Introduction

As we look ahead to 2025, the landscape of the trucking industry is fraught with uncertainty. A combination of stagnant economic growth, aging fleets, and increasing demands for fuel efficiency has raised alarms among industry stakeholders, echoing broader concerns about economic stability. The current market downturn, marked by flagging demand for new trucks, presents a stark contrast to the historically strong order months typically seen. Fleet owners are holding onto older units longer, weighing the financial implications in this unpredictable climate. Buyers are hesitant, echoing sentiments that have resonated since the onset of the COVID pandemic and subsequent economic challenges.

The critical question looms: How long can the industry sustain itself amidst such turmoil? This article delves into the factors contributing to this predicament, underlining the significance of understanding both market fluctuations and the pressures faced by operators in maintaining an efficient fleet. Join us as we unpack the challenges ahead, including crucial fleet management trends and the need for improved fuel efficiency, while exploring potential pathways for recovery in the truck sales market.

Economic Factors Influencing Truck Sales

Truck sales are significantly influenced by various economic factors. Understanding these elements helps manufacturers and dealers strategize effectively. Below are the key economic factors impacting truck sales:

1. Economic Growth

A robust economy usually leads to increased demand for trucks. As businesses expand, they require more transportation options to move goods, which stimulates sales.

2. Fuel Prices

Fluctuating fuel prices can directly affect truck sales. Higher fuel costs often lead to consumers seeking more fuel-efficient models, while lower prices might encourage the purchase of larger trucks.

3. Interest Rates

Interest rates play a critical role in financing vehicle purchases. Low interest rates make loans more accessible, increasing truck sales, while high rates can have the opposite effect.

4. Consumer Confidence

When consumers feel financially secure, they are more likely to invest in new trucks. Consumer confidence indexes provide insights into this sentiment and can predict sales trends.

5. Government Policies

Regulatory changes, such as emissions standards or tax incentives for electric trucks, can influence consumer choices and manufacturer strategies.

6. Infrastructure Investment

Government investment in infrastructure can lead to an increased demand for commercial trucks, as businesses adapt to improved transportation networks.

Each of these factors can interact in complex ways, shaping the truck sales landscape. Understanding these influences is crucial for stakeholders in the trucking industry.

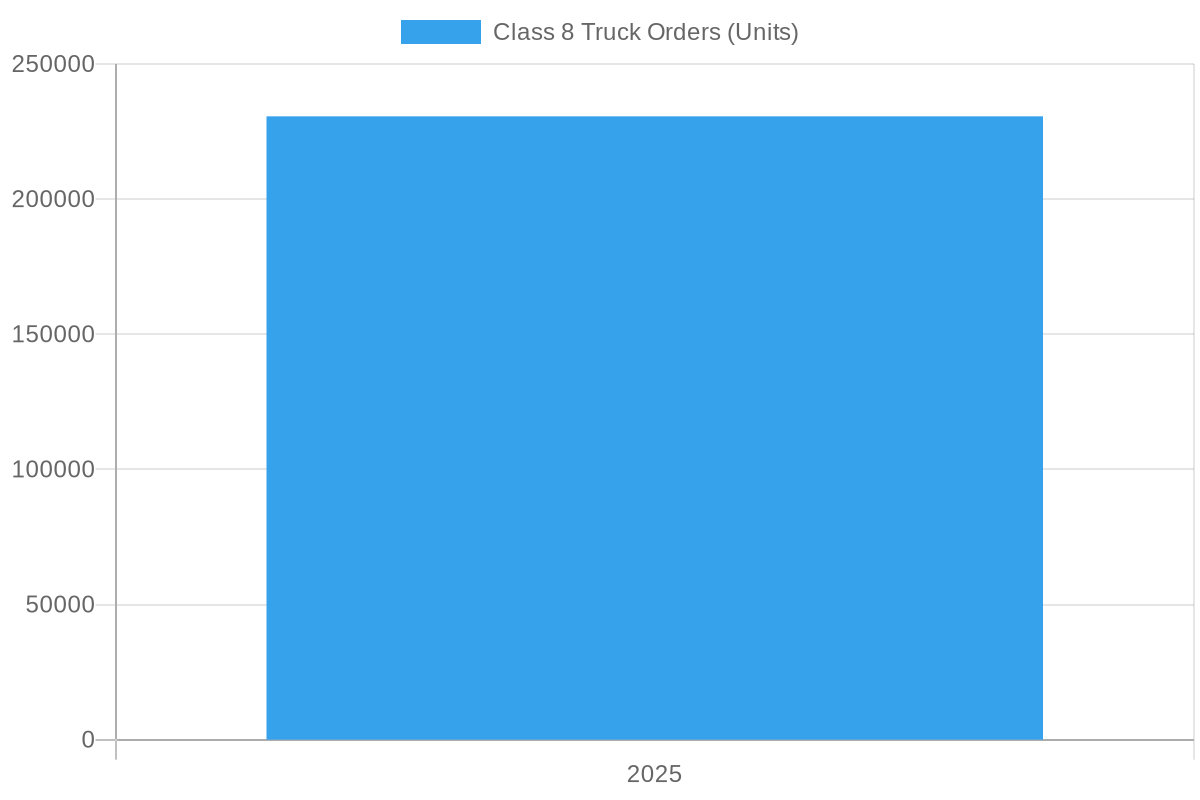

| Year | Average Order Intake | Average Downturn Total | Average Age of Trucks |

|---|---|---|---|

| 2021 | 295,000 units | 190,000 units | 6.3 years |

| 2022 | 280,000 units | 200,000 units | 6.4 years |

| 2023 | 265,000 units | 210,000 units | 6.5 years |

| 2024 | 270,000 units | 220,000 units | 6.6 years |

| 2025 | 285,000 units | 212,000 units | 6.5 years |

Urgency of Replacing Aging Fleets

With the average age of long- and regional-haul trucks hovering around 6.5 years, there’s a clear urgency for fleet operators to consider replacing aging units. Stiffer regulations and the increasing demand for fuel efficiency further compel the need for newer models to enhance operational efficiency.

With the average age of long- and regional-haul trucks hovering around 6.5 years, there’s a clear urgency for fleet operators to consider replacing aging units. Stiffer regulations and the increasing demand for fuel efficiency further compel the need for newer models to enhance operational efficiency.

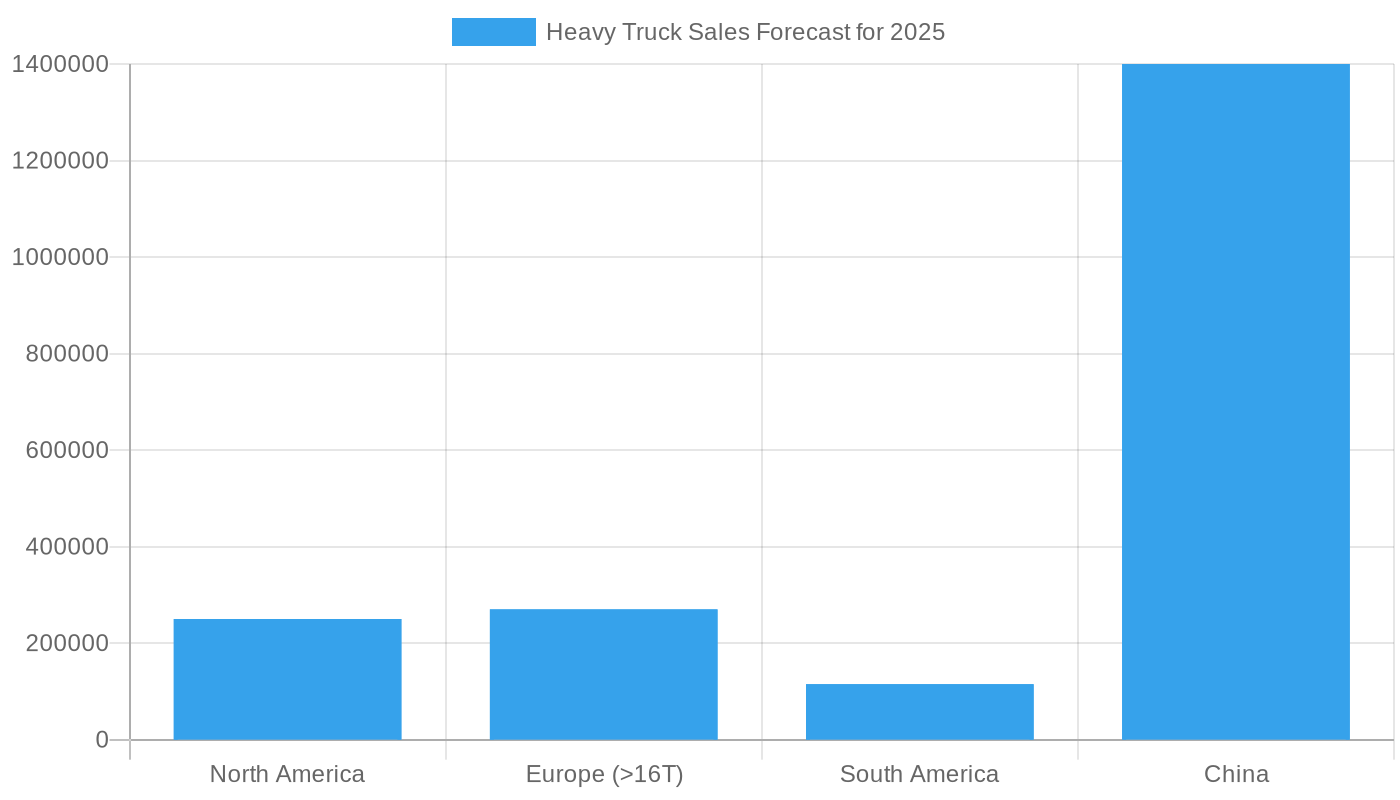

Chart of Heavy Truck Sales Forecast for 2025

The contributions of aging fleets to heavy truck sales and the necessity for strategic planning in 2025 are pivotal for overcoming industry challenges. Stakeholders must navigate economic uncertainty while addressing the pressing need to modernize their fleets effectively.

Manufacturer Responses: How Volvo Trucks North America is Preparing for Recovery

In the face of a turbulent market, manufacturers like Volvo Trucks North America (VTNA) are strategically responding to current market conditions and laying down the groundwork for potential recovery.

Addressing Market Challenges

The trucking industry is experiencing a slowdown, driven by reduced freight volumes and uncertainties related to tariffs and emission regulations. Fleet owners are holding onto their existing trucks longer than ever, as purchasing new vehicles poses financial risks amidst economic instability. In this climate of uncertainty, customers are hesitant to invest in new trucks, which directly impacts manufacturers like Volvo.

Strategic Adjustments

VTNA is adapting its business practices accordingly. Magnus Koeck, Vice President of Strategy, Marketing, and Brand Management at VTNA, acknowledges the magnitude of the downturn, stating, “This is quite a big downturn.” In response, Volvo has made difficult decisions, including laying off up to 800 workers across its U.S. facilities to better align with market demand and production pacing.

Despite this challenging backdrop, Volvo is also looking toward the future by investing significantly in new product development. The company has committed $2 billion to create the new VNL models, which are designed with enhanced fuel efficiency and advanced technology to meet the evolving needs of the market. These investments signal to the industry that Volvo is committed to emerging stronger when the market begins to recover.

Insights from Experts

Experts like Koeck highlight the importance of strategic positioning in navigating these turbulent times. He notes the reluctance among customers to purchase new trucks due to prevailing economic uncertainties, but maintains an optimistic outlook for recovery. “By mid-December, we will have a very good outlook for what next year is going to bring us,” he mentions. This cyclical view of the market underlines the importance of preparing for an upturn.

Overall, Volvo Trucks North America’s proactive response to market challenges, through operational adjustments and significant investments in new products, showcases their resilience and strategic foresight in an ever-evolving industry landscape.

Key Quotes on Truck Market Outlook for 2025

The heavy truck market outlook for 2025 has raised significant concerns among industry leaders, reflecting a landscape of caution and uncertainty. Below are pivotal statements that encapsulate the current sentiments of market stakeholders:

- Eva Scherer, CFO of Daimler Truck: “Recent months have shown a clear slowdown in order levels, reflecting ongoing market uncertainty.”

- Christian Levin, CEO of Scania and Traton: “The industry’s challenges in meeting emissions targets is a cry out for help, particularly due to high costs and inadequate infrastructure.”

- David Kriete, President of Kriete Truck Centers: “The EPA ’27 hurdle that all OEMs and dealers were planning for is now uncertain, which has absolutely had an impact in the short term on sales demand.”

- Matt Parry, Senior Vice President at Werner Enterprises: “It’s going to be a bumpy next 12 to 18 months.”

- Scott Lubischer, Truck Paper Manager at Sandhills Global: “Given the uncertainty clouding the global economy, many buyers are stalling.”

These quotes highlight how economic instability, regulatory complexity, and shifting market demands are collectively contributing to a hesitant approach to new investments in heavy trucks for the coming years. The prevailing attitude among industry leaders points towards a market that is not yet ready for a substantial rebound, necessitating careful observation of evolving conditions in 2025.

In conclusion, the trucking industry faces significant challenges due to the ongoing economic downturn, which has markedly impacted truck sales. Fleet owners are increasingly holding onto older trucks, reflecting a broader reluctance to invest in new vehicles amid economic uncertainty. This trend has resulted in an uptick in the average age of trucks on the road, highlighting the urgent need for modernization in fleets to meet both regulatory demands and efficiency standards.

Looking ahead, while the current landscape is fraught with hesitation, there is potential for gradual recovery as economic conditions stabilize. Market stakeholders will need to remain adaptable and responsive to changing demand dynamics, leveraging any signs of improvement to reinvest in their fleets strategically. Staying informed about economic patterns and market trends will be crucial for making sound decisions in this volatile environment. Ultimately, the resilience of the trucking industry will depend on its ability to navigate these challenges while preparing for the inevitable shifts that lie ahead.

As the trucking industry continues to navigate these uncertain times, staying informed about the evolving truck sales market is more crucial than ever. Timely updates can help fleet operators make better investment decisions and modernize their fleets in response to regulatory and market changes.

We invite you to share your own experiences and predictions about the truck sales landscape in the comments below. How are you planning to adapt to these challenges? Your insights could be invaluable to others in the industry. Let’s engage in a productive dialogue about the future of trucking.

Next Steps for Fleet Operators

- Evaluate Your Fleet: Conduct a thorough assessment of your current fleet conditions. Determine which trucks have the highest maintenance costs and are least fuel-efficient. Identifying these can help inform your decision-making regarding replacements.

- Monitor Market Trends: Stay abreast of economic indicators and market shifts that precede economic recovery, allowing you to make informed investment choices.

- Engage in Strategic Partnerships: Network with other fleet operators, suppliers, and manufacturers to share best practices and technologies that can lead to improved efficiency and operational success.

- Invest in Training: Equip your team with the skills necessary to optimize fleet operations and adapt to new technologies. This preparation can serve your organization well as market conditions improve.

- Embrace Sustainability: As environmental regulations become more stringent, looking into greener technologies, such as electric trucks, can not only future-proof your fleet but also position your company as a leader in sustainability.

With these actionable steps, fleet operators can not only navigate the challenges of today’s market but also emerge prepared for tomorrow’s opportunities. Embrace the change with optimism and a proactive mindset. Together, we can foster a robust future for the trucking industry.

| Category | Impact of Aging Fleets on Sales | Manufacturer Responses |

|---|---|---|

| Urgency Level | High | Moderate |

| Average Age of Trucks | 6.5 years | Older fleets being held longer |

| Demand for New Vehicles | Decreasing | Manufacturers preparing for recovery |

| Investment in New Models | Necessary | Significant investments underway |

| Customer Reluctance to Purchase | Increasing | Acknowledged by manufacturers |

This table summarizes the urgency between the impact of aging fleets on sales versus the manufacturers’ responses to market demands. It clearly indicates the pressing need for fleet updates in light of aging vehicles, alongside the strategic actions taken by manufacturers in response to current market conditions.