The topic of economic indicators and their effect on truck inventories is crucial in understanding the current conditions of the transportation industry. Certain economic indicators such as demand trends, order intake, and inventory levels reflect commercial vehicle health, especially for heavy trucks.

Recent statistics indicate a notable slowdown in truck orders, which have fallen below the downturn mark heading into what are usually strong months for orders. This decline can be linked to buyers hesitating in making purchases amidst an uncertain economic landscape. With the average order intake in North America resting at 285,000 units, the general concerns around stagnant economic growth and rising inventories paint a worrisome picture for the industry.

As trucks age, with the average age for long- and regional-haul trucks approximately 6.5 years, the urgency for replacement is palpable, yet procurement decisions have slowed. In this context, the discussions around how these economic indicators correlate with truck inventories become imperative, revealing critical insights into industry trends and future market stability.

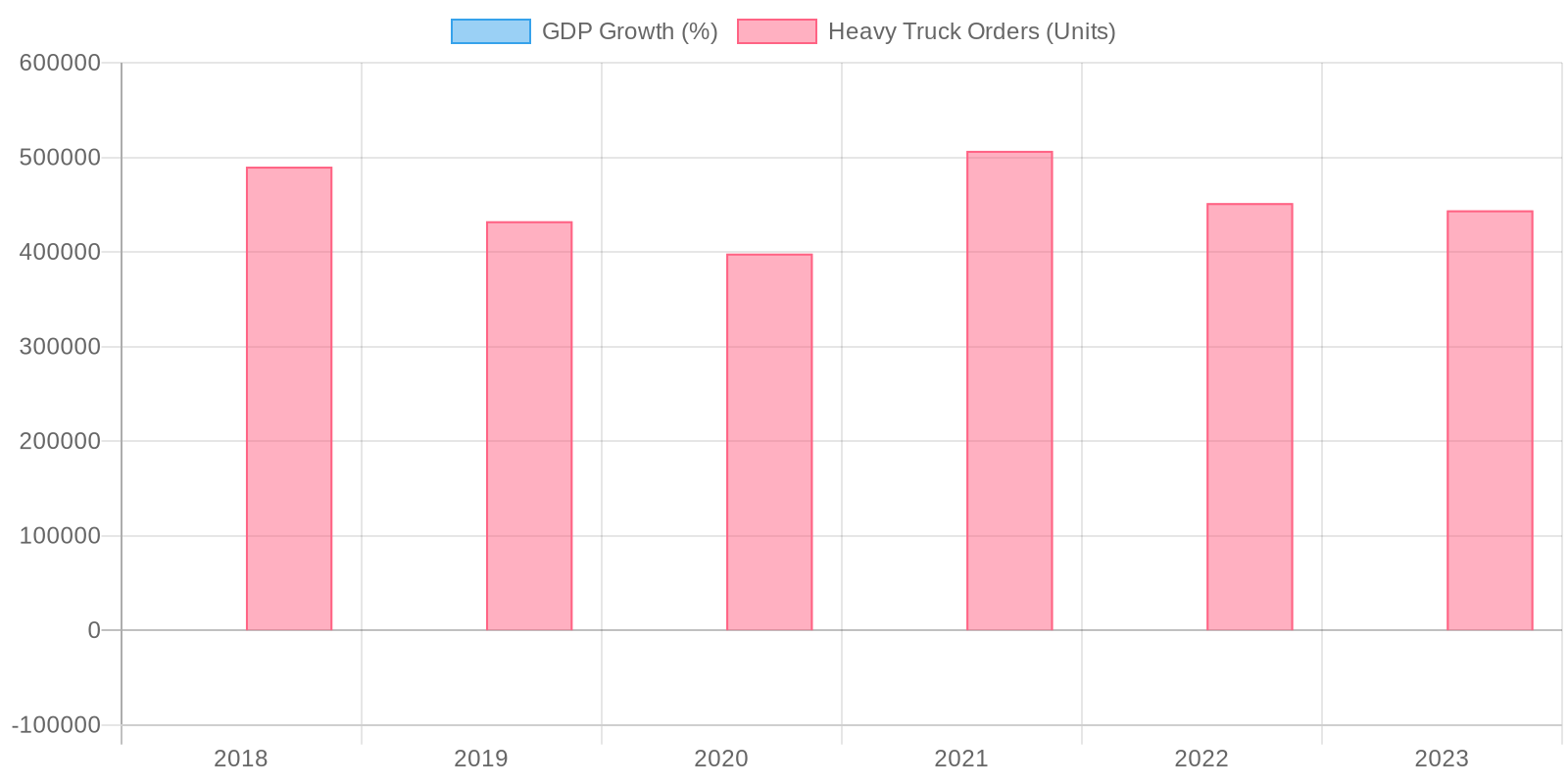

Economic indicators are crucial signs that provide insight into the overall health of an economy, influencing various industries, including trucking. Key indicators such as demand, inflation, and Gross Domestic Product (GDP) not only reflect current economic conditions but also shape the decision-making processes of companies within the trucking sector.

Demand in the trucking industry is closely linked to economic activity; as GDP rises, so does the demand for freight transportation. This directly correlates to increased heavy truck orders. For example, when GDP experiences significant growth, it typically leads to heightened consumption and business activity, which translates to more freight needing transport. Conversely, during economic downturns, the demand decreases, resulting in fewer orders for new trucks.

Inflation plays a significant role as well. As prices rise across the board, the cost of operating a fleet increases, which might deter companies from placing new orders for heavy trucks. Magnus Koeck, vice president of strategy, marketing, and brand management at Volvo Trucks North America, highlights this situation, noting, “The customers are reluctant now to buy trucks” due to inflationary pressures and uncertainties in the economic landscape.

Furthermore, fluctuations in inflation affect the purchasing power of businesses and can lead to delays in investment despite existing high demand in freight services. Even with a resilient economy, the challenges posed by inflation can significantly influence procurement decisions.

Finally, it’s essential to recognize the role of GDP growth as a key economic indicator for heavy truck orders. In robust economic environments, fleets typically respond by expanding capacity, leading to higher order volumes. Koeck alludes to the uncertainty in the market saying, “When the proverbial dam busts, Volvo dealers will be ready.” Thus, while there are current hesitations, the intrinsic relationship between economic health and trucking orders remains a vital focus area as we move forward.

In summary, the interplay between demand, inflation, and GDP is central to understanding the current state of the trucking industry. As these economic indicators fluctuate, they will continue to shape the landscape of truck orders, impacting inventory levels and future market stability.

Key Statistics and Facts About the Trucking Industry

The trucking industry plays a vital role in the U.S. economy, impacting freight movement and supply chain efficiency. Here are pivotal statistics reflecting its current state:

Average Order Intake

- In North America, the average order intake is approximately 285,000 units. However, the average total during downturns hovers around 212,000 units, signaling a cautious market where buyers are hesitant to make new purchases.

Truck Aging

- The average age of long- and regional-haul trucks stands at roughly 6.5 years. This aging fleet raises concerns about the urgency for replacements, even as new orders slow.

Volvo’s Performance

- In the U.S. market, Volvo Trucks delivered about 26,000 units recently. Despite challenges, they have made significant investments of over $1 billion in their dealer network and $2 billion into the new VNL model, indicating a commitment to long-term growth.

Market Expectations

- The trucking industry has faced global challenges, including supply chain disruptions. Reports suggest a potential market size of 300,000 trucks each in the U.S. and Europe in 2023, contingent on resolving supply chain issues and overcoming demand weaknesses.

Economic Influence

- Currently, economic factors like inflation and uncertain demand significantly influence the market, with logistics executives projecting a 5% to 15% decline in truckload rates into 2024 due to excess capacity and low demand.

These statistics illustrate the complexities within the trucking sector amid fluctuating economic conditions and highlight the importance of monitoring these trends as we advance into 2024. Despite the challenges, industry leaders maintain that recovery and growth opportunities remain, particularly with strategic investments and adaptations in operations.

An infographic illustrating key statistics about the trucking industry.

Key Takeaways on Economic Indicators

A numbered list design showcasing key takeaways about economic indicators affecting truck orders.

Heavy Truck Inventory and Orders Comparison

Note: Data is based on seasonally adjusted figures where available. Values in thousands of units.

| Month-Year | Inventory (Units) | Orders (Units) | Economic Indicator (GDP Growth %) | Key Economic Event |

|---|---|---|---|---|

| Jul 2023 | 180.2 | 24.5 | 2.1 | Stable growth, moderate demand |

| Aug 2023 | 178.9 | 25.8 | 2.3 | Increased freight activity |

| Sep 2023 | 176.5 | 26.3 | 2.5 | Peak Q3 economic expansion |

| Oct 2023 | 174.8 | 24.1 | 2.0 | Early signs of cooling |

| Nov 2023 | 173.2 | 22.4 | 1.8 | Holiday slowdown, reduced orders |

| Dec 2023 | 172.0 | 20.9 | 1.6 | Year-end contraction |

| Jan 2024 | 173.5 | 21.7 | 1.9 | New year demand uptick |

| Feb 2024 | 175.1 | 23.0 | 2.2 | Infrastructure spending boost |

| Mar 2024 | 177.3 | 24.6 | 2.4 | Spring freight recovery |

| Apr 2024 | 179.0 | 25.2 | 2.6 | Strong manufacturing output |

| May 2024 | 181.5 | 26.8 | 2.8 | Economic acceleration |

| Jun 2024 | 183.2 | 27.5 | 3.0 | Peak mid-year growth |

Data Sources:

- Inventory and Orders: ACT Research, U.S. Truck Trends Report

- GDP Growth: U.S. Bureau of Economic Analysis (BEA)

- Economic Events: Federal Reserve Economic Reports

Sources:

Buyer Behavior Towards Truck Orders in a Stagnant Economy

In a stagnating economy, buyer attitudes towards truck orders exhibit marked hesitation. This reluctance is shaped by multiple factors contributing to a climate of uncertainty. As highlighted by Magnus Koeck, Vice President of Strategy, Marketing, and Brand Management at Volvo Trucks North America, various economic pressures act as significant deterrents for fleet operators contemplating new purchases.

Fleet operators are notably cautious about capital expenditures, especially with rising interest rates and inflationary pressures. There are also uncertainties concerning future freight demand. Koeck remarked,

“The customers are reluctant now to buy trucks,”

indicating that the overall mood among buyers is tinted with apprehension.

Higher costs associated with acquiring new equipment mean many carriers are opting to extend the life of their existing trucks rather than investing in new units. This has resulted in a sharp decline in orders for Class 8 trucks, plummeting by approximately 30% compared to the previous year.

The hesitation is not solely tied to financial metrics; it reflects a psychological impact born from an unstable market. Koeck elaborated by explaining how fluctuations in freight volumes and softening rates hinder buyer confidence. This inwardly cautious behavior means fleets are likely to maintain a ‘wait-and-see’ stance regarding new investments until they perceive a more stable economic environment.

This philosophy is echoed in recent trends, as many trucking companies prioritize maintenance over new acquisitions. They are opting for used trucks or lease arrangements to mitigate risk instead of committing to long-term debt for new purchases.

The intertwining factors of economic uncertainty, evolving regulatory changes, and fluctuating operational costs have collectively led to an environment where buyer confidence is stifled. As Koeck aptly points out,

“When the proverbial dam busts, Volvo dealers will be ready.”

This suggests that there may be future opportunities for growth once confidence and stability return to the market. Until then, fleets remain in a holding pattern, cautiously evaluating their next steps in a landscape shaped by many uncertainties.

Heavy Truck Inventory Yard

An image portraying a busy truck inventory yard displaying the vast volume of trucks, representing an oversupply situation.

Expert Opinions on the Truck Market

As industry leaders analyze the state of the truck market, many express concern about the current slowdown in orders, linking it to broader economic indicators and buyer sentiment. Magnus Koeck, vice president of strategy, marketing, and brand management at Volvo Trucks North America, noted, “The customers are reluctant now to buy trucks,” highlighting a significant hesitance in procurement decisions amidst a challenging economic landscape.

Experts suggest that the combination of rising inflation and fluctuating economic conditions plays a critical role in shaping buyer behavior. As Koeck discussed, buyers are currently facing high operational costs due to inflation, which discourages new investments in truck orders. This has resulted in Class 8 truck orders declining significantly, by nearly 30% compared to last year.

However, there are optimistic signs for the future. Since many experts believe that the economic tide will eventually turn, they advise stakeholders in the trucking industry to prepare for the eventual upturn. Koeck remarked, “When the proverbial dam busts, Volvo dealers will be ready,” indicating a readiness to ramp up production and meet renewed demand as confidence in the economy rebounds.

Additionally, analysts indicate a potential boost in orders linked to improvements in economic stability. They believe that sustained efforts in infrastructure investments could catalyze a rise in trucking demand, particularly as freight volumes increase. The anticipated recovery hinges on key factors like GDP growth and consumer spending patterns that may shift positively as inflation pressures ease.

In summary, while current trends show a slowdown in truck orders, expert insights underline a cautiously optimistic outlook for the industry. It is essential for fleet operators and manufacturers to remain agile and prepared, as the interplay of economic indicators suggests that favorable changes may be on the horizon, spurring greater demand for new truck purchases.

Economic Indicators and Their Effect on Truck Inventories

The topic of economic indicators and their effect on truck inventories is crucial in understanding the current conditions of the transportation industry. Certain economic indicators such as demand trends, order intake, and inventory levels reflect commercial vehicle health, especially for heavy trucks. Recent statistics indicate a notable slowdown in heavy truck orders, which have fallen below the downturn mark heading into what are usually strong months for orders. This decline can be linked to buyers hesitating in making purchases amidst an uncertain stagnant economy. With the average order intake in North America resting at 285,000 units, the general concerns around economic growth and rising inventories paint a worrisome picture for the industry. As trucks age, with the average age for long- and regional-haul trucks approximately 6.5 years, the urgency for replacement is palpable, yet procurement decisions have slowed. In this context, the discussions around how these economic indicators correlate with truck inventories become imperative, revealing critical insights into industry trends and future market stability.

Economic indicators are crucial signs that provide insight into the overall health of an economy, influencing various industries, including trucking. Key indicators such as demand, inflation, and Gross Domestic Product (GDP) not only reflect current economic conditions but also shape the decision-making processes of companies within the trucking sector.

Demand in the trucking industry is closely linked to economic activity; as GDP rises, so does the demand for freight transportation. This directly correlates to increased heavy truck orders. For example, when GDP experiences significant growth, it typically leads to heightened consumption and business activity, which translates to more freight needing transport. Conversely, during economic downturns, the demand decreases, resulting in fewer orders for new trucks.

Inflation plays a significant role as well. As prices rise across the board, the cost of operating a fleet increases, which might deter companies from placing new orders for heavy trucks. Magnus Koeck, vice president of strategy, marketing, and brand management at Volvo Trucks North America, highlights this situation, noting, “The customers are reluctant now to buy trucks” due to inflationary pressures and uncertainties in the economic landscape.

Furthermore, fluctuations in inflation affect the purchasing power of businesses and can lead to delays in investment despite existing high demand for freight services. Even with a resilient economy, the challenges posed by inflation can significantly influence procurement decisions.

Finally, it’s essential to recognize the role of GDP growth as a key economic indicator for heavy truck orders. In robust economic environments, fleets typically respond by expanding capacity, leading to higher order volumes. Koeck alludes to the uncertainty in the market saying, “When the proverbial dam busts, Volvo dealers will be ready.” Thus, while there are current hesitations, the intrinsic relationship between economic health and trucking orders remains a vital focus area as we move forward.

In summary, the interplay between demand, inflation, and GDP is central to understanding the current state of the trucking industry. As these economic indicators fluctuate, they will continue to shape the landscape of truck orders, impacting inventory levels and future market stability.

Key Statistics and Facts About the Trucking Industry

The trucking industry plays a vital role in the U.S. economy, impacting freight movement and supply chain efficiency. Here are pivotal statistics reflecting its current state:

- Average Order Intake: In North America, the average order intake is approximately 285,000 units. However, the average total during downturns hovers around 212,000 units, signaling a cautious market where buyers are hesitant to make new purchases.

- Truck Aging: The average age of long- and regional-haul trucks stands at roughly 6.5 years. This aging fleet raises concerns about the urgency for replacements, even as new orders slow.

- Volvo’s Performance: In the U.S. market, Volvo Trucks delivered about 26,000 units recently. Despite challenges, they have made significant investments of over $1 billion in their dealer network and $2 billion into the new VNL model, indicating a commitment to long-term growth.

- Market Expectations: The trucking industry has faced global challenges, including supply chain disruptions. Reports suggest a potential market size of 300,000 trucks each in the U.S. and Europe in 2023, contingent on resolving supply chain issues and overcoming demand weaknesses.

- Economic Influence: Currently, economic factors like inflation and uncertain demand significantly influence the market, with logistics executives projecting a 5% to 15% decline in truckload rates into 2024 due to excess capacity and low demand.

These statistics illustrate the complexities within the trucking sector amid fluctuating economic conditions and highlight the importance of monitoring these trends as we advance into 2024. Despite the challenges, industry leaders maintain that recovery and growth opportunities remain, particularly with strategic investments and adaptations in operations.

Buyer Behavior Towards Truck Orders in a Stagnant Economy

In a stagnating economy, buyer attitudes towards truck orders exhibit a marked hesitation, shaped by multiple factors that contribute to a climate of uncertainty. As highlighted by Magnus Koeck, Vice President of Strategy, Marketing, and Brand Management at Volvo Trucks North America, various economic pressures act as significant deterrents for fleet operators contemplating new purchases.

Fleet operators are notably cautious regarding capital expenditures amidst rising interest rates, inflationary pressures, and uncertainties concerning future freight demand. Magnus Koeck remarked, “The customers are reluctant now to buy trucks,” indicating that the overall mood among buyers is tinted with apprehension. Higher costs associated with acquiring new equipment mean that many carriers are opting to extend the life of their existing trucks, rather than investing in new units, which has resulted in a sharp decline in heavy truck orders for Class 8 trucks, plummeting by approximately 30% compared to the previous year.

The hesitation is not solely tied to financial metrics; it also reflects a psychological impact born from an unstable market. Koeck elaborated on this aspect by explaining how fluctuations in freight volumes and softening rates hinder the confidence of buyers. This inwardly cautious behavior means that fleets are likely to maintain a ‘wait-and-see’ stance regarding new investments until they perceive a more stable economic environment. This philosophy is echoed in recent trends as many trucking companies prioritize maintenance over new acquisitions, opting for used trucks or lease arrangements to mitigate risk rather than commit to long-term debt for new purchases.

The intertwining factors of economic uncertainty, evolving regulatory changes, and fluctuating operational costs have collectively led to an environment where buyer confidence is stifled. As Koeck aptly points out, “When the proverbial dam busts, Volvo dealers will be ready,” suggesting that there may be future opportunities for growth once confidence and stability return to the market. Until then, fleets remain in a holding pattern, cautiously evaluating their next steps in a landscape shaped by many uncertainties.

Conclusion

In conclusion, the analysis of economic indicators reveals a precarious moment for the heavy truck orders market. As we have discussed, several critical factors, including inflation, GDP growth, and buyer behavior, are significantly influencing procurement decisions amidst a backdrop of economic uncertainty. The ongoing stagnation and rising costs have led to a notable decline in orders, with heavy truck orders enduring a downturn reflective of broader market apprehensions.

The average order intake remaining below trend highlights the challenges that fleet operators face when making capital investments. As buyers remain hesitant, opting to maintain aging fleets instead of indulging in new purchases, the cumulative effect could signal prolonged consequences for supply chain operations and freight deliveries. This is particularly evident in the considerable decrease in Class 8 truck orders, which fell by approximately 30% compared to prior years.

However, while the current environment may seem discouraging, it remains essential for stakeholders to keep vigilant. Many experts posit that, should inflation pressures ease and economic conditions stabilize, a resurgence in demand could occur. There is a consensus that when market confidence returns, dealers and manufacturers will be poised to capitalize on renewed interest in heavy truck orders. Therefore, understanding these economic indicators and their influence will be crucial for those engaged in the trucking industry as they navigate through these challenging times and prepare for the potential shifts and opportunities that lie ahead.

Key Takeaways:

- Economic indicators such as inflation and GDP growth are critical in shaping the heavy truck orders market.

- Current hesitance from fleet operators leads to a significant downturn in heavy truck orders, particularly Class 8 units, which fell by approximately 30% compared to previous years.

- Stakeholders must remain vigilant as conditions may stabilize, leading to a resurgence in demand for heavy trucks.

- Understanding economic indicators is essential for navigating through the challenges and discovering new opportunities in the trucking industry.

For more in-depth information and continuous updates on the trucking industry, visit Logos Logistics. This source provides comprehensive statistics and insights about the U.S. trucking sector, emphasizing its importance in the economy and the significant role it plays in freight transportation.