverage package and higher premiums. In such cases, the policy becomes more than a shield against crash costs; it becomes a financial plan for risk transfer, cargo protection, and continuity of business operations.

The research landscape also reveals regional variations that are worth noting, especially when we widen the lens beyond the U.S. market. A detailed data point from early 2026 centers on the F-150’s higher-end variant in a different market: the Raptor. In that context, a full insurance package—described as comprehensive coverage that includes vehicle damage protection, third-party liability with a substantial limit, no-deductible options, and even body-scratch coverage—was estimated at between 16,000 and 19,000 RMB per year. That range translates to roughly 18,991 RMB on an example 2025 model, with the exact figure depending on the price of the vehicle, the coverage limits, and the precise terms under which the policy is written. It is crucial to flag that this data set is tied to private-use insurance in a specific market; it does not represent a direct one-to-one mapping onto a commercial truck policy. Nevertheless, it offers a meaningful lens for comparison: even when the vehicle is a high-end variant, the concept of a comprehensive, all-in policy with robust protections can push annual costs into the several-thousand-dollar range in many countries.

That RMB example, while geographically distinct, helps illuminate a broader truth. Full-coverage policies that protect against a wide array of risks — vehicle damage, liability with substantial coverage, theft or fire, glass and cosmetic repairs, and even minor contingencies like paint scratches — carry a premium that scales with the risk transfer the policy represents. In markets where private vehicle insurance is structured to cover a wider spectrum of contingencies, the cost can be significant, especially for premium variants like the Raptor. When you translate that into a framework for a commercial policy, you should expect that a similar level of protection, applied to a work vehicle with all the accompanying exposure, will come with an associated premium that reflects the added risk: higher liability limits, broader physical damage protections, and sometimes additional endorsements that address specific commercial uses.

What this means in practical terms is simple but important: the cost of insuring an F-150 for commercial use is not a fixed line; it’s a function of risk and protection. For a straightforward delivery or service profile with a standard trim and sensible coverage limits, the numbers you see in the U.S.—roughly $1,200 to $3,500 per year—can be a reasonable starting point. If your operation includes high cargo values, dangerous routes, or a fleet of drivers with varying experience, the premium can climb quickly. And if you own or operate a high-performance variant like the F-150 Raptor—or you modify the vehicle in ways that impact repairs and safety—expect the price tag to reflect those higher risks with a higher policy cost.

In addition to the primary drivers of cost, there are practical steps that can help shape the final number. One of the most effective is to pursue quotes from multiple insurers that specialize in commercial vehicle coverage. The insurance market rewards competition, and insurers that compete for your business may tailor packages that fit your exact risk profile. When applying for quotes, you’ll typically be asked for the vehicle identification number (VIN), the anticipated annual mileage, where the vehicle will be driven (urban corridors, rural roads, or a combination), and the cargo types or tools you carry. You may also be asked about your drivers’ experience and history. A policy can be fine-tuned by adjusting deductibles, liability limits, and endorsements, which allows you to balance cost against protection.

Beyond the basics, there are several strategies that businesses and individual operators often employ to manage insurance costs without compromising essential protection. Telematics-based programs, for example, reward safer driving with premium reductions by providing real-time feedback on speed, braking, and acceleration. Implementing driver training programs can also demonstrate to insurers that you are actively managing risk, which may yield favorable rates. Regular maintenance and safety features—anti-theft devices, improved lighting, and visibility-enhancing upgrades—can reduce the probability of theft and accident-related claims, contributing to more favorable pricing over time. Bundling commercial auto policies with other lines of coverage, such as general liability or property insurance, can unlock multi-policy discounts that further moderate the total cost of risk management.

The chapter’s core idea remains: treat insurance as a strategic tool, not merely a fixed expense. The cost of insuring an F-150 that operates as a business asset should be evaluated in the context of the vehicle’s role in the operation. If the truck is essential for revenue-generating activities, the premium should be viewed as part of the overall cost of maintaining business continuity. This approach helps business owners and fleet managers quantify risk and align protection with the value the vehicle brings to the operation.

For readers seeking broader industry context as they assess the numbers, a broader industry perspective can be found in the everyday discussions that accompany fleet management. These conversations—whether about budgeting, scheduling, or policy selection—are often hosted in industry blogs and forums where practitioners share experiences and benchmark data. A good starting point for further reading is the McGrath Trucks Blog, which aggregates practical perspectives on how trucks are bought, sold, and managed in real-world settings. Reading through accessible narratives and data points on that platform can illuminate how other operators navigate insurance questions alongside maintenance, depreciation, and operational efficiency. McGrath Trucks Blog offers a relative frame of reference for the challenges and decisions that accompany commercial trucking, helping to connect the numbers you see in price sheets with the realities of daily operation.

From a policy design standpoint, it’s worth remembering that the core function of any commercial auto policy is to transfer risk. The cost reflects the level of risk transferred, the magnitude of potential losses, and the duration over which protection is provided. A policy that provides broad liability protection, strong physical damage coverage, and robust endorsements to cover non-owned vehicles, hired transportation, or cargo-specific risks will inevitably cost more than a leaner, more narrowly tailored plan. The trade-off, however, is risk certainty: a business owner can count on a clearer financial floor if an incident occurs, rather than facing an unpredictable bill for repairs, medical expenses, or liability claims.

In terms of how this topic flows toward the broader discussion in the article, consider how much the cost varies when you move from a general discussion about “how much does commercial truck insurance cost for an F-150” to the granular realities of a specific market or a specific business profile. The central message remains consistent: the cost is driven by exposure, protection, and intent. When you read or hear numbers in the abstract, it’s easy to forget that a single policy can evolve with the business it protects. An F-150 used by a one-person handyman for occasional service calls will look different in the underwriting room than a fleet vehicle that carries high-value tools across multiple counties, daily. That shift is why the best approach is to gather multiple quotes, tailor the coverage to the operation, and continually reassess as the business grows or evolves.

To connect this discussion with the broader body of industry knowledge, note that the sources behind these observations consistently emphasize the importance of specificity in how the vehicle is used and how risk is managed. The simple act of changing a usage description—from personal use to commercial delivery—can alter the entire risk profile and, thus, the premium. For readers who want more immediate context on the practicalities of fleet decisions, the linked internal resource provides a gateway to broader industry commentary and practical guidance. McGrath Trucks Blog offers ongoing coverage that can help readers interpret insurance figures in light of maintenance costs, depreciation, and the evolving regulatory environment.

In closing, the numbers you see for commercial insurance on an F-150 are not a destiny carved in stone. They are the outcome of a negotiation between risk, protection, and business reality. A cautious plan that anticipates the vehicle’s use and keeps a close eye on driver behavior, maintenance, and coverage limits can deliver reliable protection without starving the budget. The F-150 remains a remarkably versatile platform: economical enough for everyday tasks, rugged enough for worksite demands, and, when appropriately insured, a dependable backbone for a small business or independent contractor. The precise premium is a function of the story you tell the insurer about how the truck drives, what it carries, where it travels, and how carefully you manage risk over time. External data points, like those from the RMB-based analysis, add perspective by illustrating how similar risk-transfer concepts operate in other markets. These contrasts reinforce the value of shopping widely, detailing your intended use, and prioritizing risk controls that help you keep insurance costs aligned with the real value the F-150 delivers to your operation.

External Resource: https://www.iii.org/article/auto-insurance-what-it-covers

Beyond the Sticker Price: Decoding Commercial Insurance Costs for the Ford F-150 and What It Means for Your Business

The Ford F-150 has earned its reputation as a practical, versatile workhorse that can handle a wide range of tasks on a job site or on the road. For many small businesses and independent operators, it represents more than transportation; it is a revenue-producing asset that must be protected. When you start comparing insurance costs, the first surprise is how quickly the numbers diverge once you move from personal use to commercial use. A private driver may see premiums in the low to mid four figures on a full-coverage policy for a pickup, but once that same vehicle becomes a commercial tool—hauling tools, equipment, or even cargo on a daily route—the premiums jump. The difference is not merely about price tags. It’s about risk profiles, regulatory expectations, coverage needs, and the value at stake in every mile driven. In practical terms, commercial insurance for a popular light-duty pickup can land in a broad range, from a few thousand dollars a year to well into the five-figure territory, depending on how the vehicle is used, who is behind the wheel, and how much protection the business requires. The spectrum is wide because risk evolves with every business model, route, and load, and insurers price that risk accordingly.

To ground this discussion, consider the two ends of the spectrum: personal use and commercial use. For personal use, the typical full-coverage premium often lands around the mid- to upper thousands, with more modest minimum liability policies hovering under a thousand dollars in many states. These figures reflect average claims history, typical driving behavior, and standard vehicle configurations. But when a business turns that same pickup into a commercial workhorse, the odds and consequences of a loss shift in ways that are costly and complex. The result is a new baseline that every business owner should understand before they finalize annual budgets or sign a policy.

A useful rule of thumb helps illuminate the gap: commercial auto coverage tends to be two to five times more expensive than a comparable personal policy for the same vehicle, depending on usage and coverage. Yet published ranges highlight a broader reality. In some scenarios, commercial coverage can be notably less than the upper end of the spectrum if the operation is light-duty, well-documented, and tightly controlled. In others, especially where liability limits are high, cargo protection is required, or the vehicle carries specialized equipment, the costs can quickly escalate. Industry benchmarks illustrate this contrast clearly. While some early estimates place the typical commercial premium for a light pickup in the mid to high single digits of thousands, other scenarios—where cargo value, high annual miles, or specialized modifications come into play—can push premiums into the range traditionally associated with larger commercial fleets. The key is not to fixate on a single number but to understand the levers that move the price and the protection those levers buy.

The core drivers of cost lie in risk, not in the vehicle alone. A private owner may primarily worry about frequency and severity of accidents, but a business owner must also manage cargo exposure, non-owned auto liability, and the possibility of using the vehicle across multiple shifts and drivers. A commercial policy often asks for higher liability limits—frequently $1 million or more—alongside cargo coverage, insured and uninsured motorist protection, and possibly non-owned auto liability if employees use personal vehicles for work tasks. Each of these components adds layers of protection and, of course, cost. The vehicle’s usage matters as well: a pickup used to haul expensive tools or heavy equipment across long routes will be scrutinized more closely than a light-duty delivery vehicle. The mileage pattern matters too. Commercial vehicles frequently accumulate tens of thousands of miles per year, increasing both exposure to accidents and the chance of weather-related or road-condition incidents. Vehicles that are heavily modified for work, whether that means reinforced suspensions, lift kits, or specialized racks and cargo systems, introduce additional repair and replacement costs that insurers must cover, which further shifts the pricing landscape.

From a practical standpoint, pricing for commercial use splits into several layers. First is the baseline liability and physical damage coverage for the vehicle itself. Personal policies often feature lower liability limits and may assume a single-owner driver profile. Commercial policies, by contrast, typically require higher liability limits, sometimes $1 million or more, given the potential for greater exposure when a vehicle operates in a business context. Second is cargo coverage, which protects the value of tools, equipment, or goods in transit. If your F-150 services a construction site, landscapes, or mobile repair tasks, cargo limits vary widely and can be a non-negotiable part of the policy. Third is coverage for non-owned auto use, and sometimes non-owned auto liability is included or added as needed if employees drive personal vehicles for work. Finally, the regulatory and safety framework adds its own costs: proof of commercial driver qualifications, safety training records, and in some cases electronic logging device (ELD) compliance and DOT-related requirements. Each of these items has a price tag, and together they explain why commercial premiums typically outpace personal premiums by a meaningful margin.

Consider the numbers that often appear in industry discussions. For a private owner, full-coverage insurance for a Ford pickup can average around $2,600 per year, with monthly payments in the neighborhood of $219. The minimum liability policy commonly runs closer to $823 per year, or about $69 per month. These figures reflect national averages and standard risk profiles. They also underscore how much variability exists in the market, driven by factors such as driver age, location, driving record, model year and trim level of the truck, and annual mileage. When the same vehicle becomes a commercial asset, the costs can rise sharply. Real-world benchmarks commonly place full-coverage commercial auto costs in the broad range of roughly $7,000 to $15,000 per year, and sometimes higher depending on the business type and risk exposure. The jump is not just a matter of higher premiums; it is a reflection of the expanded protection package that commercial policies require. The higher end often corresponds to operations with substantial cargo, high miles, or more demanding liability needs, while leaner commercial policies can sit closer to the lower end of the spectrum if the operation maintains tight risk controls. In some analyses, premiums are noted as 2.5 to 5 times higher than personal policies for the same vehicle, but the actual numbers can diverge widely based on state regulations, the insurer’s rating system, and the business’s safety profile.

The clearest lens for understanding these costs is to unpack the variables in play. The business type matters: a contractor who uses the pickup to haul tools and equipment along a daily route will confront different risk factors than a landscaper who transports mulch and plants in a compact configuration. The annual mileage is a major driver. A commercial vehicle that logs 20,000 miles or more per year presents more opportunities for an incident, which translates into higher premiums. Vehicle modifications also influence pricing. A lift kit, heavy-duty suspension, or reinforced cargo bed can raise repair costs and insurer risk assessments, nudging premiums upward. Driver qualifications weigh in as well. Insurers often require proof of a commercial driver’s license (CDL) or confirmation that drivers meet safety standards, along with training records and safety compliance measures such as electronic logging (ELD) and regular hours-of-service reporting. The presence or absence of these elements can swing quotes by thousands of dollars.

Another important factor is coverage scope. Commercial policies typically include higher liability limits, cargo insurance, uninsured/underinsured motorist protection, and sometimes non-owned auto liability (NOAL) if employees drive personal vehicles for work. These coverages protect the business if a claim exceeds primary policy limits or involves third-party cargo damage. They add real value, but they also contribute to higher premiums. The overarching principle is simple: the more protection you purchase and the riskier the operation, the higher the price. Conversely, if you can demonstrate lower risk—through fewer drivers, shorter routes, lower annual mileage, or stricter safety protocols—you can negotiate more favorable terms.

Given this landscape, the practical path to a fair price is thorough research and proactive risk management. It is essential to gather quotes from multiple insurers who specialize in commercial vehicle coverage and to present a clear, consistent picture of how the vehicle is used. Insurers will want to know the business type, typical routes, cargo value, and whether the vehicle will operate on public roads, construction sites, or remote locations. They will also request driver information, including licensing, experience, and the company’s safety record. Because many policies hinge on the specifics of risk, providing precise details helps prevent surprises at claim time and during policy renewal. For business owners who want to stay ahead of the curve, engaging a broker who focuses on commercial auto insurance can be especially valuable. A broker can translate the nuances of your operation into a policy design that matches both risk and budget, while ensuring you avoid gaps in coverage that could complicate a claim.

To keep pricing in check without sacrificing protection, several practical strategies exist. First, invest in driver training and safety programs that reduce accident risk and demonstrate a proactive safety culture to insurers. Telematics and regular maintenance logs can quantify safe driving behaviors and mechanical reliability, which can translate into premium credits over time. Second, consider adjusting deductibles. A higher deductible lowers the premium, but you must balance this against your ability to cover the deductible in the event of a claim. Third, bundle commercial auto coverage with other lines of insurance, such as general liability or workers’ compensation, when possible. Bundling often yields discounts that offset some of the premium increase associated with commercial use. Fourth, limit exposure where feasible. If the business can minimize high-value cargo or reduce heavy-load transport, those changes can have a meaningful impact on cost. Fifth, ensure accuracy in the declared business use. If the vehicle is occasionally used for personal tasks, make sure the policy reflects the correct usage split. Misrepresenting usage can lead to claim denial or policy cancellation. Finally, discuss the possibility of phased coverage. Some insurers offer tailored solutions for smaller fleets or single-vehicle operations that can deliver essential protections at a more manageable price point.

In the end, the question of how much commercial insurance costs for a popular light pickup depends on a blend of use case, risk controls, and policy design. For some owners, the cost is a carefully justified investment in protecting revenue streams, equipment, and livelihoods. For others, it’s a trigger to rethink how the vehicle is deployed, how work is organized, and how risk is allocated across the business. The most reliable way to move from guesswork to informed decision-making is to engage with insurers who understand the nuances of commercial pickup operations, compare multiple quotes, and be willing to adjust risk factors or policy structures to align with the business objectives. If you want to see how market dynamics might be shaping your options, consider exploring industry perspectives that discuss broader market conditions and their impact on pricing. You can also consult resources that summarize how the market is evolving for commercial truck insurance amid shifting regulatory requirements and claims trends. For broader context on market conditions and pricing benchmarks, an authoritative external reference can offer a useful backbone for comparative analysis.

Internal link for further context on how market conditions affect pricing and risk management can be found in this discussion of navigating economic uncertainties in trucking markets. This resource provides a framework for understanding how cost pressures and regulatory changes influence insurance quotes and risk assessments across the sector. navigating economic uncertainties in the trucking markets.

As you move from theory to practice, remember that a precise quote requires specific information about your operation. The ranges and principles outlined here reflect national averages and typical risk profiles, but only a tailored proposal based on your business will reveal your true premium. The contrast between personal and commercial insurance for the same vehicle underscores the importance of clarity in usage and coverage requirements. Personal policies may suffice for occasional, low-mileage use, but any sustained commercial activity—especially with higher liability limits, cargo needs, or multiple drivers—demands a specialized commercial policy designed to protect revenue, assets, and people on the road. The right policy strikes a balance between comprehensive protection and predictable, manageable costs, enabling you to deploy your pickup with confidence rather than fear a costly, uncertain exposure.

External reference: NAIC Auto Insurance Premium Trends (2025) — https://www.naic.org/ciproductsandservices/insurancestatistics/insurance_statistics.htm

The Price of Protection: Navigating Commercial Insurance for the Popular Full-Size Pickup

Protecting a small-business operation that relies on a capable, versatile pickup is more than choosing a policy; it is balancing risk, cash flow, and uptime. When a light-duty truck that sits at the heart of daily deliveries, service calls, or equipment hauling shifts from personal to business use, insurers reframe the vehicle’s exposure. The change in purpose matters as much as the miles traveled or the cargo carried. In practical terms, commercial truck insurance for a pickup tends to carry higher premiums than personal coverage, and the gap can widen quickly if the driver’s history, the cargo type, or the operating environment introduces greater risk. Across markets, a reasonable ballpark for annual costs rises into a range that might surprise some owners: many policies land somewhere between the low two thousands and the mid three thousands, with substantial extensions of coverage or higher risk profiles pushing annual costs beyond five thousand. Those numbers, however, are starting points. They are influenced by a constellation of variables that combine to define the final premium, and the only reliable way to understand the true cost is to translate these variables into a tailored quote rather than guessing from a general statistic. For anyone operating a pickup in a business context, the first task is to frame the business use clearly and to acknowledge how that framing changes the insurance equation. Unlike a vehicle kept for personal errands or occasional client meetings, a business-use pickup may be asked to move tools, equipment, or goods along routes that traverse urban streets, rural backroads, or construction sites. Each environment carries different hazards—from congested traffic to rough terrain—and insurers quantify those hazards through the lens of exposure hours, miles, and the value of the cargo or tools entrusted to the vehicle. The same vehicle can produce very different premiums if it primarily serves as a local service vehicle versus a long-haul workhorse, even when the vehicle itself is the same. Because the cost is a function of risk, the most cost-effective approach is not to look for a single price, but to understand the pricing logic and align coverage to the real risk you present. Consider for a moment the core categories that typically drive a commercial auto premium for a pickup. First is driver experience and record. An operator with a clean driving history and a few years of professional driving under their belt will generally attract a lower rate than someone newer to the road or with a string of violations. Geography also matters. Urban areas with dense traffic, higher theft rates, and more claims tend to push premiums upward, while rural operation can often yield savings. Then there is usage: the same truck used to shuttle equipment between job sites or to deliver parts to customers will be priced differently than a pickup used mainly for field service with occasional errands. The frequency and length of trips, the terrain, and the potential exposure to high-value cargo or specialized equipment all influence the risk assessment. In many policies, insurers parse cargo as a separate exposure. If the pickup regularly hauls valuable tools, electronics, or merchandise, the cargo coverage component adds to the total cost, reflecting the added financial exposure if something goes wrong. Even the presence of modifications or aftermarket equipment can shift pricing. A pickup outfitted with towing gear, lift kits, or heavy-duty electronic systems can change both the risk profile and the replacement value in play. Insurers examine not only what the truck carries, but how it carries it. This examination extends to the vehicle’s classification. A vehicle used primarily for business could be treated as a commercial asset regardless of whether it is owned outright or leased, and that classification carries implications for liability limits, medical payments, and the kinds of endorsements available or required. Misclassification—treating a business-use pickup as a personal-use vehicle—can create gaps in protection and may lead to coverage denial or claim complications if a loss occurs. The consequences of misclassification emphasize a broader theme: the coverage you select should reflect actual risk, not merely the price tag on a policy that assumes a different purpose. With that context, the process of obtaining commercial truck insurance for a pickup becomes a careful conversation about coverage design. At a high level, the aim is to match the policy’s protections to the business’s risk profile while preserving cash flow and ensuring the ability to stay on the road when the unexpected happens. The essential building blocks include liability protection that reflects the potential for bodily injury and property damage in the course of customer-facing work or on job sites where other people and property may be impacted. Some business operations will justify higher liability limits, particularly for deliveries to commercial clients or when the vehicle operates in environments with greater risk of property damage. Cargo protection is another piece of the puzzle. If the pickup carries tools, equipment, or inventory, adding cargo coverage can be prudent to mitigate losses from theft, loss, or damage to the items in transit. In addition, businesses may want to consider endorsements that cover equipment breakdown, rental reimbursement if the vehicle is out of service, or roadside assistance that keeps the operation moving in the event of a breakdown far from a shop. The protective envelope can widen further if the business relies on towed loads or carries specialized gear. Each of these elements not only increases the premium but can increase the value of the coverage by reducing downtime and protecting revenue in the event of a loss. A practical approach to pricing starts with what is known as a complete needs assessment. The business owner or fleet manager should articulate the vehicle’s role in the operation: what is being transported, how often, and over what routes; the expected annual mileage; the typical work environment; and the cargo’s value and fragility. The discussion should cover the driver roster, because multiple drivers introduce variability in driving records and risk profiles. The next step is to map out the required and desirable coverage levels. Liability limits are sometimes driven by customer contracts, especially in service industries or deliveries to mid-size or larger clients that demand higher protections. A higher allowance for liability might be necessary to secure more favorable terms with clients that require these protections, even if it means a higher premium. Cargo coverage specifics depend on the nature of the items moved. Some cargos demand higher limits or specialized coverage clauses; others may be adequately protected with standard terms. A well-rounded policy might also include protections for gaps in daily operations, such as coverage for tools and equipment when not directly in the truck—an often-overlooked exposure in trades where crews go from site to site and keep gear in transit or on-site for extended periods. A critical phase in the pricing process is gathering quotes from multiple insurers that specialize in commercial auto. The market does not stand still, and different underwriters may weigh the same exposure differently, yielding a range of price and coverage outcomes. Rather than rely on a single quote, it pays to compare a small set of options side by side, paying close attention to the exact limits, deductibles, and the scope of endorsements. In this sense, the pricing conversation becomes less about chasing the lowest number and more about finding the best balance between affordability, protection, and resilience for the operation. When evaluating quotes, a few practical criteria matter beyond the headline price. Ask about property damage and bodily injury coverage and whether the policy includes or allows affordable add-ons such as roadside assistance that minimizes downtime, rental reimbursement that helps keep revenue flowing when the vehicle is in the shop, and specific cargo endorsements tailored to the type of work done. A good insurer will also explain how telematics—if available—could influence rates. Telematics can provide a fair, performance-based approach to pricing, rewarding safer driving practices with lower premiums, while offering tangible data to guide training and risk reduction efforts. If your operation is open to such tools, requesting information about telematics programs can reveal opportunities for savings without sacrificing protection. Another important angle concerns the broader landscape of insurance pricing. Prices are not fixed; they respond to factors such as claims experience, weather-related losses, and shifts in regulatory requirements that affect how risks are assessed and priced. For context on the broader market dynamics and how they can ripple through the price you pay, consider the discourse on risk exposure in trucking markets, which you can explore through this resource that examines uncertainties and their implications for costs and planning. For broader context on how market conditions shape prices, see Navigating Economic Uncertainties in Trucking Markets. (https://mcgrathtrucks.com/navigating-economic-uncertainties-key-insights-from-the-canadian-and-us-trucking-markets/)

With these pieces in place, the practical act of obtaining coverage becomes a collaborative exercise rather than a race to the lowest quoted price. The choices you make—what limits you accept, what cargo you insure, what endorsements you require, and whether you embrace a telematics-based pricing arrangement—all feed into the final premium. The process benefits from speaking with insurers who specialize in commercial auto policies and who understand the realities of a small-business operation that relies on a pickup to perform essential tasks. Instead of focusing purely on cost, look for insurers that offer clarity about what is covered, what is excluded, how deductibles are applied, and how the policy responds to common losses in your work environment. A transparent discussion is more likely to yield a policy that prevents gaps in protection and avoids surprise expenditures when a claim arises. The value of obtaining multiple quotes is not merely a safeguard against overpayment; it is also an avenue to discover the subtle differences in coverage philosophy among underwriters. One quote might emphasize a broader cargo endorsement, another might shine with a robust roadside assistance package, and a third could align best with a defensive approach to cost savings through telematics data. The net effect is that the business owner gains a clearer map of the protections available and the trade-offs required to achieve a balanced risk posture. In the end, the objective is to secure a policy that matches the operational reality and delivers peace of mind at a price that fits the budget. The insurance decision is a component of a broader risk management strategy, one that includes safety programs, driver training, vehicle maintenance, and contingency planning for downtime. These elements—when properly integrated—can contribute to safer operations and, over time, more favorable pricing trajectories. For readers seeking a broader frame of reference about how the market adapts to changing conditions and what that means for small fleets and solo operators alike, the external resource linked here offers a contextual view worth considering as you plan your coverage and your business strategy. External resource: https://www.naic.org

Final thoughts

Understanding the costs associated with commercial truck insurance for the Ford F-150 is essential for effectively managing your fleet’s logistics. By assessing the various factors impacting insurance rates, acknowledging the differences between commercial and personal insurance policies, and following recommended practices, fleet managers and procurement teams can make informed decisions that align with their operational needs. Leveraging these insights will ensure comprehensive coverage while managing costs efficiently.