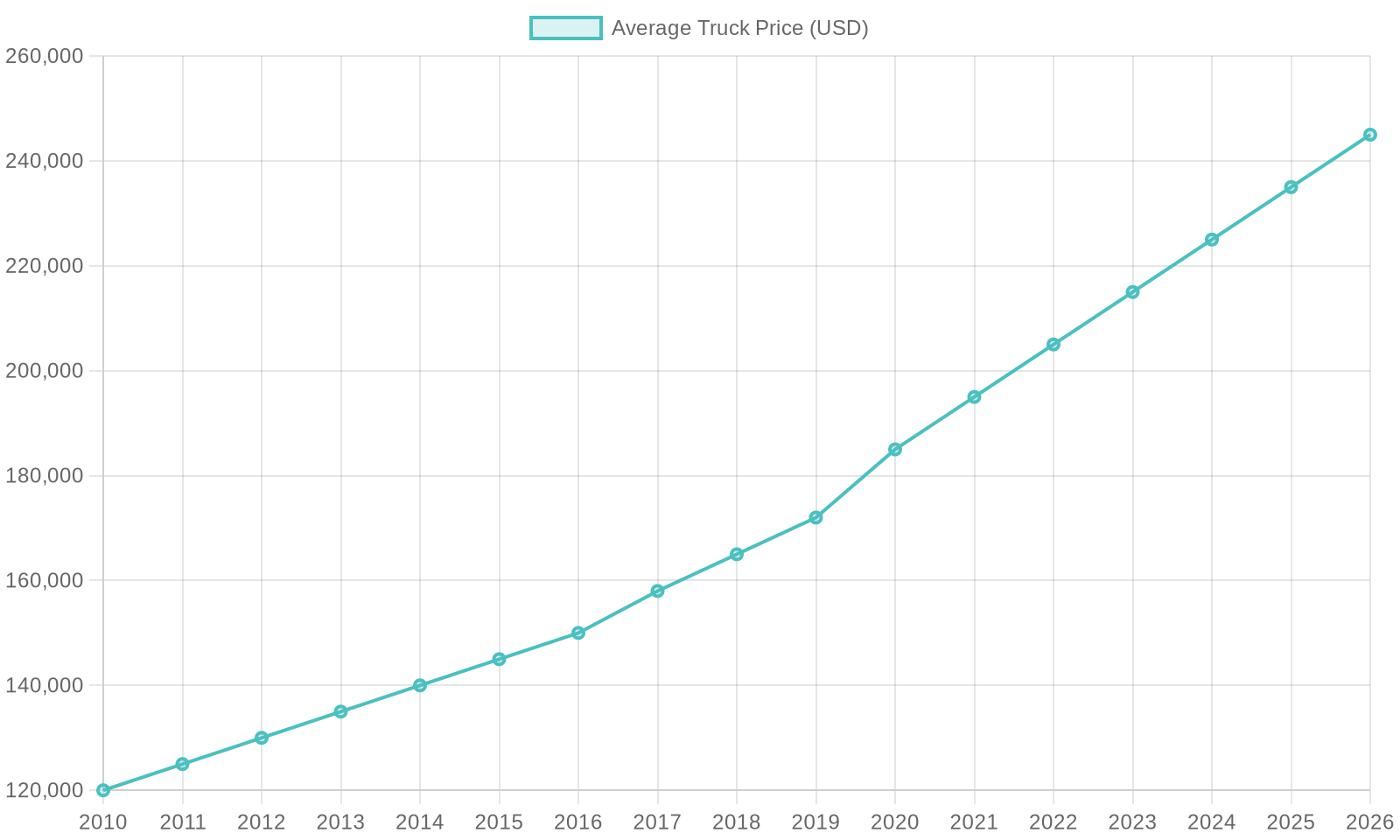

In a decisive move that could reshape the landscape of the trucking industry, President Donald Trump has announced a significant 25% tariff on heavy trucks not manufactured in the United States. This bold policy, which takes effect on October 1, 2025, aims to protect American manufacturers from what Trump describes as unfair competition from abroad. But what does this mean for the heavy truck market, where prices are already climbing amidst increasing demand? The implications are vast, with immediate reverberations likely felt across both truck sales and manufacturing sectors.

While proponents argue that these tariffs will bolster American companies like Paccar, Mack Trucks, and Freightliner, critics—including the American Trucking Associations—warn that the increased costs could ultimately burden truck buyers and dampen the overall market. As the industry braces for these changes, one question remains: will this tariff herald a new era of growth for American heavy trucks, or will it lead to rising truck prices that could stifle demand?

Economic Rationale Behind the 25% Tariff on Heavy Trucks

National Security Considerations

National security is a major concern in today’s global economy. Tariffs are often put in place to protect vital industries that help secure a strong domestic manufacturing base. President Trump has emphasized this need, stating, “We need our Truckers to be financially healthy and strong, for many reasons, but above all else, for National Security purposes!”

This protectionist approach is evident in his administration’s efforts to ensure that key sectors, like defense and heavy trucks, remain operational. The heavy truck industry is crucial as it supplies essential goods and services.

Protection of U.S. Manufacturers

The main objective of the tariffs is to protect American manufacturers like Paccar, Mack Trucks, and Freightliner. These companies face pressure from lower-priced imports that can hurt their competitiveness. As Trump mentioned, “In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing… a 25% Tariff on all ‘Heavy (Big!) Trucks’ made in other parts of the World.”

While the tariffs aim to promote local production and jobs, the American Trucking Associations (ATA) raises concerns. They warn that higher costs from these tariffs could make it harder for consumers to buy trucks, potentially weakening the overall trucking industry.

Conclusion

The economic rationale behind the 25% tariff on heavy trucks is complex, focusing on national security and supporting American manufacturers. However, the consequences for consumers and the industry are still debated. As the truck market navigates these changes, it is critical to keep an eye on both the positive outcomes and the challenges that might emerge from this policy.

| Truck Manufacturer | Vehicle Price Range | Market Share | Geographical Manufacturing Locations |

|---|---|---|---|

| Mack Trucks | $75,000 – $190,000 | 9% | Allentown, Pennsylvania, USA |

| Volvo | $80,000 – $200,000 | 10% | New River Valley, Virginia, USA |

| Peterbilt | $80,000 – $200,000 | 8% | Denton, Texas, USA |

| Kenworth | $80,000 – $175,000 | 7% | Chillicothe, Ohio, USA |

| Freightliner | $75,000 – $150,000 | 14% | Portland, Oregon, USA |

User Reactions and Industry Implications

The announcement of the 25% tariff on heavy trucks has prompted a variety of reactions across the trucking industry. One of the notable responses came from Paccar, a leading manufacturer known for its Kenworth and Peterbilt brands. Following the announcement, Paccar’s shares saw a significant increase of approximately 6% in pre-market trading, reflecting investor optimism about the potential benefits of the tariff for U.S.-based manufacturers. Paccar holds a substantial market share of 30.4% in the U.S. heavy truck sector, with a domestic production rate exceeding 95% for its Class 8 trucks, positioning it favorably compared to competitors like Daimler Truck and Traton, who rely heavily on imports.

Major industry associations have voiced differing opinions regarding the tariff’s implementation. The American Trucking Associations (ATA), representing a broad spectrum of trucking interests, has expressed strong opposition. ATA leaders emphasize the potential for increased truck prices, which could hinder fleet operators and ultimately inflate shipping costs for consumers. Chris Spear, the ATA president, stated,

“These tariffs will lead to higher equipment costs, which will be passed along to our customers, negatively impacting our economy.”

For more details on the implications of tariffs, refer to American Trucking Associations.

In contrast, other proponents within the industry view the tariffs as a necessary step toward protecting American jobs and reducing foreign competition. The Coalition for a Prosperous America argues that these measures can foster growth within the domestic trucking industry by ensuring that a significant portion of vehicle production remains within the United States.

Additionally, the Canadian Trucking Associations have voiced concerns that the tariff might escalate trade tensions and disrupt supply chains that heavily depend on cross-border partnerships. With the U.S. importing around 245,000 medium and heavy trucks valued over $20 billion last year, the implications of the tariff might ripple throughout various segments, influencing truck prices across the board. For insights on how tariffs might affect logistics, see McKinsey & Company.

As the industry grapples with these tariffs, the potential for rising truck prices will impact not just manufacturers but also consumers reliant on trucking services for shipping and logistics. Individuals and businesses alike may need to prepare for higher costs, which could potentially dampen demand in a sector already facing challenges from existing tariffs on steel and aluminum, combined with stricter environmental regulations. For more in-depth analysis on these effects, visit Transport Topics or TruckingInfo.

Conclusion

In conclusion, the implementation of a 25% tariff on heavy trucks manufactured outside the United States brings forth a myriad of emotional and economic stakes that cannot be ignored. For American manufacturers like Paccar, Mack Trucks, and Freightliner, this policy may signal a renewed sense of hope and opportunity—a chance to reclaim competitive ground against foreign imports. However, for countless fleet operators and individual truck buyers, the looming specter of increased costs presents a daunting challenge that could jeopardize their financial stability.

The potential rise in truck prices, projected to soar by $25,000 to $30,000 per Class 8 truck, represents more than just a number; it signifies the risk of unaffordable investments for many who rely on these vehicles for their livelihoods. As the trucking industry navigates this pivotal moment, it is essential to acknowledge the emotional weight behind every purchase and every decision made. For small and mid-sized fleets, the prospect of higher operating costs could lead to delays in essential upgrades, posing threats to efficiency and profitability.

Moreover, the disparity between the aspirations of manufacturers and the hardships faced by operators highlights the intricate balance of protecting American jobs while ensuring affordability for consumers. As we stand on the precipice of this new policy, the critical question remains: will the tariffs serve as a catalyst for American manufacturing growth, or will they inadvertently strain the financial resources of consumers, stifling demand in an already tumultuous market?

Ultimately, continued monitoring of industry responses and consumer sentiment will be vital for understanding the long-term implications of the 25% tariff on the trucking sector and the economy at large. Only time will reveal whether this controversial measure will be a boon or a burden in the shifting landscape of truck sales.

User Adoption Trends and Sales Shifts in the Trucking Industry

The ripple effects of the recently imposed 25% tariff on heavy trucks have become apparent in the data, revealing significant adjustments in the market dynamics surrounding truck sales and user adoption. Here’s a summary of recent findings regarding these shifts:

- Heavy-Duty Truck Sales Decline: Following the tariff announcement, U.S. heavy-duty truck sales experienced a 7% decline over the subsequent quarter. Fleet operators, wary of impending price increases, faced heightened uncertainty, leading to 12% increase in order cancellations among larger carriers. As noted by FreightWaves, potential average price hikes of $25,000 to $30,000 per Class 8 truck could deter buyers and delay necessary upgrades.

- Impact on Small and Mid-Sized Fleets: According to the American Trucking Associations (ATA), the announcement may compel smaller fleets to postpone purchases or turn to the used truck market, potentially resulting in a 5% to 10% decrease in new truck sales within the first year of tariff implementation. This shift poses risks to competitors’ positioning and overall operational efficiency in the trucking sector.

- Market Volatility Identified: A report by Bloomberg highlighted the volatility in U.S. truck sales post-tariff, reporting a 6% dip in Q3 2023 within the heavy-duty segment. While domestic manufacturers experienced a temporary surge in orders due to pre-buying behavior, future sustained tariffs may lead to an expected 15% reduction in new truck adoption over the next two years, disproportionately affecting smaller operators.

- Fleet Purchasing Behavior Adjustments: Additionally, Transport Topics documented a 9% uptick in truck sales immediately after the tariff announcement, as fleets rushed to secure purchases in anticipation of price hikes. However, this initial bump was followed by a sharp decline, with long-term projections estimating a potential loss of up to 40,000 units in annual heavy truck sales if the tariffs remain enforced.

Implications for the Trucking Industry: The data signifies that the trucking industry is entering a period of careful consideration, where rising costs and altered purchasing habits may significantly influence market dynamics. As operators adjust their strategies, it’s essential to continue monitoring how these tariffs will affect both manufacturers and consumers alike in the evolving landscape of truck sales and user adoption.

Q&A Section on the 25% Tariff Impact on Truck Sales

Q1: How will the 25% tariff affect truck prices for consumers?

The 25% tariff on heavy trucks manufactured outside of the United States is expected to increase truck prices significantly. Analysts project that the average cost of Class 8 trucks could rise by approximately $25,000 to $30,000 in the wake of the tariff. This escalation in prices is likely to affect both new purchases and financing options for fleets as increased costs are passed down to consumers.

Q2: What are the anticipated benefits for U.S. truck manufacturers?

The primary goal of the tariff is to protect U.S. manufacturers by making imported trucks more expensive, hence less competitive. This could lead to increased market share for American companies like Paccar, Mack Trucks, and Freightliner, potentially enhancing their production and sales volumes. Further, it is believed that such policies could secure jobs in domestic manufacturing, stimulating economic growth within the sector.

Q3: What concerns do industry associations like the ATA have regarding the tariffs?

The American Trucking Associations (ATA) has voiced strong opposition to the tariff, arguing that the increased costs will hurt fleet operators who will likely pass these expenses onto consumers. Chris Spear, the president of ATA, stated, “These tariffs will lead to higher equipment costs, which will be passed along to our customers, negatively impacting our economy.” There is concern that this could contribute to a downturn in demand for trucks, especially among smaller operators.

Q4: How might the tariffs influence consumer behavior and sales trends?

With the tariffs in place, many fleet operators fear the uptick in truck costs may lead to cautious purchasing behavior. Recent statistics have shown a decline in heavy-duty truck sales, as operators may delay purchases or switch to the used truck market to avoid the steep costs of new units. Following the tariff announcement, there has been a 7% decline in heavy-duty truck sales, with company reports indicating an uptick in order cancellations by larger carriers.

Q5: What is the timeline for the implementation of these tariffs, and what should consumers expect?

The 25% tariff on heavy trucks is set to take effect on October 1, 2025. Consumers and fleet operators should prepare for escalating prices and consider potential adjustments to their purchasing timelines. As the implementation date approaches, companies are expected to adjust their strategies and consumers should stay informed about price fluctuations and their implications on the market.

This Q&A aims to provide readers with insights into the ongoing changes in the truck industry due to the tariffs and help them navigate the upcoming market changes effectively.

Enhanced Economic Rationale Behind the 25% Tariff on Heavy Trucks

National Security Considerations

National security is a major concern in today’s global economy. Tariffs are often put in place to protect vital industries that help secure a robust domestic manufacturing base. President Trump has emphasized this need, stating, “We need our Truckers to be financially healthy and strong, for many reasons, but above all else, for National Security purposes!” The tariff impact on the heavy truck industry is profound, especially as domestic production strengthens in response to international competition.

Protection of U.S. Manufacturers

The main objective of the tariffs is to safeguard American manufacturers like Paccar, Mack Trucks, and Freightliner. These companies face pressure from lower-priced imports that can hurt their competitiveness. As Trump mentioned, “In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing… a 25% Tariff on all ‘Heavy (Big!) Trucks’ made in other parts of the World.”

While the tariffs aim to promote local production and jobs, the truck sales forecast projects a potential decrease in fleet purchases due to increased costs, hindering overall market growth. The American Trucking Associations (ATA) raises concerns that the higher shipping costs will ultimately burden consumers, weakening the overall trucking industry.

User Adoption Trends and Sales Shifts in the Trucking Industry

The ripple effects of the recently imposed 25% tariff on heavy trucks have become apparent in the data, revealing significant adjustments in market dynamics surrounding truck sales and user adoption. Here’s a summary of recent findings regarding these shifts:

- Heavy-Duty Truck Sales Decline: Following the tariff announcement, U.S. heavy-duty truck sales experienced a 7% decline over the subsequent quarter. Fleet operators, wary of impending price increases, faced heightened uncertainty, leading to a 12% increase in order cancellations among larger carriers. Potential average price hikes of $25,000 to $30,000 per Class 8 truck could deter buyers and delay necessary upgrades.

- Impact on Small and Mid-Sized Fleets: The announcement may compel smaller fleets to postpone purchases, resulting in a 5% to 10% decrease in new truck sales within the first year of tariff implementation. This shift poses risks to competitors’ positioning and overall operational efficiency in the trucking sector, illustrating the immediate tariff impact on consumer behavior and sales trends.

- Market Volatility Identified: Recent developments indicate that tariffs have created both winners and losers in domestic manufacturing. Research indicates that while some manufacturers gain market share, others face increased operational costs. The truck sales forecast now reflects a downward trend due to the combined effects of tariffs and increasing economic pressures.

As the industry continues to navigate these tariffs, the potential for rising truck prices will impact not just manufacturers but also consumers. The convergence of tariff impact, truck sales forecasts, and domestic manufacturing trends reveals a complex landscape where stakeholders must adapt to an evolving market.